时间:2024-06-24|浏览:267

用戶喜愛的交易所

已有账号登陆后会弹出下载

这将是一篇很长的文章,我花了好几天的时间进行研究,这是一个悲观的观点,但都是基于事实。

如果您对了解更广泛的市场风险不感兴趣,那么就不要继续阅读了。

如果您在加密货币上投资了大量资金,那么值得一读。

我这样做并不是为了传播 FUD 或影响你的决定,我发帖完全是出于热爱,我没有从中获得任何好处。

如果您选择了红色药丸,请继续阅读。

首先,如果我们回到 2023 年底,当时人们普遍预测美联储今年将降息 5-6 次,这是避免经济衰退所必需的,但 6 个月过去了,我们并没有降息,也没有明确的方向,这并不表明美联储能够控制美国经济。

鲍威尔和美联储正重点关注通胀和失业率,并以此证明其长期加息立场是有效的。

通货膨胀是一个滞后指标,就像回顾过去看看未来会发生什么,而且劳动力市场一旦开始恶化就会迅速崩溃,而并不总是逐渐下降。

以下几点表明美联储可能即将引发经济衰退,

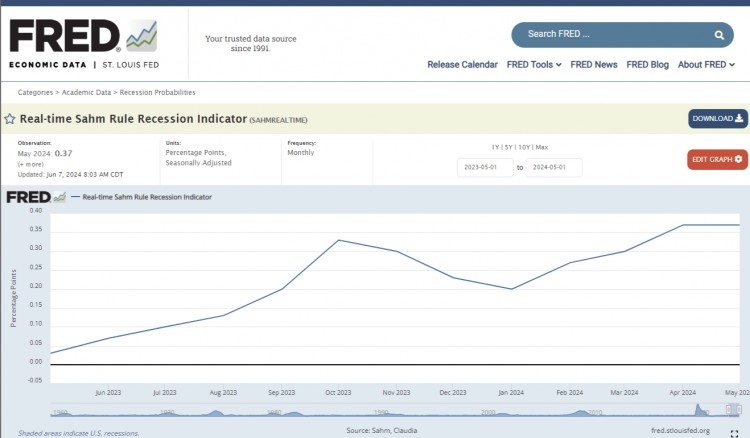

-萨姆规则,萨姆规则是一种跟踪失业率移动平均值的指标,自 1948 年以来,该规则适用于每一次经济衰退,目前萨姆指标正在发出风险警告,如果失业率继续以过去 3 个月的速度上升,就会触发萨姆规则的经济衰退警告。失业和失业动态会自我加剧,如果人们失业,他们就会停止消费,从而导致更多的失业。

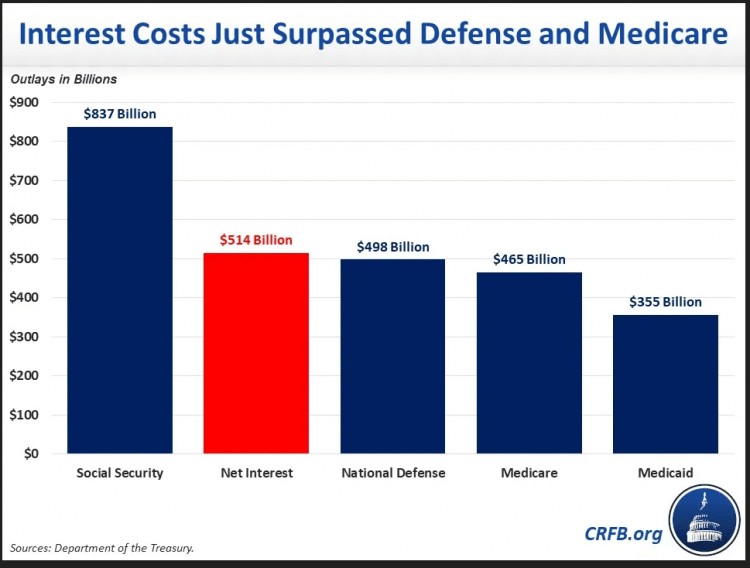

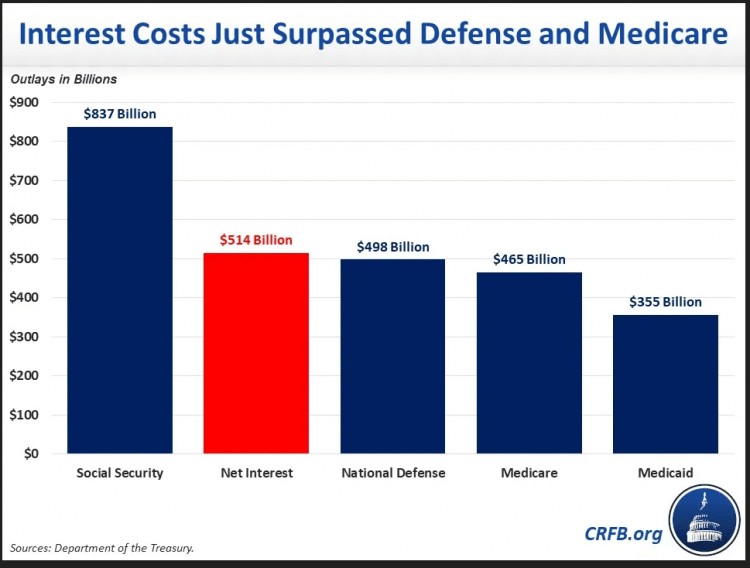

-美国国债利息支出(不是债务,只是利息)现在是美国预算的第二大项目,它已经超过了国防和医疗保险预算,预计到 2024 年将达到 8700 亿美元(占 GDP 的 3.1%)

-数百家美国银行面临破产或资本不足的风险。

- 信用卡违约率达到12年来的最高水平。

- 上个季度,所有类型债务的拖欠转变率都有所上升。

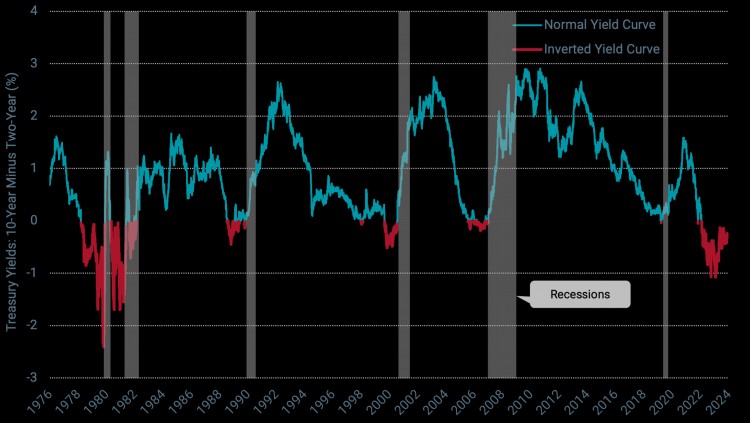

- 收益率曲线倒挂目前是有记录以来最长的,几十年来,收益率曲线倒挂一直是预示经济衰退的领先指标。

-消费者支出和零售额下降(消费者占美国GDP的70%)

-消费者对非必需品的兴趣下降。

-消费者在购物时更有可能降低价格或使用稍后付款的选项。

-由于看到了经济衰退的风险,许多 G10 央行已经开始降低利率,许多央行在通胀仍然高于目标价格的情况下这样做了,而美联储仍然坚持己见。

-In most major recession and economic crashes of the past, we have seen a stage of Euphoria which pre-dated it, this is exactly the same conditions we have seen in Crypto, S&P 500 and many other stocks over the last year.

-In many stock market crashes of the past we have seen similar conditions to what we see today with Nvidia. The Nasdaq and S&P 500 gains are all being supported by Nvidia, yes AI is booming but this also shows risk, firstly it shows extreme greed(FOMO), Secondly it shows investors are not finding value(diversity) in other stocks, this is a huge warning sign for the overall market.

There are many other warning signs, these are just a few that need to be noted.

These signs may take months to materialize but if they do it will be terrible for crypto, also note the FED might take drastic steps if these do materialize (lower interest rates to late, pump stimulus into the economy) this can lead to a last gasp Euphoric Bull phase.

If Unemployment starts to break down and we see increased numbers in the next 1-2 months i would advise positioning yourself for the worst case scenario, expect the best but prepare for the worst.

Cash out some/most of your crypto or stocks if this happens, ask yourself is the possible 5-10% extra you could make worth the risk of a massive shock( Im assuming most high leverage traders didnt make it this far, so this applies mostly to Spot holders)

I dont presume to know more than the FED, i research and listen to analysts i trust, not paid analysts who are employed to ONLY be bullish.

Now, more than ever, it will be important to monitor the US economic data, especially the labour market, dont ignore or be stubborn if this shows signs of breaking down further.

This is not anti crypto or FUD, i post to try help people who dont understand market risks.

Many new traders dont see how Crypto and the global economy is linked but it is, if we see a recession or crash then crypto prices will be hit hard, it will be a firesale.

The FED has stood by its policy for to long, they will need to act fast and correctly in the coming months, it could already be to late(Policy changes take a year or more to have an effect)

The market will be very sensitive to data in the coming months, especially Unemployment and Inflation, before you do anything, before you enter any trade, monitor the news ahead for the week.(Forexfactory.com)

It sucks but the price of Crypto is now firmly in the hands of the FED and the policy decisions they make in the next 3 months, dont be naive and think otherwise.

It took me a long time to research and write this post, if you made it this far(and found this helpful) a like is always appreciated.

Thanks for reading.

Peace.

![[加密混乱]支持加密货币游说团体称 18 名美国参议员支持加密货币](/img/btc/138.jpeg)