时间:2024-06-27|浏览:260

用戶喜愛的交易所

已有账号登陆后会弹出下载

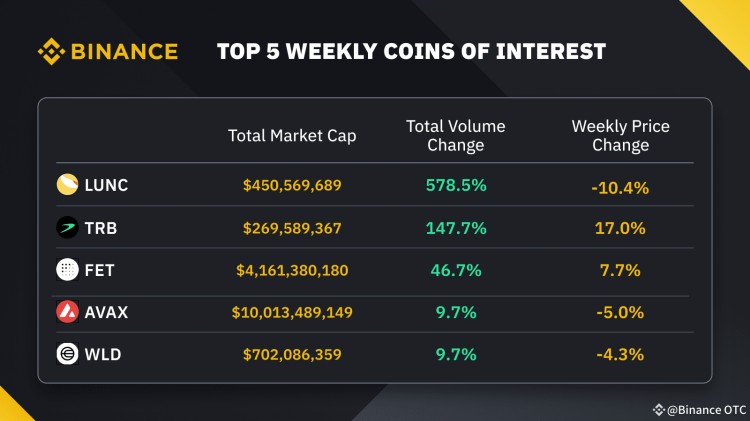

由于鲸鱼和其他投资者抛售 Terra Luna Classic ($LUNC),Terra Luna Classic 生态系统代币的价格大幅下跌。由于 LUNC 价格波动,我们的交易台对 $LUNC 的交易需求有所增加。

随着 7 月 1 日合并截止日期的临近,Fetch.ai ($FET)、SingularityNET ($AGIX) 和 Ocean Protocol ($OCEAN) 的持有者都兴奋不已,期待着最终结果。随着合并活动的临近,所有相关代币的价格都在飙升。虽然比特币横盘整理,但市场正在重新关注与人工智能相关的项目。随着合并公告的发布,我们的交易台观察到这三种与人工智能相关的代币需求强劲,其中 Fetch.ai 在 Convert 上的交易量变化最大。

随着市场将焦点重新转向人工智能项目,WorldCoin ($WLD) 再次成为热门代币。此外,Worldcoin 宣布与 Alchemy 合作,为其区块链 World Chain 构建基础设施,这提振了市场对该代币的热情。

整体市场

上图以 1D 图显示了 BTC 价格走势。

上周三未能突破下降楔形的上限后,BTC 价格下跌寻求进一步支撑。我们看到,在跌破下降楔形并在 60/61,000 美元区间找到支撑后,出现了强劲的抛售。

抛售是由几条利空消息引发的:

德国政府自上周四开始出售从一家盗版电影网站运营商手中缴获的大量比特币。这笔近 5 万比特币最初是从 Movie2k.to 运营商手中缴获的,Movie2k.to 是一家盗版电影网站,上次活跃时间是 2013 年。在嫌疑人主动投降后,这些比特币于 1 月份移交给了德国联邦刑事警察局 (BKA)。

Mt. Gox 将于 2024 年 7 月开始向客户返还资产。目前尚不清楚发送给前客户的比特币的具体数量,但可能在 65,000 到 140,000 之间。交易员预计,大多数债权人在收到 BTC 后不久就会出售,从而导致 BTC 价格进一步下跌。

周三美国交易时段,比特币(BTC)回落至 60,000 美元,此前一个与美国政府有关的钱包将约 3,940 个被扣押的 BTC 转移到 CEX,引发交易员对这些数字资产将被出售的担忧。

BTC 在 60/61,000 美元区间找到支撑,但并未迅速或坚定地反弹。相反,它在该区间内震荡,增加了它重新测试支撑位并进一步下跌的可能性。

如果 60/61,000 美元的支撑位失效,市场可能会进一步下跌,直到达到 52,000 美元,然后获得强劲支撑。如果出现这种情况,从 73,650 美元的高点的回撤幅度将超过 25%。

A 25% retracement is not uncommon during a bull market. During the 2021 bull market, the Bitcoin price experienced six 25% or greater retracements.

Our desk sees an increasing likelihood of this 25% retracement case after market sentiment shifted bearish, and risk management is critical to overcoming a large retracement in a bull market.

The above table is the 25-delta skew for BTC and ETH options.

According to the table, BTC options have a negative skew in the near-tenor options but a positive skew in the long-duration options.

It means that options traders are bearish on the Bitcoin price in the short term, but bullish on it in the long term, with a stronger bullish view in 180 days.

Ethereum, on the other hand, has a positive skew across options with different tenors. Options traders have similar views on the long-term price of BTC and ETH. However, in the near term, with the possibility of an ETH ETF listing in early July, both 7-day and 30-day ETH options have a positive skew.

Last Thursday (24-06-13)

In May, the US PPI fell 0.2% month on month, compared to an expected 0.1% increase and a 0.5% increase in April. The lower-than-expected PPI could lead to lower inflation, increasing the likelihood of the Federal Reserve cutting interest rates in September.

US initial jobless claims reached a nine-month high of 242k, exceeding the estimated 225k and last week's 229k. The recent increase in initial jobless claims suggests that the tight labour market in the United States is easing.

The Bank of Japan maintained its interest rate at 0.1%, unchanged. According to the statement, the Bank of Japan may reduce its purchases of Japanese government bonds after the next monetary policy meeting, which is scheduled for the end of July. USD/JPY rose to 158.2 from 157.3 prior to the announcement.

On Monday (24-06-17)

The Reserve Bank of Australia maintained the interest rate at 4.35%, unchanged. Governor Michele Bullock emphasized that high inflation was harming the economy and that lowering inflation was the top priority for the RBA. She stated that the RBA did not consider a rate cut case in this meeting, and the case for an interest hike was not increasing.

On Tuesday (24-06-18)

In May, the eurozone's CPI increased by 0.2% month over month, down from 0.6% in April. The annualized CPI growth rate in May was 2.6%, up from 2.4% in April. The core CPI growth rate increased by 2.9% on an annual basis, up from 2.7% in April.

In May, US retail sales increased by 0.1% month on month, falling short of the expected 0.3% growth but improving on April's 0.1% decrease. Core retail sales fell 0.1% month over month in May, falling short of the expected 0.2% increase.

In May, the UK CPI rose by only 0.3% month on month, falling short of the expected 0.4% increase. In May, the annualized CPI growth rate was 2.0%, which was lower than Apirl's figure of 2.3%.

Later this week, we have

Bank of England interest rate decision on Thursday

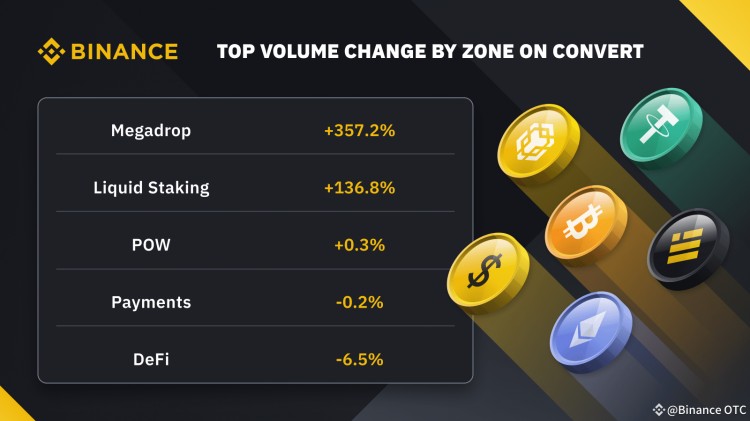

转换门户体积变化

上表显示了我们的转换门户上各区域的成交量变化。

本周,Megadrop 计划的第二个项目 Lista ($LISTA) 开始交易,我们的交易台发现整个交易台对该代币的需求激增,导致该区域的交易量增加了 +357.2%。

本周,随着 ETH ETF 有望获得美国证券交易委员会 (SEC) 批准并于 7 月 4 日开始交易,ETH 再质押板块继续跑赢大盘,Liquid Staking 区交易量环比增长 136.8%。

上周,我们的交易台注意到 Convert 上对比特币($BTC)的需求很高,这是 POW 区交易量增加 0.3% 的主要原因。

为何进行场外交易?

币安为客户提供多种方式进行场外交易,包括聊天沟通渠道和币安场外交易平台(https://www.binance.com/en/otc),用于手动报价、算法订单或通过币安转换和大宗交易平台(https://www.binance.com/en/convert)和币安转换场外交易 API 进行自动报价。

如需了解更多信息, 请发送电子邮件至:

trading@binance.com 。

加入我们的 Telegram ( https://t.me/BinanceOTC )以随时了解市场动态!