时间:2024-04-12|浏览:333

用戶喜愛的交易所

已有账号登陆后会弹出下载

How the US macro market will affect Bitcoin

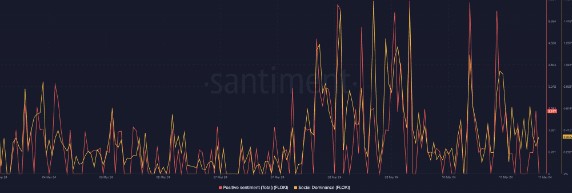

One of the reasons for the strong performance of major markets in March may be the interest rate cut signals sent by various central banks, which has also affected Bitcoin's relatively strong performance. According to a Bloomberg survey, all G10 central banks, except the Bank of Japan, are expected to cut interest rates in the coming year. Various developments in the past month have reinforced this outlook. For example, at the March 19-20 meeting, Federal Reserve officials said that despite the expected strong GDP growth and rising inflation, they still plan to cut interest rates three times this year. Similarly, the Bank of England had no officials supporting rate hikes for the first time since September 2021, and the Swiss National Bank unexpectedly cut interest rates on March 21.

On Thursday, April 5, the number of non-farm payrolls in the United States increased by 303,000 in March, far higher than the expected value of 200,000 and the previous value of 270,000, marking the largest increase since May last year. The rebalancing of the labor market is clearly reflected in the departure data, job vacancies, employer and worker surveys, and the continued gradual decline in wage growth. The CME Fed Watch tool shows that the probability of the Fed's first rate cut in June this year has dropped to around 50.8%, and the market will fully price in the Fed's first rate cut from July to September.

Powell's latest speech said that the latest data did not substantially change the overall situation, which continued to show solid growth, a strong but rebalancing labor market, and inflation falling towards the 2% target on a sometimes bumpy road. We do not expect it will be appropriate to lower our policy rate until we have more confidence that inflation will continue to fall to 2%. Given the strength of the economy and progress on inflation so far, we have time to let future data guide our policy decisions.

Crypto V Bitwu.eth (@BTW0205) said: The Fed's expectations for rate cuts have dropped sharply, and the probability of the first rate cut in June has fallen below 50%. Powell's "three rate cuts this year" is probably questionable. Combined with the current huge debt and interest, in order to keep the economy from collapsing in the election year, the United States has only two choices this year: either cut interest rates in line with market expectations, or continue to expand debt issuance. Otherwise, this mess will be an epic disaster for anyone. But no matter which choice is made, it will further promote the bull market of gold and #Bitcoin.If nothing unexpected happens, 2024 will be the transition year for macro liquidity to expand from contraction. It is very likely that interest rate cuts will not officially begin until 2025, and a new round of hot money will pour in.

Overall, the Fed's expectations for a rate cut in June have dropped significantly. The market is currently more inclined to July or later, and some radicals even believe that interest rates will not be cut until 2025. For Bitcoin, the market originally regarded the Fed's rate cut as the core driving factor for Bitcoin's further rise, because the increase in liquidity makes Bitcoin prices more likely to be pushed up. However, with the Fed's expectations for rate cuts postponed, considering the weakening signs of whales' holdings, Bitcoin's consolidation time is expected to last longer. In addition, geopolitical tensions have become an important factor affecting Bitcoin, such as the Russia-Ukraine conflict and the Israeli-Palestinian conflict, which have become factors that induce Bitcoin price fluctuations.