时间:2024-03-28|浏览:544

用戶喜愛的交易所

已有账号登陆后会弹出下载

Original title: Omni

Original author: PAUL VERADITTAKIT

Original source: VeradiVerdict

Compiled by: Mars Finance, MK

Omni brings natural interoperability to Ethereum's Rollups ecosystem, allowing Ethereum to return to operating as a single, unified operating platform for decentralized applications.

introduction

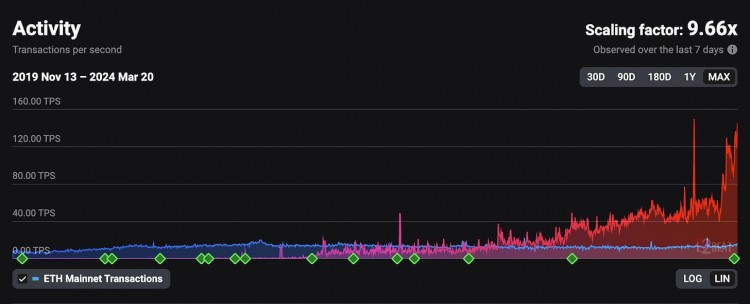

Rollups are the current status and future direction of Ethereum’s expansion. From 2021 to 2023, the use of Rollups has continued to increase, and its adoption has recently accelerated, bringing nearly a tenfold increase in transaction processing capacity to Ethereum L1.

Source: https://l2beat.com/scaling/activity

Rollups effectively help Ethereum process more transactions by processing them off-chain, storing data or proofs only on Ethereum L1. This approach allows Rollups to inherit the security of Ethereum’s L1 while remaining compatible with its vast ecosystem of developer tools and applications.

However, Rollups introduced negative externalities when scaling Ethereum through an independent off-chain environment, affecting Ethereum's network effects. Specifically, liquidity, users, and developers are dispersed across ecosystems. The proliferation of rollups designs and their increasingly widespread adoption have only exacerbated these problems. Therefore, Ethereum needs a native interoperability protocol to realign the network with its original purpose as a single unified operating system for decentralized applications.

Omni’s key innovations

Omni is an Ethereum-native interoperability protocol that establishes low-latency communication among all Ethereum Rollups, enabling Ethereum to operate as a collaborative system in the modular era. Omni is built by a team with deep industry experience and aims to integrate Ethereum's decentralized Rollups ecosystem through the following features.

safety

Interoperability protocols have historically faced security challenges. Early protocols relied solely on a set of trusted participants to authenticate and relay messages between networks. These protocols have been the target of numerous vulnerabilities over the years, costing the industry more than $1 billion.

Second-generation protocols improve upon this design by applying cryptographic economic security mechanisms to the network. This approach requires participants to stake the protocol’s native assets for verification. This is a step in the right direction, but relying on native assets makes the protocol’s security guarantees unstable.

Omni brings a new security model for interoperability protocols by introducing EigenLayer. By re-mortgaging $ETH, Omni secures its validator fleet, scaling in tandem with Ethereum’s L1 security budget. Ethereum’s current security budget exceeds $100 billion, which is far larger than any other PoS network. Utilizing rehypothecated $ETH, a highly liquid, low-volatility asset, Omni’s security increases significantly. Additionally, Omni inherits security from Ethereum, consistent with the Rollups it connects to, driving a security model that grows in step with the Ethereum modular ecosystem.

Omni sets the standard with EigenLayer’s Active Verification Service (AVS). As the first to strike a deal with a Liquid Collateralization (LRT) provider, Omni made this landmark happen when it agreed to lease $600 million worth of recollateralized $ETH from EtherFi. Omni's team has also secured agreements with multiple other LRT vendors, resulting in a security budget of over $1 billion at launch, providing Omni with industry-leading security while avoiding the high costs of network launch. . As the only Active Validation Service (AVS) running on the testnet, besides EigenDA, Omni is regarded as one of the most prepared AVS on the market.

Sub-second verification

One of the biggest advantages of an integrated blockchain like Solana is low-latency transactions compared to modular systems. Users have adapted to a sub-second trading experience similar to modern cloud-based web applications. In order for Ethereum to compete with these alternative platforms, the latency of messages across Rollups must match the transaction speed of the integrated system.

Omni brings sub-second cross-Rollups message verification experience to Ethereum Rollups through an innovative protocol architecture. After a previous testnet that processed 7.5 million transactions and data from 550,000 wallets, Omni Labs overhauled the network’s architecture. At the heart of this design is Octane, a new open source framework for fusing EVM and CometBFT consensus. Octane uses the Ethereum Engine API and ABCI++ to clearly divide the execution and consensus links of the Omni node, thus isolating factors that affect performance in the existing EVM CometBFT framework.

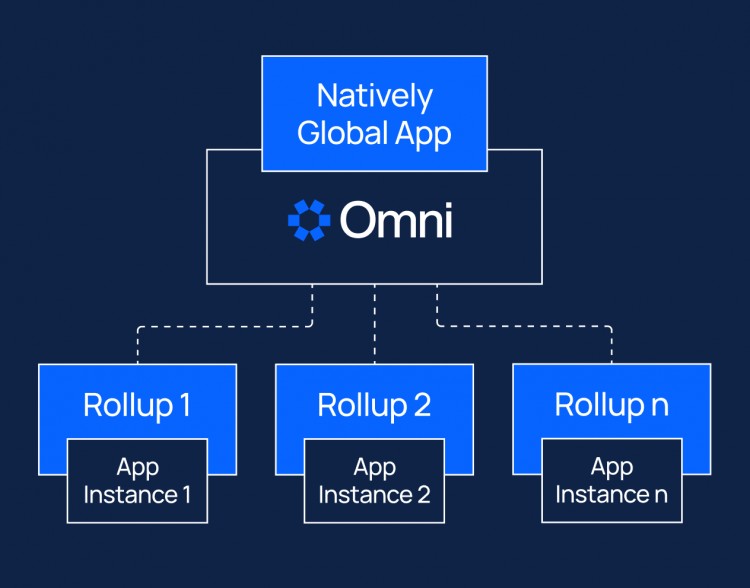

Naturally Global Apps (NGAs)

Omni not only provides cross-Rollups message verification, but also launched a dedicated execution environment - Omni EVM, allowing developers to uniformly manage all their Rollups application deployments. By using Omni EVM as the orchestration layer, developers can deploy Naturally Global Applications (NGAs). NGAs are a new class of applications that can dynamically distribute contracts and interfaces into any Rollups, providing default access to Ethereum's full liquidity and user base. Through NGAs, developers can take advantage of the scalability of Ethereum Rollups without having to deal with distributed state across multiple Rollups environments.

As the Rollups ecosystem continues to grow, the project will develop more custom Rollups solutions, each targeting specific functionality and performance needs and incorporating unique virtual machines, programming languages, and data availability frameworks. Omni is designed to support any Rollups architecture, enabling seamless application management through Omni EVM.

backwards compatible

Considering the adaptability to existing Rollups applications, Omni was designed with special emphasis on backward compatibility. Applications can integrate Omni without changing deployed contracts. The application enables Omni to serve as an enhancement layer to existing deployments by using modified front-end directives to build messages across Rollups. Additionally, Omni introduces a universal gas market for delivering cross-Rollups messages to target networks, reducing the need for users to manage different collections of gas tokens.

team

Omni Labs is led by a team with deep industry experience. The team is led by Harvard graduate and CEO Austin King, who previously founded the Interledger network, which processed billions of payments and was eventually acquired by Ripple. Tyler Tarsi, a Harvard graduate and chief technology officer, is responsible for the engineering side of the team and brings experience in building machine learning infrastructure for quantitative trading systems. Prior to founding Omni, the two worked together at Rift Finance, a DeFi protocol that accumulated $50 million in total value locked (TVL) in just two days.

Looking to the future

Omni has taken a unique approach to the interoperability of Ethereum Rollups, which will soon be available to all users and developers. Omni Labs recently deployed its final testnet, called Omni Omega. In Q2, Omni will become the first Active Validation Service (AVS) to launch on mainnet, bringing a secure and high-performance interoperability solution to Ethereum's decentralized Rollups ecosystem. Just as Rollups have become a critical infrastructure for processing transactions, Omni is expected to become the standard solution for interoperability within the Ethereum ecosystem.