时间:2024-03-11|浏览:244

用戶喜愛的交易所

已有账号登陆后会弹出下载

随着市场转为看涨,多种山寨币表现出色。然而,最新数据暗示山寨币将进一步牛市反弹。

Considering the recent buzz surrounding AI tokens and meme coins, could they be the start of an upcoming show?

Altcoins start to rebound

Moustache, a popular cryptocurrency analyst, recently tweeted about an interesting development. According to the tweet, the altcoin has yet to break above the November 2021 highs, suggesting further gains are in store for the altcoin.

At the time of the tweet, the coins were in a consolidation phase, which could trigger a price increase soon.

A similar situation occurred in 2013 before the altcoin market cap reached ATH in 2017.

If history repeats itself, altcoins may soon exhibit bullish momentum, taking them to new highs in the coming months or years.

How is the king of altcoins doing now?

When it comes to altcoin rallies, all eyes are on Ethereum as it is most likely to trigger a rally.

The price of ETH increased by more than 16% last week, according to CoinMarketCap. However, its value has changed only slightly over the past 24 hours. At press time, it was trading at $3,949.87.

Most indicators have also turned bearish, as ETH’s relative strength index (RSI) and stochastics are both in overbought territory at press time.

相当多的其他指标也看跌山寨币。AMBCrypto 对 CryptoQuant数据的分析显示,ETH 的外汇储备正在增加,表明抛售压力很大。

Ethereum’s Korean Premium and Fund Premium also posted losses. This means that selling sentiment among funds and Korean investors dominated.

Check out the meme coin

Unlike Ethereum, memecoin’s gains last week were more prominent, with most coins seeing double-digit gains. Notably, PEPE’s value surged nearly 130%.

To understand what’s causing this surge, AMBCrypto examined the meme coin’s daily chart. We saw last week that the MACD remained positive for the bulls.

Its Chaikin Money Flow (CMF) and Relative Strength Index (RSI) also remained elevated last week, giving PEPE an impressive performance.

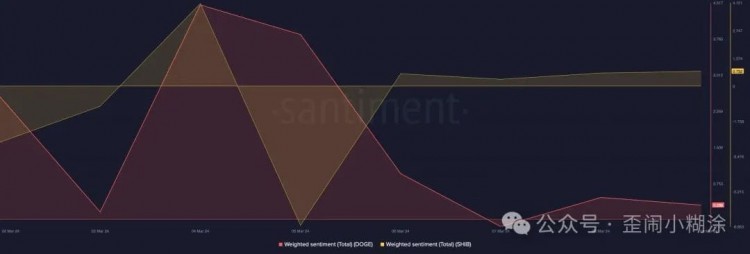

狗狗币 [DOGE]和柴犬 [SHIB]上周也表现良好,其价值分别飙升 33% 和 72%。

Interestingly, despite the price increase, market sentiment for DOGE remains bearish, as evidenced by the decline in its weighted sentiment. However, SHIB remains in positive territory.

The price action of all the aforementioned meme tokens has remained dormant over the past 24 hours, suggesting that they may also be about to initiate a bull rally in the near term.

All eyes on artificial intelligence?

Similar to meme coins, AI tokens have a similar fate. This could be due to overall market conditions or the altcoin being in a consolidation phase.

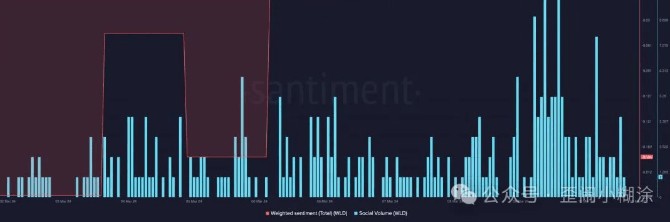

Worldcoin [WLD] has been in the headlines recently due to a significant price increase, with the price falling by 5.11% in the past 24 hours alone.

As of this writing, WLD is trading at $10.01 and has a market capitalization of over $1.48 billion.

However, the bullish sentiment surrounding AI tokens has improved over the past few days. Its social volume has also surged, reflecting its popularity in the cryptocurrency space.

为了更好地了解 AI 代币的情况在未来几天是否会发生变化,我们查看了其日线图。我们的分析显示,WLD 的价格触及布林带的上限。

Whenever this happens, it is a sign that prices are about to correct.

Its relative strength index (RSI) also fell, meaning investors are selling. The coin’s Chaikin Fund Flow (CMF) is also following a similar downward trend, further indicating a lower price.

Nonetheless, MACD remains bullish.

除了 WLD 之外,另一个流行的 AI 代币是Fetch.ai [FET]。不幸的是,FET 的情况看起来也很相似。根据 CoinMarketCap 的数据,FET 在过去 24 小时内下跌了 7% 以上。

As of this writing, it trades at $2.83, giving it a market capitalization of over $2.36 billion.

The daily chart for FET also looks similar to that of WLD, as the former’s price touches the higher bands of Bollinger Bands. Its RSI and CMF also declined.

Bitcoin problem

While the performance of top altcoins has played much of the role in triggering the bull rally, some role for Bitcoin [BTC] cannot be ruled out. As the largest cryptocurrency, BTC affects the entire market.

Recently, Bitcoin prices surged past the $70,000 mark, giving investors hope of a new rebound. Therefore, it will be difficult for altcoins to challenge Bitcoin’s bull rally, given Bitcoin’s absolute dominance.