时间:2024-03-09|浏览:295

用戶喜愛的交易所

已有账号登陆后会弹出下载

Original author: Lincoln Murr

Original source: Bitpush

With Bitcoin breaking through all-time highs of $69,000 and $70,000, it’s safe to say we’re back in a bull market. Although it is uncertain how high Bitcoin will rise, and whether other altcoins such as Ethereum or even meme coins will continue to follow suit, every ordinary person has a chance to be in the bull market through sensible investment decisions. Create and accumulate wealth.

This article will discuss some time-tested strategies to ensure you take advantage of this bull market wave without getting too carried away.

During bear markets, dollar-cost averaging (DCA) is one of the best strategies for accumulating assets in traditional and crypto markets.

The concept of DCA is to set up automated recurring purchases over a period of time, rather than “using all the bullets” at once. This ensures investors enter at a more even price, rather than being exposed to wild price swings and full capital risk at the same time.

On the other hand, the same strategy can be used in a bull market - repeatedly automatically selling a certain number of positions, which can be set weekly or monthly, or linked to a take-profit target price you have in mind. For example, many investors sold Bitcoin a few days ago when it first topped $69,000, and BTC subsequently retraced nearly $10,000. There is no shame in taking profits; otherwise, a portfolio is just numbers on a screen rather than actual gains. It is also important to make the decision to sell as soon as possible, before the excitement and emotional decision-making caused by a bull market overwhelms reason.

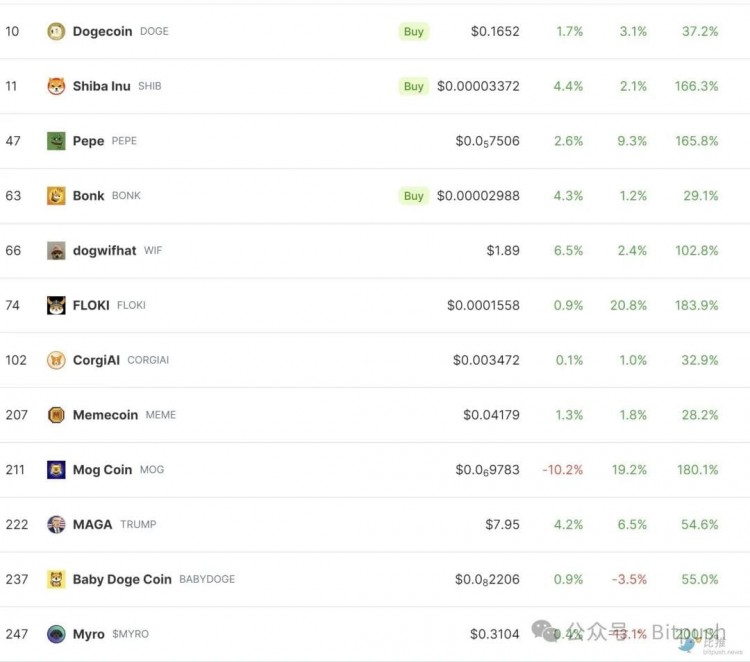

While it might seem like everyone could get rich off meme coins, the reality is that it’s closer to gambling than investing, or gambling to be precise. These markets suffer from survivorship bias, with mainstream media reporting on five or six meme coins, making everyone think they can easily find the next Dogecoin or Dogwifhat.

In fact, tens of thousands of memecoins are created every day, and most have never topped $10,000 in market cap. Either they have been abandoned by early investors, proven to be an elaborate scam, or will never gain traction. While there is nothing wrong with this type of speculation, memecoins are purely bets on community behavior and psychology. Other types of cryptocurrencies may not offer as high returns, but have the opportunity to be safer and longer-term investments. .

As with memecoin trading, day trading (or T, "day trading", "day trading") and leveraged trading often result in the loss of large amounts of money in an instant. When prices rise, it might seem like a good idea to buy $1,000 worth of Bitcoin for $50 using derivatives or a perpetual exchange, but when prices take a quick dive, a liquidation awaits. Buying, holding, or earning interest using DeFi protocols is much safer than taking risks with leverage. Trying to do a T is also a risky strategy and generally not recommended unless you are very good at interpreting trend charts. This strategy is far from foolproof, and there are far more losers than winners.

In every cryptocurrency bull run, there’s always a few projects that everyone seems to believe are the next big thing. Then, when the next bull market comes, these projects are either dead or dying.

There are many examples of 2017 and 2021 that no one has heard of today, tokens and protocols worth billions of dollars at the time that no one cares about today. The safest bets in the cryptocurrency space are Bitcoin and Ethereum, followed by other long-established currencies with real utility or interest.

Speculative utility games are those that don't currently have much developer attention or user interest, or are still under construction, but show potential to create better systems than the current market leaders. Even with these tokens, investors must remain cautious as good technology does not always win. For example, Ethereum remains the market leader in smart contracts and DeFi, despite being extremely slow and extremely expensive to trade. In theory, alternative L1s like Avalanche, Fantom, Solana, etc. could easily attract investors to place bets, but ecosystem development and activity is arguably more important than pure technical achievements.

Finally, many DeFi protocols will offer high percentage yields, but the tokens they issue will also increase year-over-year. Unless compounded manually or automatically using a service like Beefy Finance, this gain will ultimately be worthless, so it's important to make a profit as quickly as possible.

Joining and riding a bull market is an exciting experience. For those who accumulated coins throughout the bear market, now is the time when patience and faith will pay off, but only if you are determined and dedicated enough and don’t get too attached to a particular coin or think it will only go up Not falling. If Bitcoin continues to soar into the hundreds of thousands of dollars, it could easily fall back to its current price (if not lower), and the profits will be just a bunch of numbers until you're safe. It may sound pessimistic, but it is truly the safest way to ensure that the bull market is not wasted and that personal wealth is accumulated.