时间:2024-03-08|浏览:205

用戶喜愛的交易所

已有账号登陆后会弹出下载

作者:格雷索恩

引言

欢迎阅读Greythorn 2024年2月的市场研究报告。随着加密货币在金融领域日益重要,我们将持续为读者提供数字资产和区块链技术的最新趋势和前沿信息。

Greythorn将持续为读者提供加密货币市场的月度分析报告,包括市场趋势的详细分析、监管动态的更新,以及影响这些数字货币的宏观经济因素。

比特币分析

2月市场动态

2月份,经济信号、监管行动和市场情绪的复杂互动塑造了比特币的市场格局。早些时候,美联储公开市场委员会(FOMC)后记者出席,鲍威尔的语气与之前的会议相比发生了显着转变,未再强调美国银行体系的债务,债务在金融市场引发了连锁反应,对包括比特币在内的不同资产类别产生了不同的影响。

这显示了比特币市场行为的特点。它可以与更广泛的金融市场保持一致,作为一种风险资产,而在经济不确定时期,它又构成避险资产。

尽管最初出现下跌,

环境担忧与比特币挖矿

监管发展与立法复兴

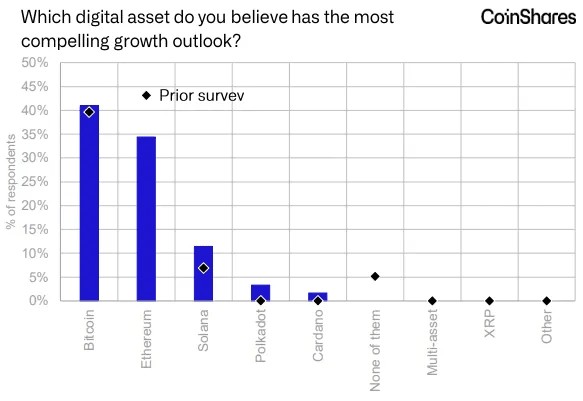

价格波动、投资者情绪、流动性以及机构对加密货币的兴趣

来源:CoinShares

尽管以太坊市场的流动性改善且没有直接受益于与ETF相关的资金流,但

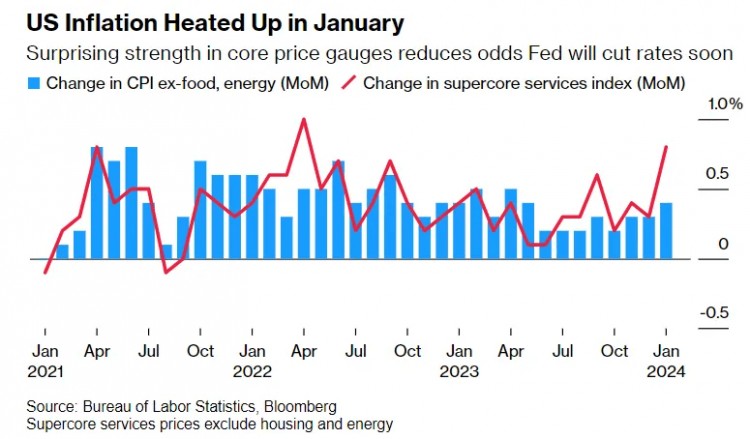

随着2月份的进展,比特币价格出现了大幅波动,于14日突破了50,000美元的标志性大关,这证明了攻击压力的增加和攻击压力的减弱。1月份CPI数据的发布显示了持续性的通胀挑战,最初引发了BTC价格的急剧下跌。然而,比特币很快与传统风险资产脱节,迅速回升甚至达到了新的年内高点,再次展现了BTC可作为风险资产和经济不确定性的一种对冲工具。

来源:彭博社

另外,在刚刚过去的2月,有不同的表明,

2月份以太坊市场流动性讨论

比特币2月末的价格突破

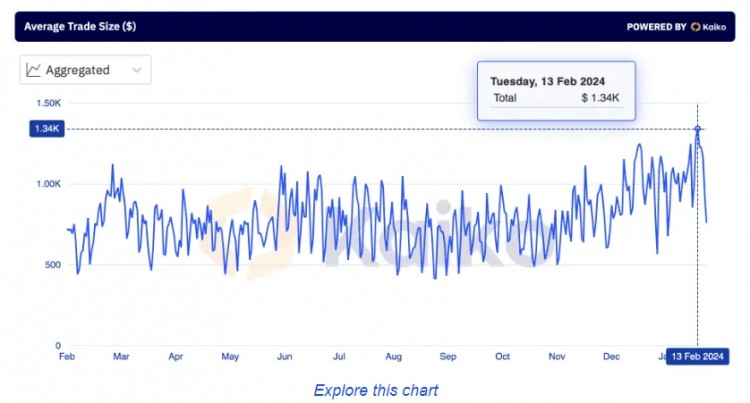

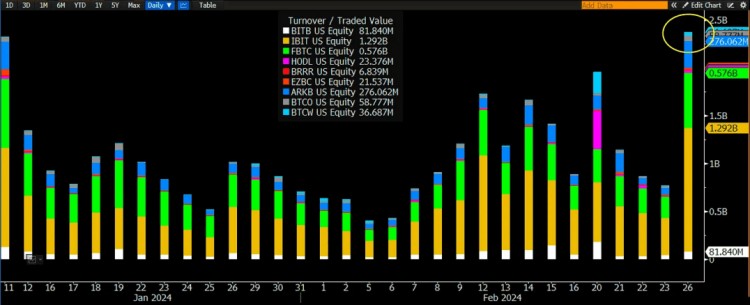

在经历了一段相对平静期后,尽管以太坊取得了收益,比特币在2月末迎来了一次大幅上涨,价格突破了60,000美元大关。亚洲投资者的积极参与。例如,贝莱德的IBIT产品单日交易额接近13亿美元。虽然这并不能完全代表净流入,但很大一部分可能代表了新的投资。

值得注意的是,ETF投资等因素使得本轮市场周期如此凸显,预计未来将巩固市场基础。任何价格的回调都可能被普遍投资者视为入市的机遇,他们认为上升空间尚未完全错过。

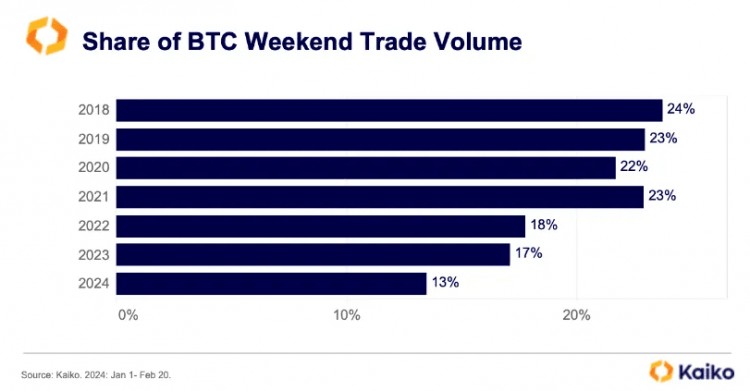

重要的是,考虑到比特币价格的飙升,比特币在周末的交易量,相对于其总交易量的比例,仍占六前交易量水平的一半。

链上分析

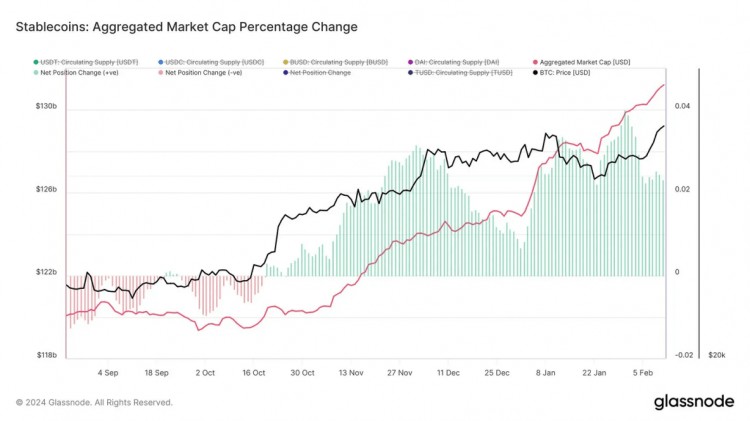

2月份,稳定币领域的供应量资金急剧上升。这种发展远超市场的一贯活跃,引发了人们对加密货币领域的信心有了新的提升,这体现了市场中相当数量的新流入。

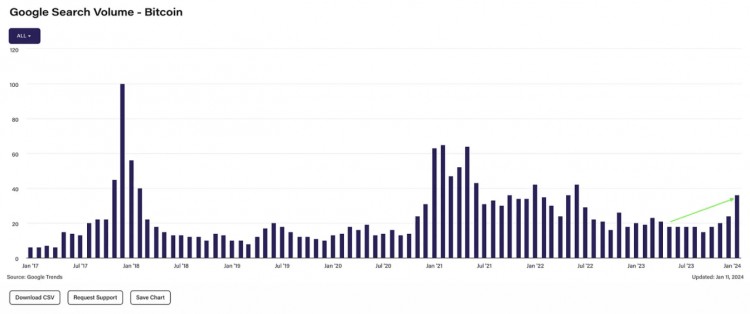

随着比特币接近历史高点,公众对此的好奇心显着增加。谷歌搜索趋势数据显示,“比特币”的搜索量达到自 2022 年 6 月以来的最高点。

来源:谷歌搜索量 - 比特币

When comparing open interest in Bitcoin futures on CME to other exchanges, CME’s dominance shows strong interest from U.S. institutional investors. Currently, CME leads the way in open interest in Bitcoin futures, even surpassing Binance, indicating increased institutional participation. However, this trend does not extend to Ethereum, where CME ranks only fifth in the Ethereum futures market.

Despite a slow start to 2023, Ethereum has quietly staged a remarkable rebound, with year-to-date performance significantly ahead of Bitcoin, Solana, Avalanche, and leading second-layer solutions such as Arbitrum and Optimism.

Investments in all Bitcoin spot ETFs increased, setting an unprecedented record for the ETF industry in the first few weeks of the year.

Considering the inflow of new funds, Bitcoin appears to be embarking on a new phase. Currently, funds contributed by short-term investors account for 35% of the total realized value.

Despite the current positive market trends, short sellers continue to bet on a bearish market and are therefore facing liquidation of their opposite bets. It seems that bears are not paying much attention to on-chain indicators.

Over the past week in particular, funds that initially flowed to Sui and Solana at the beginning of the month appear to have started flowing back into Ethereum.

Pandora NFTs are rebounding, which means ERC404 may be here for the long term. Meanwhile, the Pudgy Penguins NFT remains strong with a floor price of 20 ETH. However, the famous series Sappy Seals and Kanpai Pandas are absent, and the value of both has also increased significantly, with the base price of Seals exceeding 1.7 ETH and the base price of Pandas exceeding 2.5 ETH.

Disclaimer: The cryptocurrency ecosystem is vast and constantly evolving, with numerous indicators of concern on a daily basis. This overview is intended to highlight selected monthly metrics for brief insight and is not intended to be a comprehensive report.

MicroStrategy Bitcoin portfolio reaches $12.4 billion as Bitcoin crosses $60,000 mark.

The U.S. Securities and Exchange Commission (SEC) has charged the founder of HyperFund in a $1.7 billion fraud.

Tether posted a profit of $2.9 billion in the fourth quarter and boosted its reserves to $5.4 billion.

FTX suspended its restart plan and promised to repay user funds in full.

Celsius Network went bankrupt and began distributing more than $3 billion in assets to creditors and creating new Bitcoin mining companies.

Ethereum has reached an important milestone, and 25% of ETH has been pledged.

Bitcoin mining difficulty breaks through the 80 trillion mark, a new high.

The cumulative trading volume of spot Bitcoin ETF exceeds 50 billion US dollars.

The Ethereum Dencun upgrade was successfully deployed on the Sepolia test network, and the main network is planned to be launched.

Harvest Fund Eyes First Hong Kong Spot Bitcoin ETF.

Bitcoin mining company GRIID makes its debut on Nasdaq.

Uncorrelated Ventures launches $315 million fund to focus on startups in encryption and software fields.

Vitalik Buterin focuses on the synergistic prospects of cryptocurrency and artificial intelligence to support a new generation of leadership.

Polygon Labs is laying off 19% of its employees as part of its organizational restructuring.

The account of Ripple's co-founder suffered a $113 million security breach, causing the price of XRP to fall.

The total pledge value (TVL) of EigenLayer exceeds US$6 billion, and the deposit limit has been increased accordingly.

Kraken expands its European business and gets Dutch license approval.

Binance decided to delist Monero (XMR), sending the price down 15%.

The Solana network is back up and running after a five-hour downtime.

Frax Finance launches the second-layer network Fraxtal.

Ethereum NFT transaction volume is approaching annual highs.

Thailand announces exemption from VAT on cryptocurrency gains.

OKX expands to Argentina and launches exchange and wallet services.

Coinbase’s fourth-quarter earnings exceeded expectations, and trading revenue increased significantly.

PlayDapp lost $290 million in tokens in a double security breach, Elliptic provides data support.

Pudgy Penguins NFT surpasses Bored Ape Yacht Club in historic floor price flip.

The unlocking of Starknet tokens has sparked controversy among investors and the community.