时间:2024-02-23|浏览:305

用戶喜愛的交易所

已有账号登陆后会弹出下载

Written by VIKTOR

Compiled by: Deep Wave TechFlow

I spent considerable time researching the last bull run, the different narratives that were popular at the time, profit maximizing rotations, the best performing coins in 2021 and the logic behind their massive gains.

This new cycle will not be exactly like the previous one, but there are many lessons we should remember because history is similar, especially in financial markets, where much of the prosperity comes from the way the human brain thinks and that will never change.

Let’s get right to the point.

General experience in bull markets

New coins perform well, old coins underperform

A significant trend in the 2021 bull market is the poor performance of old coins. Almost all coins in the 2018 cycle will perform well in 2021.

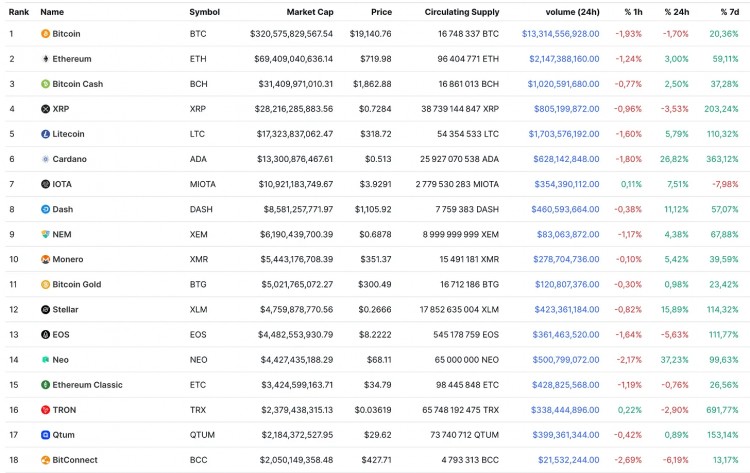

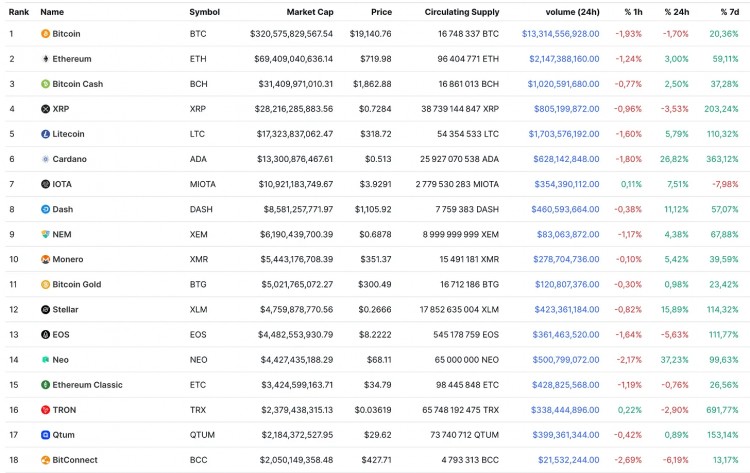

Ripple (XRP), Stellar Lumens (XLM), Bitcoin Cash (BCH), NEO, XEM, IOTA, EOS, Dash, Monero (XMR), Zcash (ZEC), and Tron (TRX) never reached their previous highs again (in USD terms) and they have essentially only fallen relative to BTC since 2018.

Of course, apart from BTC and ETH, the only good performances among the major legacy coins came from BNB, Cardano (ADA), Ethereum Classic (ETC) and of course DOGE.

This is a screenshot of CoinMarketCap’s rankings in December 2017. I highly recommend you look at these historical snapshots for a few dates to help you understand how the cryptocurrency market "rotates."

Most coins underperformed BTC before the bull market really started

When we are in the middle of a bear market and think we are close to the bottom, it is obviously the best time to buy BTC and ETH and hold until the next bull market.

But by the same logic, you might also be tempted to buy altcoins because they have a high beta against BTC and should therefore perform better. Even though this is true for some altcoins, it wasn’t entirely true during the last bull run.

Most altcoins underperformed Bitcoin during the Bitcoin rally in late 2020 until early 2021, when they suddenly started taking off.

The good news is that by holding BTC and ETH until the bull market begins, you are not really missing out on excess returns.

If history repeats itself, this is what we should expect: BTC (and maybe ETH too) should have a period where it takes off on its own, while altcoins lag behind, BTC market share rises, and then suddenly the rotation begins, and that’s when the altcoins start going crazy rise.

But I don’t think this is exactly what has happened or will happen: what we have seen over the past few months is that $BTC has risen simultaneously with BTC dominance, just like in 2020, but this time from June 2023 to now , we have seen many coins outperform BTC.

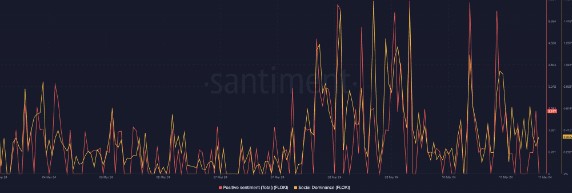

BTC market share

My explanation is:

For long-term investors, the bottom to buy is $BTC (and $ETH, even if in hindsight not touching ETH in 2023 was the best idea) in November 2022, while the time to buy the right altcoins is Around June 2023

There's a lot of variation in altcoin performance: $ETH underperformed $BTC in 2023, some older altcoins also underperformed $BTC over the past few months, and some altcoins have significantly outperformed the market

Still, we haven’t seen the altcoin mania phase yet, which I expect will be a full blown frenzy when BTC breaks out of its past high price (69,000).

Most gains are concentrated within a few months

Most of the gains in these cryptocurrencies are concentrated in a fairly short period of time. Almost all performances occur within a few months, especially on altcoins.

For example, in the last bull market, it was from January to May 2021, and then from August to November. The market is in a period of “all up, no down” and your new opponents are retail investors who have given up on cryptocurrencies for 3 years.

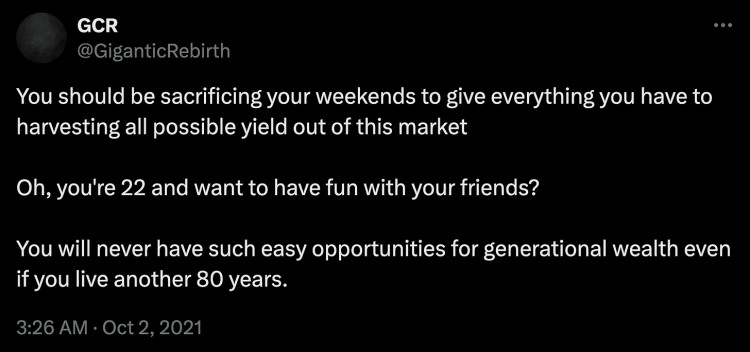

These are the critical moments when you need to put 100% of your energy into the market. There is a famous GCR tweet that sums up what you need to do during these times:

Here are a few examples to give you an idea of how rapid and concentrated the rise has been:

$CHZ: Grew 30x in one month from February to March 2021

$BNB: 8x growth in 20 days in February 2021

$DOT: Grew 8x in two months from January to February 2021

$SUSHI: Grew 6x in one month, January 2021

$AAVE: Grew 6x in one month, January 2021

$HOT: Grew 35x in 2 months February-March 2021

$JOE: 60x growth in two weeks in August 2021

Don’t let post-traumatic stress disorder (PTSD) from a bear market rob you of your chance to make crazy gains during bull and copycat seasons

If this is your first market cycle, there's a good chance you'll enter the market too late, let your investments soar at irrational valuations without making timely profits, and then bounce back and forth between many gains. However, if you're reading this, chances are you've been through the last cycle and survived a particularly brutal bear market in 2022. In a bear market, you have to be alert to every rally and be ready to short every time an altcoin rallies on some catalyst. This behavior will be rewarded. However, in a bull market, this completely changes: coins rise higher than you think. You have to be ready to benefit from it.

Here are a few examples of some tokens that have seen crazy gains in a fairly short period of time in 2021, and the very large valuations they have reached:

In January 2021, $DOGE increased nearly 10x in one day, when it was already a billion-dollar token

$THETA’s market cap rose from $1 billion to $12 billion in 3 months

$RUNE’s market cap grew from $200 million to nearly $5 billion in 5 months

$FIL once reached an FDV of nearly $400 billion

$ICP launched with $250 billion in FDV

$AXS’s market capitalization rose from $200 million to $10 billion in 5 months, and its FDV was $43 billion at its peak

$GALA’s market capitalization reached $5.4 billion at its peak in 2021, compared with the project’s market capitalization of just $5 million at the beginning of the year

$TEL’s market cap increased from $10 million to $30 billion (300x) in 5 months

The evolution of total cryptocurrency market capitalization during the last bull run

The main narrative of the 2021 cycle, and the best returns:

DeFi 1.0:

DeFi became the new thing in cryptocurrencies in 2020, offering new use cases and something fresh out of nothing. DeFi is the focus of the market in the summer of 2020, which is why it is called “DeFi Summer” and we can describe it as the beginning (or pre-start) of the bull market.

Add a Ponzinomics aspect to the whole thing and you have a recipe for huge gains. The two biggest winners in DeFi with strong fundamentals are $AAVE and $SNX. From bottom to top, these have returns ranging from 500x to 1000x. We can also mention $SUSHI, which grew 30x between November 2020 and March 2021.

Everything L1

The L1 trade is the most persistent trade in cryptocurrencies and one of the most valuable trades of the last cycle: the main winners of this trade are $SOL, $LUNA, $AVAX, but also include $FTM, $ADA, $BNB , $EGLD.

The market places a very high premium on Alt L1s, meaning that on average, their value (market cap or FDV) is higher than other categories, such as applications. Once you know this, you know you have to engage with this narrative. It quickly became clear that this was one of the themes of the 2021 bull run, as some of them were almost the best performing coins from the start until the Terra-Luna crash in May 2022.

The lesson here is: once you understand what the main theme of the cycle is, you simply go with the flow. The second lesson is: Layer 1 (Alt L1) transactions never go away. This is a dominant theme in 2021, but in fact it was already the case in 2017 and will be the case again in 2023-2024.

alt L1 Ecosystem Playbook

In cryptocurrencies, whenever a coin rises, traders look for coins that are correlated with the rising coin, or that should logically follow the rise. This is why, when an L1 network currency rises, people start looking for all the tokens in this network's "ecosystem" because these tokens have smaller market caps, so are expected to rise more dramatically, and as L1 currencies "beta".

Typically, the main ecosystem coin is the network’s dominant decentralized exchange (DEX), and that’s where some crazy gains were made during the last cyc