时间:2024-02-04|浏览:304

用戶喜愛的交易所

已有账号登陆后会弹出下载

On February 2, ARK Invest, a Bitcoin ETF issuer and controlled by Cathie Wood, released a 160-page annual report titled "Big Ideas 2024: Subverting Conventions and Defining the Future."

The entire 160-page report focuses on topics such as artificial intelligence, Bitcoin, smart contracts, robots, digital wallets, electric vehicles, reusable rockets, and 3D printing. The full report has 15 parts in total. It focused on topics such as artificial intelligence, Bitcoin, and electric vehicles.

We know that among the 11 Bitcoin spot ETFs approved by the US Securities Regulatory Commission on January 10, ARK 21Shares Bitcoi ETF ARKB, owned by Sister Mu’s ARK Invest, is one of them. Before the US Securities Regulatory Commission approved the ARK 21Shares Bitcoin ETF, Sister Mu also held nearly $80 million in Grayscale’s Bitcoin fund GBTC. Of course, after launching its own Bitcoin ETF, it gradually withdrew from GBTC and switched to its own ARKB.

Strictly speaking, Sister Mu is a senior Bitcoin believer. Previously, BlackRock founder Larry Fink also called himself a Bitcoin believer.

As of February 2, within 16 trading days since the launch of the Bitcoin ETF, ARKB had reserved 16,415 Bitcoins, worth approximately US$700 million. Second only to BlackRock and Fidelity. Ranked third.

Carbon Chain Value will extract part of the entire report "Big Ideas 2024" that focuses on Bitcoin for readers and friends to refer to. When talking about Bitcoin, the report is divided into two parts. One part talks about "Bitcoin Allocation", focusing on improving the role of Bitcoin in investment portfolios. The other part talks about "Bitcoin In 2023", focusing on Bitcoin's resilience and resilience after encountering challenges in 2022.

The report stated in the "Bitcoin Allocation" section that Bitcoin is a relatively new asset class and its market is rapidly changing and full of uncertainty. Bitcoin is largely unregulated, and investments in Bitcoin may be more susceptible to fraud and manipulation than more strictly regulated investments. Bitcoin is subject to unique and significant risks, including significant price fluctuations, lack of liquidity, and risk of theft.

ARK stated that the information provided in the report is based on ARK's research content and does not constitute investment advice.

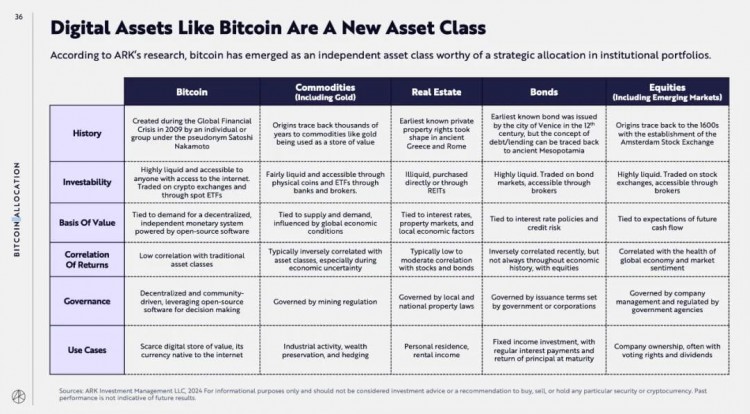

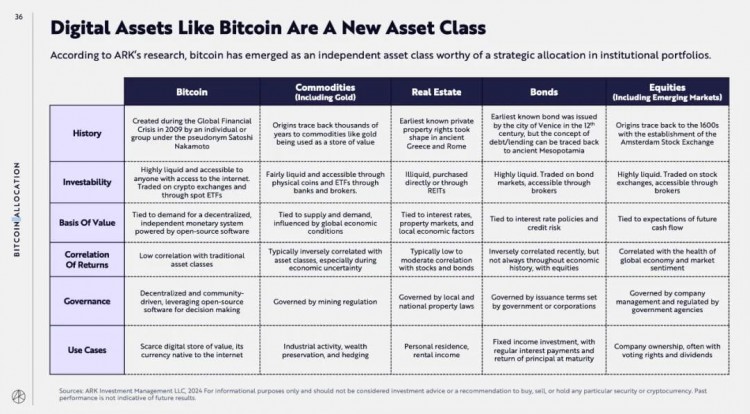

According to ARK’s research, Bitcoin has emerged as an independent asset class worthy of strategic allocation in institutional portfolios.

In the "Bitcoin Allocation" section, the report compares Bitcoin with commodities, real estate, bonds, and stocks from six dimensions: history, investability, basic value, rate of return, management, and cases.

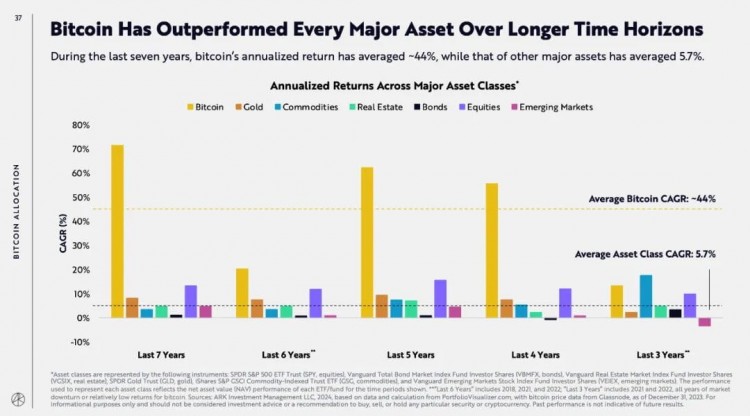

Bitcoin outperforms all other assets over longer time frames, the report said. For example, over the past seven years, Bitcoin's annualized return has averaged about 44%, while other major assets have averaged 5.7%.

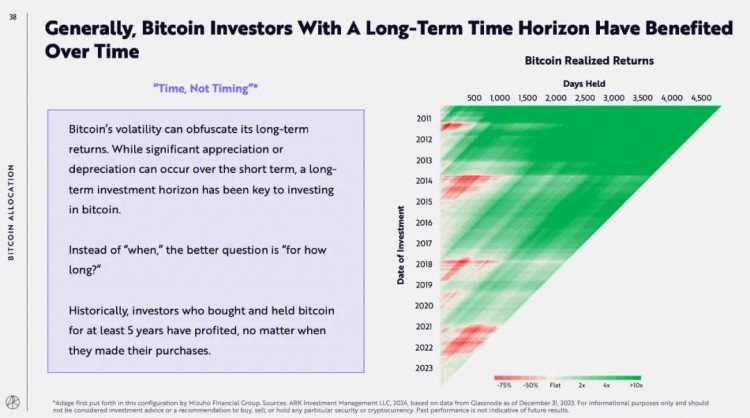

Investors with a long-term view will benefit over time. Bitcoin’s volatility can mask its high returns. However, a long-term investment perspective is the key to investing in Bitcoin. Instead of asking “when,” ask “how long.”

Historically, investors who buy and hold Bitcoin for at least 5 years have made a profit regardless of when they purchased it.

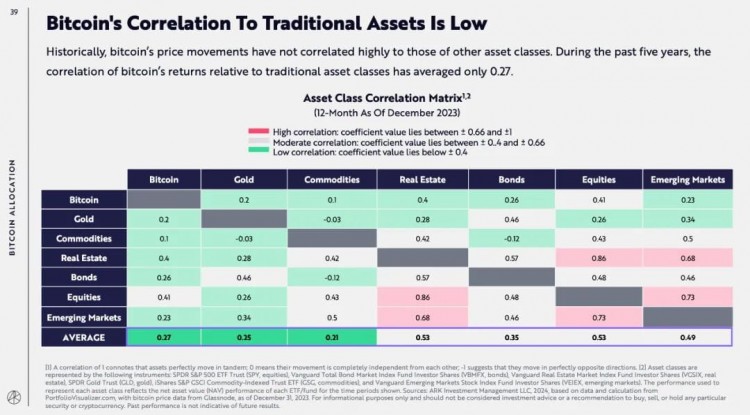

Bitcoin has a low correlation with traditional assets. Historically, Bitcoin’s price movements have not been highly correlated with those of other asset classes. Over the past 5 years, Bitcoin’s returns have averaged a correlation of just 0.27 with traditional asset classes.

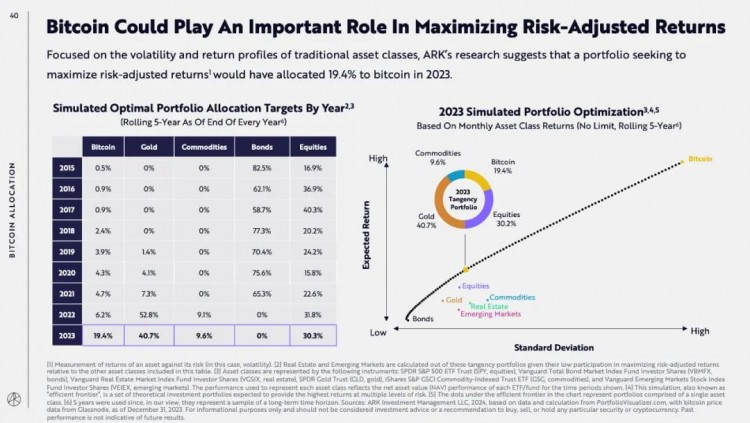

Bitcoin has an important role to play in maximizing risk-adjusted returns. ARK's research, which focuses on the volatility and returns of traditional asset classes, shows that a portfolio that maximizes risk-adjusted returns would have 19.4% of its funds allocated to Bitcoin in 2023.

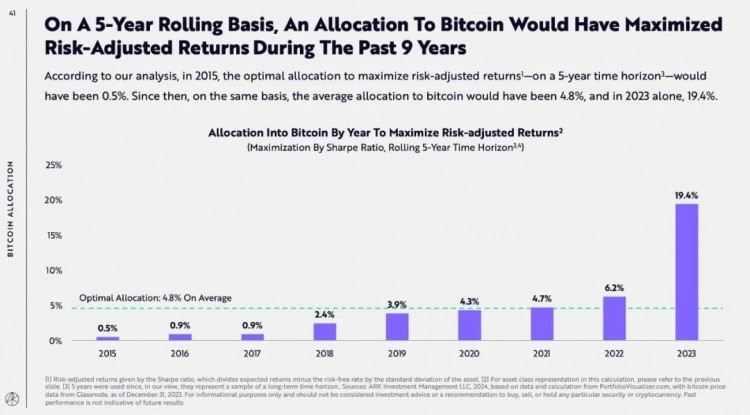

On a 5-year rolling basis, an allocation to Bitcoin would have maximized risk-adjusted returns over the past 9 years.

According to our analysis, in 2015, the optimal five-year allocation to maximize risk-adjusted returns should be 0.5%. Since then, on the same basis, the average allocation to Bitcoin has been 4.8%, reaching 19.4% in 2023 alone.

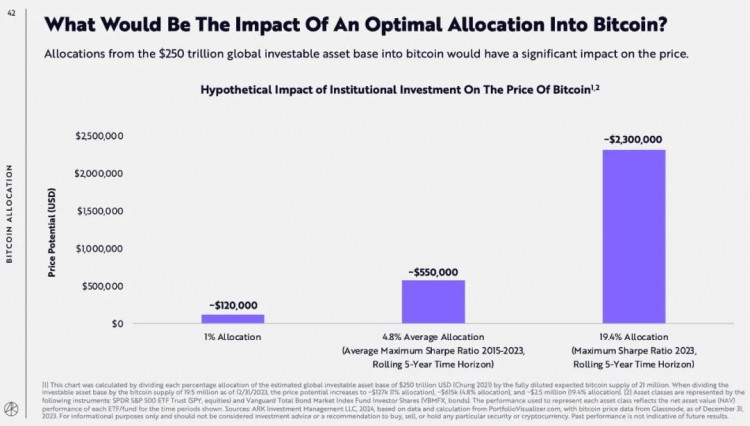

What would be the impact of optimally configuring Bitcoin? Allocating the world's $250 trillion investable asset base to Bitcoin will have a significant impact on Bitcoin prices. For example, if you allocate 1% of the funds, the Bitcoin price will reach about $120,000. With an allocation of 4.8%, the Bitcoin price would reach $550,000. With an allocation of 19.4%, the price of Bitcoin would reach $2.3 million.

In the "Bitcoin In 2023" section, the report stated that in 2023, the price of Bitcoin surged 155%, and the market value increased to US$827 billion.

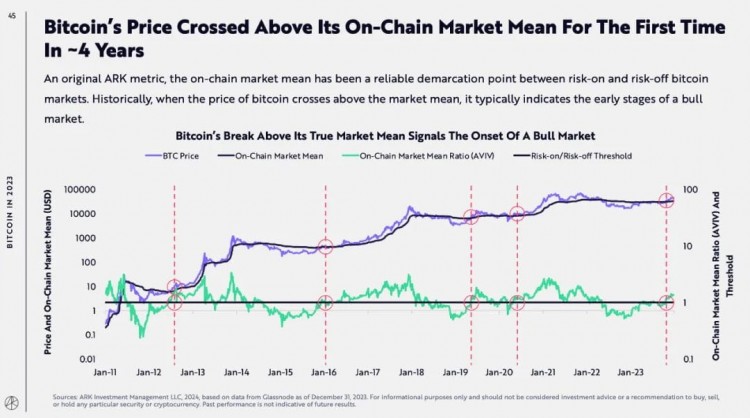

Bitcoin price exceeded the on-chain market average for the first time in 4 years. As ARK's original indicator, the on-chain market average has always been a reliable dividing point for upward and downward risks in the Bitcoin market. Historically, when Bitcoin price crosses a market moving average, it usually signals the early stages of a bull market.

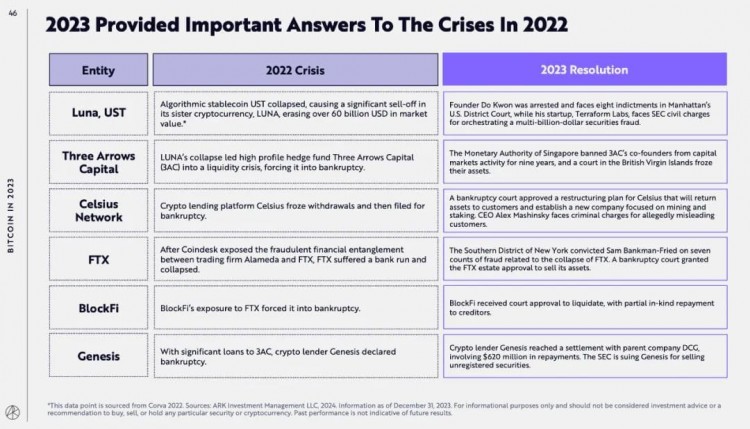

2023 provides important answers to the crisis of 2022. Crises in 2022 include: the collapse of the algorithmic stablecoin UST, the collapse of Luna, the bankruptcy of Celsius, the collapse of FTX due to a run, the bankruptcy of BlockFi, and the declaration of bankruptcy by Genesis.

The 2023 resolution includes: Do Kwon was arrested in Manhattan and faces eight indictments. The Monetary Authority of Singapore bans 3AC co-founders from participating in capital market activities for nine years. Bankruptcy court approves Celsius reorganization and plans to return assets to customers. The Southern District of New York found SBF guilty of seven counts of fraud related to FTX’s collapse. BlockFi received court approval to liquidate and repay creditors in part. Crypto lending company Genesis reached a settlement with parent company DCG involving repayments of $620 million.

Bitcoin served as a safe haven during regional banking collapses. In early 2023, during the historic collapse of U.S. regional banks, Bitcoin prices rose by more than 40%, highlighting its role as a hedge against counterparty risk.

The surge in the number of inscriptions heralds the Bitcoin network’s role beyond transaction settlement. Launched in January 2023, Bitcoin Inscription introduces a unique numbering system for each Bitcoin.

The smallest unit of Bitcoin, "Satoshi", is based on its position in the blockchain. Each Satoshi is identifiable and immutable, allowing users to imprint their data, images or text.

Bitcoin’s fundamentals have remained unaffected by the 2022 crisis and will continue to develop rapidly in 2023.

CME surpassed Binance to become the world’s largest Bitcoin futures exchange. After the outbreak of the epidemic in 2022, people's demand for more standardized and safer infrastructure increased, and Bitcoin's market dynamics shifted more to the United States. CME Bitcoin futures open interest hit a record $4.5 billion.

Bitcoin is evolving into a reliable safe-haven asset. As macroeconomic uncertainty increases and people's trust in traditional "flight to safety" decreases, Bitcoin has become a viable alternative.

ARK evaluated Bitcoin as a risk asset from 6 dimensions. They are: safety and capital protection, diversification, long-term investment horizon, liquidity and accessibility, and hedging against inflation.

There will be a major catalyst for Bitcoin in 2024.

First, the Bitcoin spot ETF was launched.

On January 11, 2024, the launch of the Bitcoin Spot ETF laid the foundation for the development of Bitcoin and provided investors with a more direct, more standardized and more liquid investment method. Bitcoin spot ETFs trade on major stock exchanges, allow investors to buy and sell shares through existing brokerage accounts, and should reduce the learning curve and operational complexity associated with investing directly in Bitcoin.

Secondly, Bitcoin halving. The Bitcoin halving occurs approximately every 4 years, halving the reward for new Bitcoin blocks mined. Historically, every halving has coincided with the start of a bull market. Expected in April 202

![[尼约宇宙]Gala Music 的 $MUSIC 代币为 Inclus 铺平了道路](/img/20231222/3015623-1.jpg)

![[尼约宇宙]Gala Music 的 $MUSIC 徽标:象征意义和设计](/img/20231223/3021411-1.jpg)