时间:2024-01-30|浏览:251

用戶喜愛的交易所

已有账号登陆后会弹出下载

Project name: Picasso Network

Project type: cross-chain, re-pledge (Restaking).

Codename: $PICA (natural cross-chain token)

Cryptocurrency Ranking: #489

Market cap: $67 million

Fully diluted valuation: $149 million

Circulating supply: 4.53 billion (45.34%)

Total supply: 10 billion

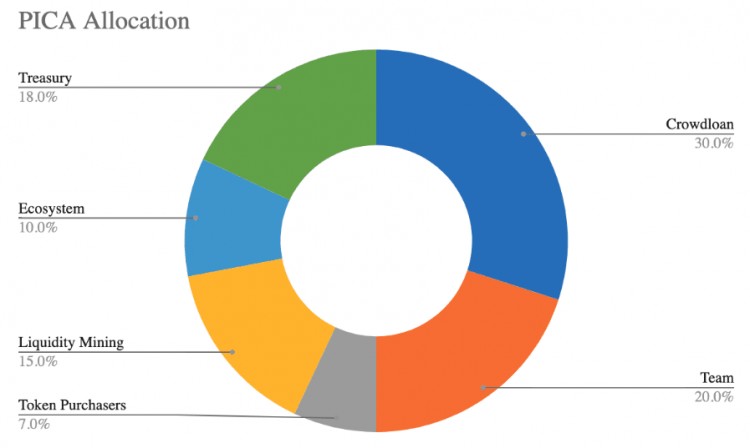

Crowdloan: Total 30% (18.1% unlocked, 11.9% locked)

Details: 50% will be released at the project’s initial token generation event (Token Generation Event, TGE), and the remainder will be unlocked in the next 48 weeks. The entire balance is available for governance; unclaimed tokens revert to the Treasury after 3 months.

Treasury: Total 18% (-/-)

Details: Funded by 75% of network fees, initially managed by the General Council and later by PICA holders.

Liquidity Mining: Total 15% (-/-)

Details: As a reward for participating in the liquidity program.

Team: 13.7% total (fully locked)

Details: Distributed over two years, with initial six-month lock-in period.

Ecosystem: Total 10% (-/-)

Details: Reward network activities, such as running an oracle.

Series A: 7% total (fully locked)

Details: 3-month lock-in period, 2-year gradual unlocking (vesting).

Partners & Advisors: 6.35% total (fully locked)

Details: Allocated over 2 years, including a 6-month lock-in period.

Source: Cryptorank.io

Between January and December 2024, the PICA token will undergo a series of unlocking events that will have an impact on its total supply and market capitalization. This pattern includes:

1. Regular crowd loan unlocking: 31.26 million tokens (approximately 0.31% of the total supply) are unlocked almost every week. These ongoing releases are intended to support crowdlending participants.

2. Larger unlocks in important rounds: At several key moments throughout the year, significantly larger unlocks will occur, with 108 million tokens released each time (approximately 1.08% of the total supply). These tokens will be distributed to different stakeholders:

- Team: Release some of the team's allocations to reflect their ongoing contribution to the project.

-Series A investors: Investments from Series A investors will be unlocked, indicating their early support for the project.

- Partners and Advisors: This group is critical for providing strategic guidance and building partnerships, and they will also receive a portion of the tokens.

The PICA token plays a key role in the Picasso and Composable Cosmos ecosystem, covering multiple aspects of functionality:

1. Staking shards on Picasso: 25% of Picasso’s handling fees will be used to reward shard producers for block production, and the remainder will flow into the community governance reserve.

2. Oracle staking through Apollo: By staking PICA tokens, users can run Oracle nodes, thereby improving the security of network data.

3. Composable Cosmos Staking: PICA tokens are used to maintain the security of the Composable Cosmos chain, marking its dual utility in the Kusama and Cosmos ecosystems. The network requires 1 billion PICA tokens for validator staking to provide network security and earn an annualized return of approximately 10%.

4. Polkadot Liquidity Staking: Composable has introduced Liquid Staked DOT (LSDOT) to generate revenue for PICA token holders through liquidity staking fees.

5. Gas Token in Picasso Ecosystem: PICA token is used to facilitate transactions and dApp operations, with fees dynamically adjusted based on network load.

6. Main trading pair on Pablo DEX: The PICA token is one of the main trading pairs on Pablo DEX to incentivize the provision of liquidity.

7. Governance: The PICA token plays an important role in the governance of Picasso and Composable Cosmos, supporting decentralized decision-making.

1. Seed round (July 2021): Composable’s seed round was successfully completed, raising $7 million, marking an important initial stage of their financial journey.

2. Series A (March 2022): This round of financing takes an important step forward, raising a total of more than $32 million. The strong lineup of investors includes Coinbase Ventures, Blockchain Capital, Figment Capital, Fundamental Labs, GSR, Jump Capital, New Form Capital, NGC Ventures and Krypto Ventures, etc., reflecting the firm confidence in the project.

Additionally, Composable recently entered into partnerships with two strategic partners to enhance its capabilities and facilitate growth across the ecosystem: DAO5 and Santiago Santos.

About DAO5: DAO5 is a developing cryptocurrency fund moving towards a DAO structure designed to co-manage assets by portfolio founders. The fund is led by key leaders in the crypto space such as Tekin Salimi and is supported by several advisors, details of which can be found on their website.

About Santiago Santos: Santiago R. Santos is a distinguished expert in finance and crypto, known for his significant contributions to investment firms and his significant influence in the crypto space. He co-hosts "The Empire Podcast" with Blockworks' Jason Yanowitz ", providing key insights into industry trends.

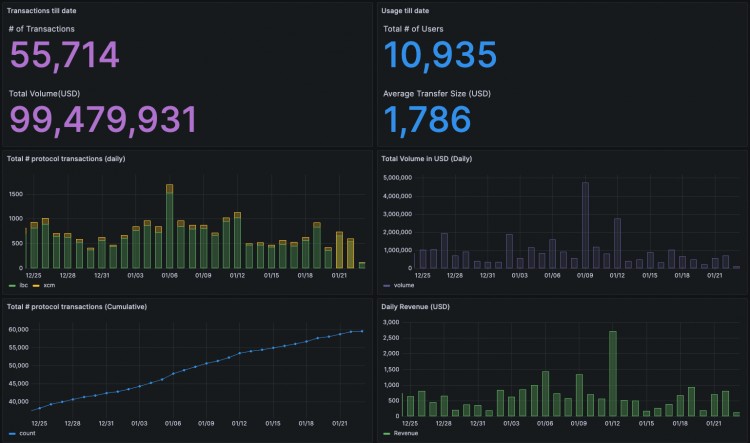

As of January 23, 2024:

From a quick review of the statistics, we can clearly see that, while not outstanding, the network is highly active, processing an average of over 500 transactions per day, with an average transfer amount of $1.7k. It will be interesting to watch as these metrics may change with integrations with Solana and Ethereum.

Picasso has successfully achieved interoperability with the following ecosystems, enabling seamless data transfer, asset movement, and smart contract interaction between Picasso and these ecosystems. Here are the sources of relevant ecosystems:

Table source: Picasso Asset List

1. As Solana integrates with Polkadot, Cosmos, Kusama and Ethereum via IBC, these connections are expected to enhance the value for holders of the $PICA token, positioning PICA as the core of the growing cross-chain landscape.

2. Strong partnerships and successful financing rounds, including a $7 million seed round and a $32 million Series A round, reflect investors’ strong confidence in the project and the support of the strategic network.

3. The multi-faceted role of PICA tokens in the ecosystem in terms of staking, governance and liquidity enhances its intrinsic value and appeal.

4. The team continues to work hard to explore new features, especially in the areas of interoperability and trustless DeFi, demonstrating its commitment to evolving and adapting to the needs of the blockchain industry.

1. The practicality and technical complexity of the project may be too complex for new and casual users, potentially resulting in reduced participation. This risk may increase if competitors introduce similar but easier-to-use features. Although there are currently no related re-staking projects for SOL, this market may soon attract competitors.

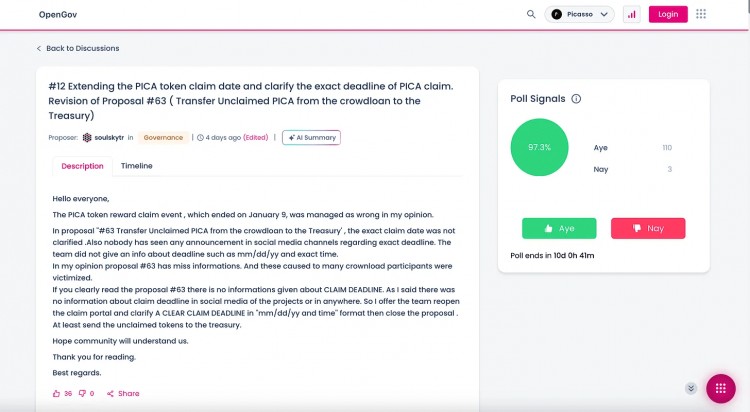

2. The mismanagement of $PICA tokens that are not claimed by crowdlending participants is mainly due to insufficient communication of information about the redemption period, which leads to dissatisfaction among contributors. Picasso’s OpenGov forum community pushed for the reversal of the decision to allocate these tokens to the treasury, a key issue affecting the project’s community relations stance.

3. CEO Omar Zaki’s past disputes with the US SEC and association with controversial projects (such as Bribe Protocol) have brought reputational challenges. The issue was important enough that it led to the departure of some key team members, including 热点: THE