时间:2024-02-02|浏览:319

用戶喜愛的交易所

已有账号登陆后会弹出下载

2024 is a promising year for the encryption market. All eyes are focused on new tracks worthy of attention in the encryption field, including leading institutions. Various institutions have published their own research reports at the beginning of the year, looking forward to 2024 from a professional and detailed perspective, which is of great reference value.

Vernacular Blockchain reviewed the research reports of 23 leading institutions (including Messari, a16z, Coinbase, MT Capital, etc.), trying to summarize and find "institutional consensus" to improve certainty, which is now summarized as follows:

01

The top ten tracks that are generally optimistic

1) Bitcoin ecological renaissance

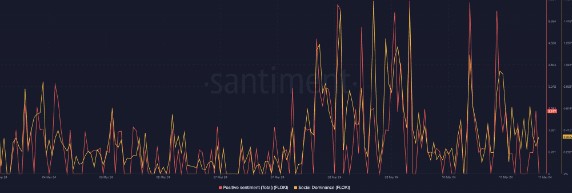

After the launch of Ordinals (a digital content encoding method based on Bitcoin) in December 2022, it led to the inscription and Bitcoin ecological craze. In 2023, the Bitcoin ecosystem will develop strongly, and Bitcoin's dominance (Bitcoin's proportion of the cryptocurrency market value) will increase from 38% in January to about 50% in December, making it the most noteworthy ecosystem in 2024. one.

Institutional forecasts are also generally optimistic about the development of the Bitcoin ecosystem this year:

Bitwise, a mainstream U.S. crypto index fund management company, predicts that the Bitcoin trading price will exceed $80,000 in 2024;

Coinbase believes that at least in the first half of 2024, the main focus of institutional investment will continue to be on Bitcoin, as the passage of ETFs will create strong demand from traditional investors to enter this market.

The forecasts of other institutions are also optimistic. The main reasons are:

The U.S. Securities and Exchange Commission (SEC) has approved a spot Bitcoin ETF, and the next big event, the Bitcoin halving event in April, is coming, and supply and demand are expected to change significantly;

The Bitcoin ecosystem will see infrastructure upgrades, the addition of programmable features, including basic protocols (such as Ordinals), as well as the development of protocols such as Layer 2 and other extensible layers (such as Stacks and Rootstock).

2) Development of Ethereum L2

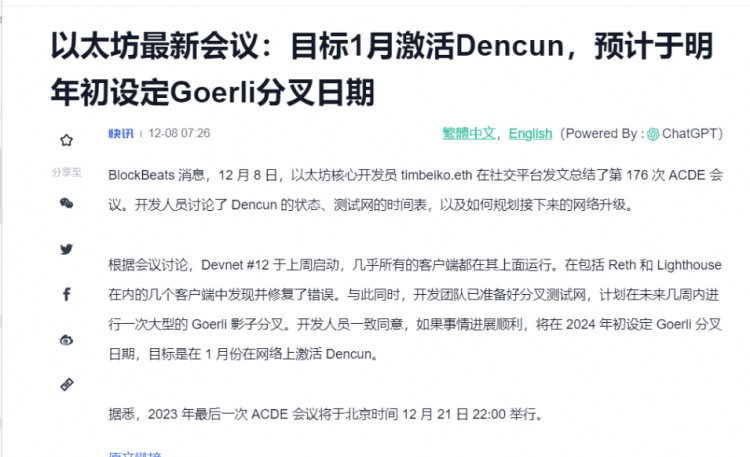

In addition to the Bitcoin ecosystem, Ethereum, as the pioneer of smart contracts, the development of Ethereum Layer 2 is also a major event that various institutions predict in 2024, especially with Vitalik releasing the Ethereum 2024 roadmap and the Cancun upgrade approaching. , ARB, OP and other Ethereum Layer 2 project tokens have experienced skyrocketing prices recently.

Competition in the public chain ecosystem has always been fierce. In 2023, public chain ecosystems such as Solana and Avalanche have developed rapidly, and their momentum has even surpassed Ethereum. However, Ethereum, as the leader, has also begun to exert its influence. Most of the predictions of various institutions are based on the completion of the Cancun upgrade, gas costs will further drop significantly, which can drive the explosion of the Ethereum Layer 2 ecosystem in 2024. Bitwise believes that a major upgrade to the Ethereum blockchain will bring average transaction costs below $0.01, laying the foundation for more mainstream uses.

If the upgrade is successfully implemented, some leading Ethereum Layer 2 projects (such as Optimism, Arbitrum, Base, etc.) can completely compete with other Layer 1 public chains in terms of performance.

In addition, according to Vitalik's vision, in the long run, the direction of zero-knowledge proof is the future of Layer 2 of Ethereum, and the two Layer 2 projects of zkSync and StarkWare are also favored by everyone.

3) Development of Solana Ecosystem

In the past 2023, the Solana public chain ecosystem has performed well. Whether it is technology accumulation or community, it has laid a solid foundation for the long-term development of the Solana ecosystem, and the explosion of the Solana ecosystem has also attracted a large number of users and funds.

Various institutions predict that in 2024, more projects will choose or migrate to the Solana public chain, and the Solana ecosystem will continue to explode. Because, whether it is TPS, gas fees, or community users, Solana is more resistant to attack.

Market institutions’ expectations for Solana in 2024 focus on the following aspects:

Solana’s technical upgrades, such as the development of light clients through Tinydancer, allow validators to complete verification work at a lower cost and achieve a higher degree of decentralization;

Solana's performance improvements, including improving throughput and performance, improving user experience, deploying new Token standards, etc., have enhanced its robustness;

The launch of new products, increased on-chain liquidity, and expansion of developer tools have contributed to the prosperity of the Solana DePIN ecosystem.

4、DePIN(Decentralized Public Internet Network)

DePIN, or decentralized physical infrastructure network, is a new method of building and maintaining infrastructure in the real world. Its goal is to build decentralized networks in industries such as telecommunications, energy, mobile communications, and storage. In 2023, there are over 650 DePINs with a market cap of over $20 billion and annual revenue of over $150 million.

An overview of DePin development in 2023

In 2024, the cryptocurrency data platform CoinMarketCap has listed DePIN as an independent classification, reflecting the encryption market’s high focus on this area.

DePIN covers a wide range of fields, including server networks, wireless networks, sensor networks and energy networks. Currently, various companies predict that the DePin track has huge growth potential. For example, according to predictions by encryption research institute Messari, the overall industry size of DePIN is currently approximately US$2.2 trillion and is expected to grow to US$3.5 trillion by 2028. Messari also pays special attention to the following subdivided DePIN sub-tracks: cloud storage market, decentralized database, decentralized wireless network and combination with AI.

However, while making predictions, various institutions also believe that the maturity of DePIN will require long-term investment and operational development by the market, institutions and developers before it can gradually penetrate into people's lives and applications and complement the existing infrastructure. Parallel, to substitution.

5) The combination of AI and blockchain

The rapid development of artificial intelligence (AI) in 2023 has also promoted the development of AI+ web3 services. In early January 2024, the market value of AI-related Tokens reached US$7.04 billion. Given the increasing popularity of artificial intelligence, forecasts are mostly optimistic about using AI as a core function to enhance the appeal of blockchain-based encryption platforms.

At present, the tracks that various institutions are more optimistic about are:

Direct applications of AI in crypto: trading bots, automated payments and arbitrage bots combined with blockchain. Integrated scenarios include AI Agent utilizing encrypted infrastructure for payment, smart contracts to securely schedule AI models, and Token rewards for personal fine-tuning of models and collection of valuable data. Messari believes that advancements in AI will increase demand for cryptocurrency solutions.

Innovative applications of AI and encryption technology: Here AI is used to improve the user experience and efficiency of Web3, and more blockchain technology is used as guardrails and transparent layers for AI. For example, we have seen research and new use cases on zero-knowledge and machine learning (ZKML), games that allow users to train AI agents using ERC 6551, etc.

Bankless analyst Jack Inabinet believes crypto + artificial intelligence could be an explosive combination. While early activity was largely about promoting worthless projects to capitalize on the hype, the promise is still huge.

Encryption company DWF believes that by guiding social cognition and its limitations in centralized AI, decentralized AI has great potential for development in 2024 and can lead the future of AI through Web3.

6) The outbreak of GameFi and the development of chain games

The blockchain games in 2021 and 2022 are in full bloom, developing from "Play to Earn" to "X to Earn", with smash hit projects such as Axie and Stepn coming out. In comparison, the blockchain games in 2023 are relatively bleak. However, with the improvement of infrastructure, various institutions are still optimistic about the future development of chain games.

After all, from the perspective of the traditional Web2 market, games are a very potential market and have almost become a part of many people's lives. And most traditional game users don’t have much knowledge abo