时间:2024-01-25|浏览:267

用戶喜愛的交易所

已有账号登陆后会弹出下载

注:本文来自@blockTVBee Twitter,火星财经整理如下:

好久没有写关于市场的文章了。 最近市场波动比较大,所以我想谈谈这个话题。

角度一:廉价雕船

从周期角度看

BTC大约需要2023年一整年的时间才能经历2019年上半年的牛市走势,2019年6月见顶,随后回落,2019年12月见底(312有黑天鹅,暂不考虑) 。

自2024年1月ETF通过以来,BTC仅回调了14天。

此外,山寨币在2023年2月-3月部分上涨,11-12月上涨。 总共至少会有3-4个月的增长。 因此,BTC最初从48,000美元回落,而大多数山寨币并没有跟随。 但当比特币继续下跌时,山寨币开始回调。

从币价角度

2018 年底,BTC 价格约为 3200 美元。 2019年的高点约为13,500美元,增加了10,300美元。 2019年12月底部约为6500美元,回调7000美元,回调幅度约为68%(=6500/10300)。

本轮低点约15500美元,高点约48500美元,临时回调低点约38500美元,回调幅度约30%(=(48500-38500)/(48500-15500))。 还不到上一轮的一半。

当然,今年不能和2020年一样。从情感角度来看,人们对BTC的信心正在增强,从财务角度来看,ETF将长期带来资金流入。

由于信仰和ETF的影响,BTC的底部不会太低,但目前还不能确认是底部。 从周期角度看,可能还会有持续下跌或者震荡的时候。

角度2:微距

从宏观角度来看,这与2019年下半年非常相似。有两个相似之处:

一是利率——加息已经停止,降息还没有开始。

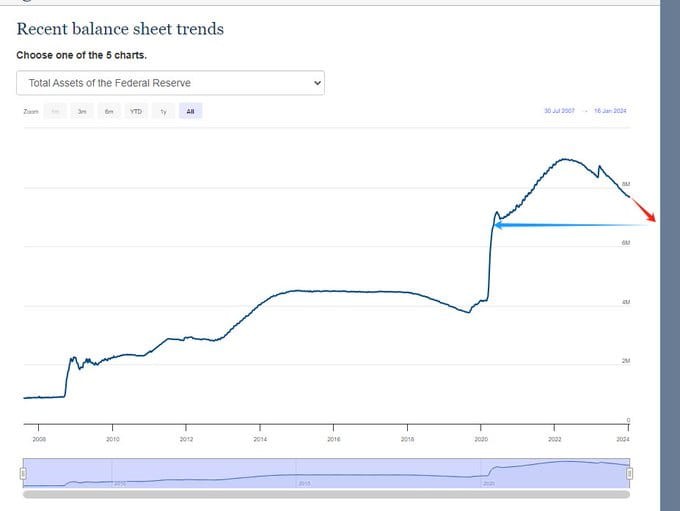

第二是资产负债表收缩——资产负债表收缩仍在继续。

但是,请注意,存在明显的差异。 2018年底明确表示2019年下半年将停止缩表。也就是说,紧缩周期有明确的结束时间。 但目前,我们不知道什么时候可以停止缩减资产负债表。

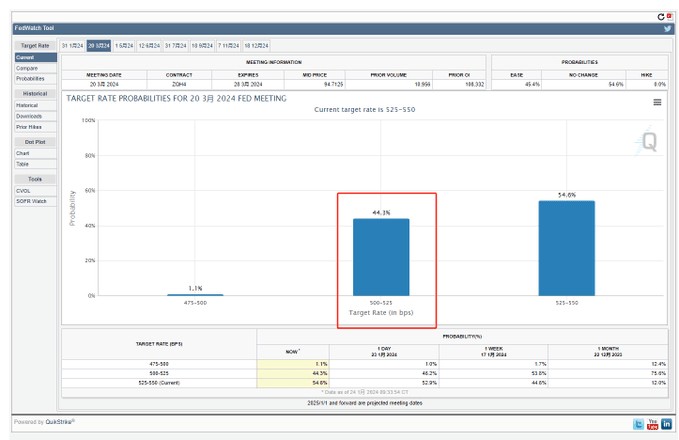

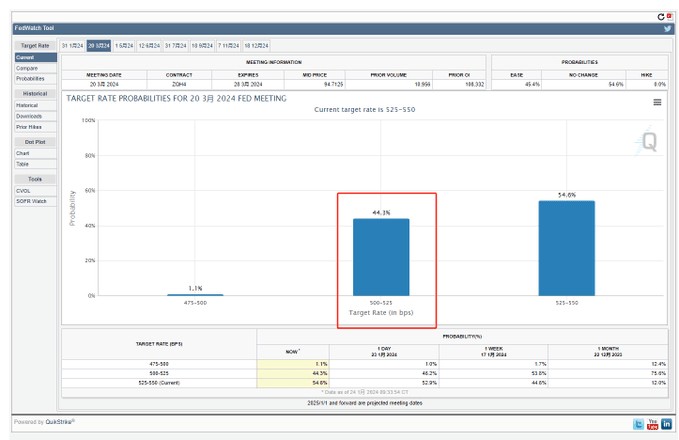

The Federal Reserve’s interest rate decision on February 1st will see an interest rate cut impossible, but some signals may be revealed. For example, when to stop shrinking the balance sheet. In addition, the minutes of the January meeting will be released in February. These two points in time may shatter expectations for a rate cut in March. About a month ago, the expected probability of a rate cut in March was 80%, and it is currently 44.3%.

Coupled with the expected realization of the Spring Festival holiday, the market in February may not be optimistic.

Angle 3: Halved

The halving is a good thing. There is an explanation in another article of Little Bee, so I won’t say more.

In 2016, there was a wave of decline before and after the halving.

Before the 2020 halving, 312 was already in a downward trend before it plummeted. There was no obvious big rise after the halving.

Halving is the halving of output. We can start from the perspective of BTC producers, that is, miners. After the halving, the income will decrease, and there is a high probability that BTC will usher in a big bull. Therefore, miners are willing to increase mining power and purchase more mining machines. The motive for liquidation before and after the halving is likely to be to purchase new computing power.

But this round is slightly different. Inscriptions have increased miners’ profits, and miners may have been less willing to sell coins in the past.

Medium term

Little Bee believes that 2024 (mainly the first three quarters) may be a period of market shock or convergence.

To put it bluntly, just two sentences:

It won’t be too low

It won’t be too high

The price will not be too low. The impact of beliefs, ETFs, and inscriptions should be understood and not discussed in detail.

The increase will not be too high, mainly due to the influence of the macro environment. In the environment of high interest rates and balance sheet shrinkage, market liquidity is limited.

Looking at the halving expectations or the macro impact alone may be one-sided. The market trend in 2024 should be the superposition of the effects of the halving cycle and the interest rate cut cycle.

Short term

It is true that BTC is not expensive now, but the bottom cannot be 100% confirmed in terms of point and cycle.

The macro aspect of February (expectations of an interest rate cut in March were denied), the realization of the Spring Festival, and before the halving, these are all unfavorable factors for the market in February.

Next, we need to pay attention to the Federal Reserve meeting in March, because a new dot plot will be released and there will be further predictions on the specific time of interest rate cuts.

From February to March, attention will be paid to the Fed's decision to stop determining the time to stop shrinking its balance sheet. Stopping shrinking its balance sheet means the complete end of tightening.

About Black Swan

不一定有黑天鹅。

黑天鹅的一种预期是,历史上有过高利率持续后降息初期爆发危机的记录。 2000年的互联网泡沫和2008年的次贷危机都是在高利率持续后的降息初期爆发的。 本轮加息的高点与2006年差不多。如果如最后一张点图所示,9月份降息,那么高利率将持续一年,就像2007年一样。

不过,本轮扩表规模确实很大。 即使再缩表8个月,也仍处于相对宽松的水平。

不过,大概率会出现利率的初始下降,不一定是在降息之后,也可能是在降息之前。 由于预期影响,市场可能会提前表现。

当然,小蜜蜂也会给黑天鹅留一点位置。 天鹅是约定好的,但当然也有意想不到的情况。

另外,跟单者与大盘的涨跌并不完全同步,因此分批建仓更为理性。

关于抄底

小蜜蜂认为抄底机会可能有两个:

减半前后可能会出现下跌,加上三月份降息的预期逐渐减弱。

降息前后可能会出现下降。 因为历史表明,降息时美股往往会下跌。 (小蜜蜂对这个逻辑的主观理解是,在降息之前,炒作预期推高股价,然后发货偿还高息贷款,然后利率降低再放贷。)这种期待似乎已经在一些人中形成了共识。 所以利率下降的时候还是要小心。

我们现在应该走在通往机遇 1 的路上。

![[加密市场分析师]Anodos Finance 创始人确认支付团队](/img/20231220/2993781-1.jpg)