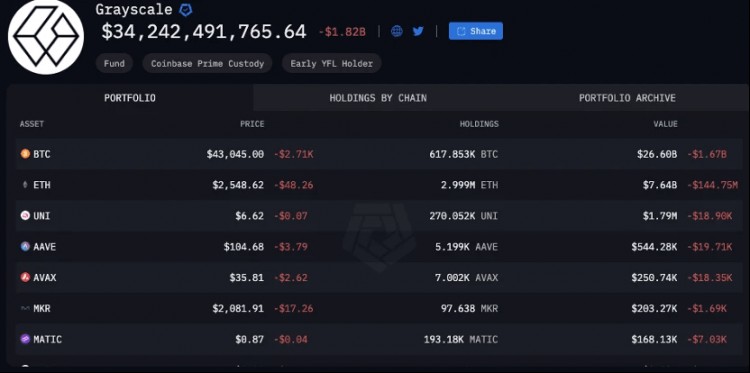

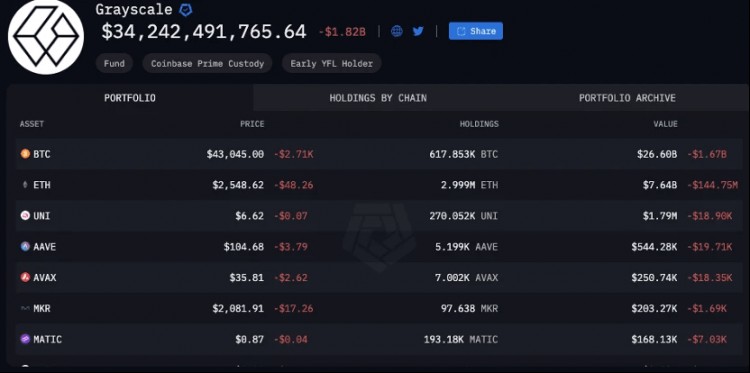

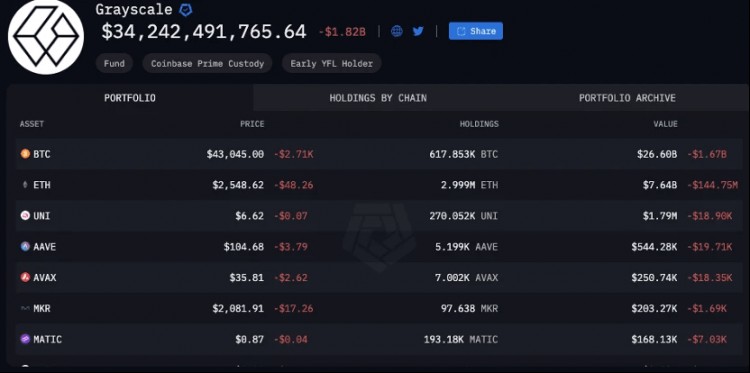

"Is the ETF approved but BTC plummeted because of Grayscale's market crash? How much selling pressure is still on the way?"As previously reported, according to data from Yahoo Finance, the spot Bitcoin ETF’s trading volume on the first day of trading was US$4.6 billion, and the total trading volume on the second day reached US$3.1 billion, with the cumulative total trading volume approaching US$7.7 billion. Among newly launched spot Bitcoin fund issuers, BlackRock led the way with $564 million in volume on Friday, while Fidelity had $431 million.Neither comes close to the volume of Grayscale’s GBTC – the ETF accounted for more than half of the total volume at $2.29 billion on Thursday and $1.83 billion on Friday.However, market sentiment has not eased. One possible argument is that not all grayscale addresses are recorded on Arkham, and the recorded grayscale addresses may not be accurate. This statistics may miss some BTC sales and transactions, so the $1.67 billion sell-off may not be accurate. Not precise.If investors are unwilling to submit the 1.5% management fee, they can choose to sell their GBTC shares and switch to other ETFs. Since all ETFs are redeemed in cash, when selling GBTC shares, you cannot choose to sell them for Bitcoin, but can only sell them for US dollars, which will inevitably bring about selling pressure and reduce the price.(Conclusion: The first risk is that Chinese people mostly buy, the second risk is that the records on ARK are incomplete, and the third risk is that Grayscale rates are the highest and share the risk of other Brick ETFs)

热点:Bitcoin etf CRASH