时间:2023-12-16|浏览:274

用戶喜愛的交易所

已有账号登陆后会弹出下载

最近,知名加密硬件钱包制造商 Ledger 遭遇重大安全漏洞,震惊了加密货币世界。多个基于以太坊的去中心化应用程序 (dApp),包括 Zapper、SushiSwap、Phantom、Balancer 和 Revoke.cash 均因此次泄露而受到损害。此后,Ledger 修复了恶意代码,并建议用户利用“Clear Sign”功能来确保与其服务的安全交互。据报道,这次攻击被归类为针对 Ledger Connect Kit 的“供应链攻击”,已导致超过 15 万美元的加密货币损失。 Sushi 首席技术官 Matthew Lilley 警告不要与任何 dApp 交互,直至另行通知,强调了情况的严重性。

这一消息发布之际,随着美联储、欧洲央行和英格兰银行等央行的决定,比特币 (BTC) 的价值一直徘徊在 42,000 美元上方。最近的发展对以太坊 (ETH) 和 Solana (SOL) 等主要加密货币产生了显着影响,影响了投资者情绪和市场动态。

继续深入研究加密领域,我们发现了令人兴奋的发展。 StealthEX 与 CryptoDaily 合作,以节日气氛搅动加密货币场景!是的,这不仅仅是深入了解加密货币市场波动——而是在这个假期季节赢得大奖!

今年圣诞节赢得大奖:StealthEX 的 1,000 美元节日赠品等待着您!

准备好在 12 月 13 日至 23 日期间享受 StealthEX 激动人心的 1,000 美元赠品,感受节日的魔力吧!这个节日的幸运是向所有人开放的。只需交换您最喜欢的加密货币,例如以太坊 (ETH)、Solana (SOL) 等(最低交易额为 100 美元),提交您的交易详细信息,您就可能赢得大奖。

节日的欢呼声更加盛大,奖品丰富:大奖获得者将获得 500 美元,两名幸运的亚军将获得每人 250 美元的奖金。获奖者将于 12 月 24 日公布,敬请关注 StealthEX 频道。

与 StealthEX 一起参与节日活动,进行兑换,并成为节日兴奋的一部分。祝您的圣诞节快乐、幸运,并且可能有利可图!

使用 StealthEX 将互换转化为胜利!

以太坊的飞跃:将先进的加密技术融入其核心

Ethereum (ETH) is poised for potentially transformative developments that could significantly influence its price trajectory. Recently, Vitalik Buterin, Ethereum's co-founder, proposed "enshrining" zkEVMs (zero-knowledge Ethereum Virtual Machines) into the main Ethereum blockchain. This initiative marks a shift from the previous emphasis on layer-2 networks or "rollups." zkEVMs, blending zero-knowledge cryptography and Ethereum's programming environment, could streamline transaction verification on Ethereum, enhancing both efficiency and security. This move could integrate layer-2 functionalities, like fast pre-confirmations and MEV (Maximum Extractable Value) mitigation strategies, more closely with Ethereum's core protocol.

Buterin's vision suggests a future where Ethereum's light clients, less resource-intensive than full nodes, become increasingly powerful and capable of fully verifying transactions using zero-knowledge proofs. This development could lead to a built-in zkEVM on Ethereum, potentially making these advanced cryptographic functions natively available for rollups. Such advancements in Ethereum's infrastructure are expected to boost its scalability and efficiency, making it a more attractive platform to users and developers. These developments, enhancing both the utility and efficiency of the Ethereum network, could be a major driver for ETH's price performance and its ability to outperform its peers in the digital asset market.

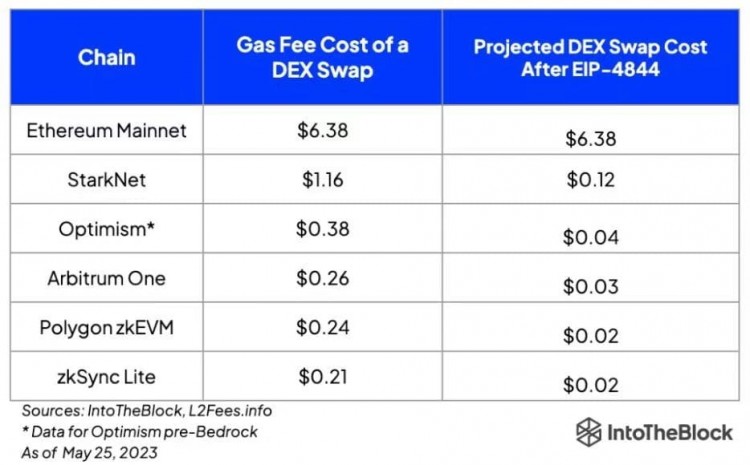

Meanwhile, JP Morgan analysts have expressed skepticism about the potential impact of Bitcoin ETFs, instead favoring Ethereum's prospects for 2024. The institution is particularly bullish on Ethereum, highlighting the anticipated Ethereum Improvement Proposal (EIP) 4844, known as "Proto-dank sharding." However, JP Morgan also cautions about the challenges of centralized staking within the Ethereum network, indicating a balanced view of the cryptocurrency's future potential.

Ethereum (ETH) Technical Analysis

Ethereum (ETH) has been navigating a complex market landscape. The Relative Strength Index (RSI) for ETH currently stands at 36.73, suggesting a bearish sentiment as it is below the neutral 50 mark. The Stochastic %K is at a low 5.47, reinforcing the bearish outlook. Additionally, the Commodity Channel Index (CCI) at -151.86 indicates an oversold condition, which could potentially lead to a price rebound. The Average Directional Index (ADI) at 17.37 points to a weaker trend strength, suggesting that the current downward trend might not be strongly established. Ethereum's Moving Average Convergence Divergence (MACD) Level at -4.67 also shows a lack of bullish momentum.

Regarding moving averages, ETH is currently trading below its 10-day Simple Moving Average (SMA) of $2,266.00 and its 200-day SMA of $2,286.01. This positioning could be interpreted as a bearish signal, indicating potential for further price declines. However, the Ethereum market is known for its volatility, and rapid changes in investor sentiment or market conditions could alter this trend.

Ethereum (ETH) Price Prediction

Despite the current bearish technical indicators, Ethereum's fundamental background, including the integration of zkEVMs into its main blockchain, sets a strong foundation for future growth.The increased efficiency and scalability could attract more users and developers, which would lead to an increase in ETH demand. In a bullish scenario, Ethereum could rebound from its immediate support level at around $2,227.54 and target the next resistance level at approximately $2,527.57. If the market sentiment shifts positively, ETH could potentially aim for a higher resistance level near $2,740.35.

Moreover, if the market aligns with JP Morgan's outlook and the EIP-4844 upgrade delivers on its promises, Ethereum could experience significant growth, possibly outperforming Bitcoin in 2024. This would potentially see ETH rebounding from its current levels, surpassing immediate resistance, and possibly achieving new highs.

On the other hand, if Ethereum fails to capitalize on its fundamental strengths and market sentiment remains bearish, it could break below its immediate support level and head towards the next support level around $2,114.18. Continued negative market trends and a failure to hold key support levels could see ETH testing lower supports, potentially reaching down to the 1-month low of $1,909.86.

Exchange Ethereum (ETH) Now to Join the StealthEX Giveaway!

Solana's Strategic Move: Airdrop-Driven Sales Surge

Solana (SOL) has experienced a remarkable surge in its ecosystem, particularly with the rapid growth in sales of its crypto phone, the Saga. This surge is largely attributed to the enticing arbitrage opportunity presented by the recent airdrop of the Solana memecoin Bonk (BONK), which has seen an exceptional rise of over 1,100% in the past month.

The 30 million BONK airdrop significantly surpasses the Saga phone's current price. This unique situation has led to a more than tenfold increase in phone sales, with co-founder Raj Gokal confirming that the phone is on track to sell out before the new year.

The substantial gain in BONK's value and the subsequent increase in Saga phone sales have had a positive impact on Solana’s market presence. This strategic move and its successful outcome could positively influence Solana's price, as it reflects the innovative approaches being adopted within the Solana ecosystem to boost market traction and user involvement.

Solana (SOL) Technical Analysis

Solana (SOL) presents a mixed technical landscape. The Relative Strength Index (RSI) at 53.41 indicates a neutral market sentiment, leaning neither strongly bullish nor bearish. The Stochastic %K, at 40.42, suggests that SOL is neither overbought nor oversold. However, the Commodity Channel Index (CCI) at 3.27 and the Average Directional Index (ADI) at 27.36 do not show strong directional momentum, indicating potential sideways movement. The Awesome Oscillator at 3.23 and MACD Level at 1.26 also point towards a lack of strong momentum in either direction. Notably, SOL is trading around its 10-day Simple Moving Average (SMA) of $76.85 and its 200-day SMA of $71.16, indicating a potential equilibrium in the market.

Solana (SOL) Price Prediction

Solana’s recent strategic success, particularly the surge in sales of its Saga phone due to the BONK airdrop, could positively impact its market sentiment. In a bullish case, if SOL can maintain momentum and break above its immediate resistance level at around $75.64, it could target the next resistance level near $89.19. The innovative approaches adopted within the Solana ecosystem, like integrating crypto airdrops with hardware products, could further bolster investor confidence and push SOL towards the 52-week high of $79.21.

Conversely, if the market fails to respond positively to Solana's recent developments and sentiment turns bearish, SOL could fall below its immediate support level of approximately $70.11. A break below this level might lead to a test of the next support level around $51.84, the 1-month low.

It's also crucial to consider various price predictions to gain a well-rounded view of its potential market performance. Some experts predict Solana prices will increase by up to +85% in 2024, reaching $127.82. You can delve deeper into this forecast by visiting StealthEX's blog on Solana (SOL) price prediction. While the recent developments in the Solana ecosystem are promising, market dynamics and external factors could still significantly influence the price of SOL.

Swap Solana (SOL) Now for Your Shot at a Merry Crypto Christmas!

Final Words

From the evolving landscape of Bitcoin to the promising advancements of Ethereum and Solana, the crypto world continues to captivate. The StealthEX holiday event adds an extra layer of excitement, blending the thrill of crypto trading with festive giveaways. Ethereum balances innovation with market dynamics, while Solana maneuvers through its unique challenges and opportunities. These stories highlight the dynamic nature of cryptocurrencies – a sector where technology, market sentiment, and regulatory frameworks intersect to forge the future of digital finance. Stay engaged, stay informed, and who knows, your journey in crypto might just be the next headline!

免责声明:这是一篇赞助文章,仅供参考。它不反映 Crypto Daily 的观点,也不打算用作

![[币圈老司机]以太坊现货ETF成功获批!ETH有望突破历史新高,以太坊生态即将大爆发!](/img/btc/113.jpeg)