时间:2024-03-28|浏览:635

用戶喜愛的交易所

已有账号登陆后会弹出下载

A 100% increase in one week! Etherfi surges past $6, hitting all-time high

The current total lock-up value (TVL) exceeds US$3 billion, making Etherfi ($ETHFI) the leader in the liquidity re-hypothecation track. It was listed on Binance in mid-March. $ETHFI peaked at around $5.3 when it was first listed, and later fell back to fluctuate between $2 and $4.

However, $ETHFI has suddenly risen rapidly in recent days. As of the time of writing today (27th), it once rose to $6.43, a record high, with a one-week increase of 104.66%. Etherfi recently announced the launch of the second quarter airdrop points activity, which may be a major boost to the currency price.

Although the re-pledge project is not as easy for retail investors to understand as the Solana meme coin and AI token, it has long been listed as the most watched project in this bull market by some institutions and DeFi researchers. For example, a well-known DeFi researcher wrote "DeFi Degen's Bull Market Guide" at the end of last year, which already mentioned the re-pledge track.

In recent months, the Ethereum re-staking track has grown rapidly. If you still don’t know what re-staking is, this article will briefly introduce the three more important re-staking projects with the largest lock-up volume on Ethereum, allowing you to understand the leaders of the re-staking track at once.

OwnLayer

After Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS) mechanism, Liquidity Staking (LST) has always been an important track in the DeFi field of Ethereum. Lido and Rocket Pool are commonly used staking projects. For example, users who pledge Ethereum ($ETH) on Lido will obtain stETH pledge certificates and receive annualized interest on a regular basis.

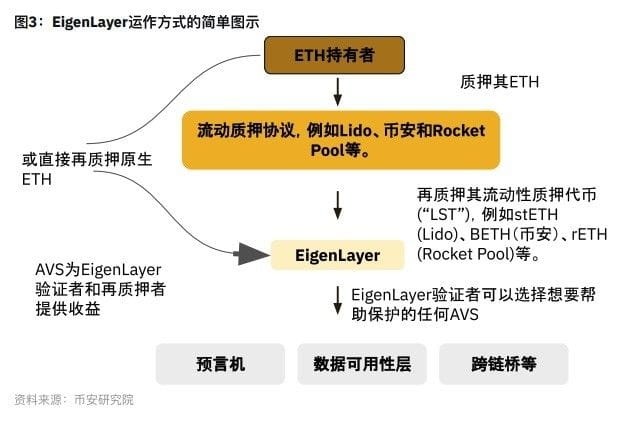

Subsequently, EigenLayer emerged and proposed the concept of restaking. Allow users holding stETH and rETH (Rocket Pool) to stake on EigenLayer (you can also choose to stake with native $ETH). EigenLayer's goal is to solve the problem of decentralized blockchain security and the difficulty of establishing a consensus network, and to promote the development of Active Verification Service Providers (AVS).

In the Ethereum blockchain, the proof-of-stake consensus mechanism is mainly created through the system of pledging $ETH.

However, for new projects, it is more difficult to establish a PoS consensus mechanism like Ethereum, and the process of generating sufficient security is also very time-consuming, and may not be as secure as Ethereum. EigenLayer solves the above problems by gathering the security of large public chains such as Ethereum and providing it to other decentralized applications (dApps).

In order to attract user investment, EigenLayer has also launched a points system to build airdrop expectations, but it has not yet announced when it will officially issue coins or airdrops.

Binance Research has written a report detailing how EigenLayer works. You can refer to the picture below:

According to previous reports by CoinDesk, EigenLayer developer Eigen Labs has received the favor of venture capital institution a16z, which helped lead a $100 million investment. DeFiLlama data shows that EigenLayer’s total locked-up value has reached US$12.1 billion, growing rapidly after February this year.

Etherfi($ETHFI)

After the emergence of EigenLayer, the Ethereum DeFi platform began to create business opportunities around the concept of re-hypothecation, and Etherfi took the lead in the Liquidity Re-hypothecation Track (LRT).

If you want to withdraw and re-stake, Etherfi allows users to exchange eETH back to $ETH or stETH at any time, which is very convenient for users pursuing liquidity.

This narrative of eating two fish and having leveraged investment benefits has attracted many Ethereum users. Even Justin Sun, the founder of TRON, once deposited 20,000 $ETH before the end of Etherfi’s first airdrop event, successfully Nearly 3.5 million tokens were obtained.

Etherfi's non-custodial re-pledge model has also been favored by BitMEX founder Arthur Hayes. Not only has he issued a document recognizing the potential of the project, but he has also participated in investment through his family office fund Maelstrom.

Renzo, Puffer and Kelp DAO, etc.

In addition to Etherfi, there are also many re-staking projects vying for market share. DeFiLlama data shows that the following 3 projects are among the top in lock-up volume:

Renzo: The current locked-up volume reaches $1.7 billion, ranking second in the rehypothecation market. Renzo supports re-staking on multiple chains such as Ethereum, Arbitrum, Blast, and Binance Smart Chain (BSC). In January this year, Renzo announced the completion of US$3 million in financing, and the next month Binance Labs also announced its participation in investment.

Puffer: The current lock-up volume reaches $1.3 billion, making it the third largest player in the rehypothecation market. Like Renzo, Puffer is backed by Binance Labs. Different from other re-staking projects, users who participate in Puffer re-staking and obtain the native liquid staking token (nLRT) pufETH can receive both traditional PoS verification rewards and re-staking rewards, while other projects generally provide rewards related to their native tokens. points reward.

Kelp DAO: The current lock-up volume reaches 700 million US dollars, ranking fourth in the re-hypothecation market. Kelp DAO is a multi-chain liquidity staking platform whose founder previously founded the liquidity staking project Stader Labs. Kelp DAO also has a reward mechanism. The airdrops received by users depend on the number of re-stakes and the number of days of staking.

Binance: New technologies come with new risks

Facing the rapid development of the re-staking track, Binance Research believes that even though many people believe that re-staking can bring great changes to the blockchain ecological infrastructure, the beginning of the development of new technologies and the emergence of new companies are often full of risks. In fast-moving, innovative emerging markets, surprises are not inevitable, and participants must carefully consider the possibility of risks.

As more AVS are expected to be officially launched this year, more and more different slashing conditions (punishment mechanisms) may appear, so it will become very important to choose which platform to use for re-staking. Binance Research also observed that liquidity restaking projects can handle large amounts of $ETH (or LST) and delegate them to different validators. This means that these projects can become key stewards of Ethereum’s decentralization if they choose to do so.

[Disclaimer] There are risks in the market, so investment needs to be cautious. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions contained in this article are appropriate for their particular circumstances. Invest accordingly and do so at your own risk.

This article is reproduced with permission from: CryptoCity

Review editor: Gao Jingyuan

More coverageSuspected of violating anti-money laundering regulations! The founder of the exchange KuCoin is sued by the United States. Will he eventually pay a settlement like Binance?RE:DREAMER Lab completes pre-seed round of fundraising! Will expand the Domin Network ecosystem and create an on-chain consumer database