时间:2024-03-21|浏览:307

用戶喜愛的交易所

已有账号登陆后会弹出下载

The bull market is like this. Yesterday it was all plummeting and wailing, but today it has reversed. The market trend was like a roller coaster, which verified the words of the contract players. In one night, the token price did not change, but the position was gone.

Generally, after a sharp rise and fall, the market will inevitably enter a period of adjustment, and the overflowing liquidity will take the opportunity to cooperate with the market to cause trouble. At this time, a piece of news may trigger the outbreak of a narrative sector.

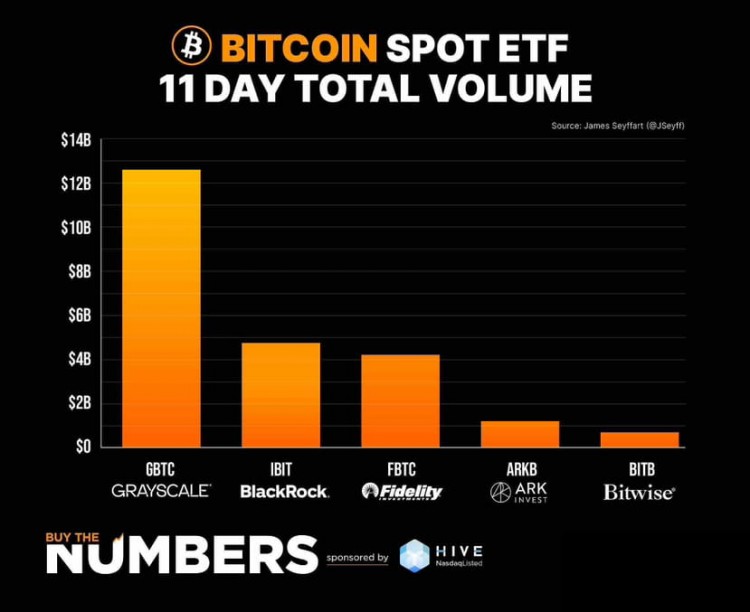

1. After the Bitcoin ETF was approved, a large amount of funds flowed in from TradFi, with "global asset management" as its core.

This suggests that the future cryptocurrency narrative may be dominated by entities such as BlackRock/Fidelity.

2. Recently, BlackRock launched the "BlackRock USD Institutional Digital Liquidity Fund (BUIDL)".

This interest from industry leaders demonstrates how quickly the RWA narrative has shifted from "high potential" to "an industry to watch."

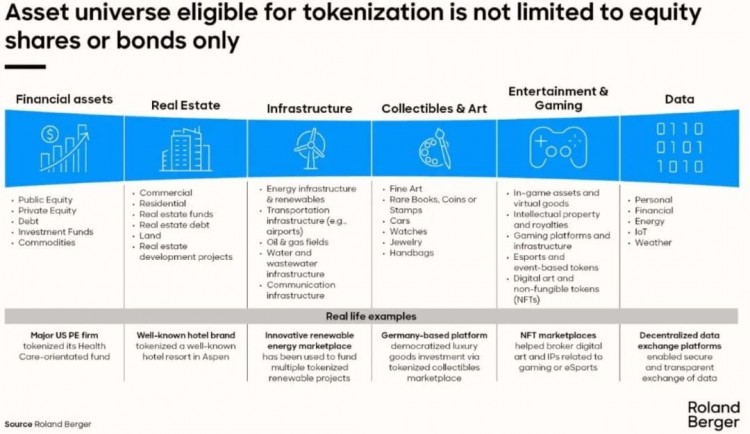

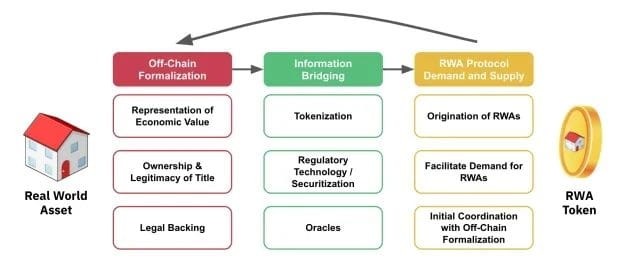

3. "Real world assets" refers to the on-chain representation of real world assets.

RWA is mainly divided into RWA loans and RWA tokenization, usually involving assets such as treasury bonds, private credit, real estate and equity.

4. The main advantages of RWA include:

• Faster settlement and reduced costs

• Increase liquidity (small investments, partial real estate investments)

• Improved access to loans (to finance emerging market companies)

• New products (liquidity of illiquid traditional assets such as real estate, art and private equity)

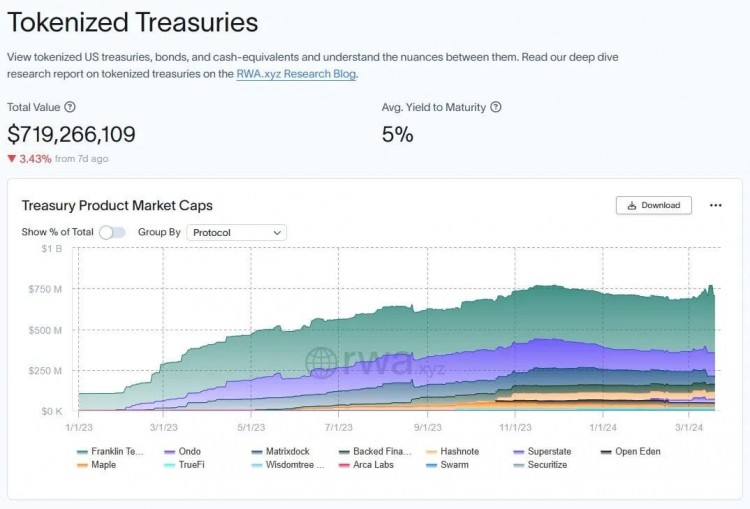

5. Over the past year, risk-weighted assets have been rediscovered through Treasury bonds.

Protocols $MKR, $ONDO, and others that utilize U.S. Treasury bonds to tokenize connect high-yielding, secure government debt with blockchain liquidity, attracting massive capital inflows.

6. RWA lending and real estate sectors should benefit from capital inflows.

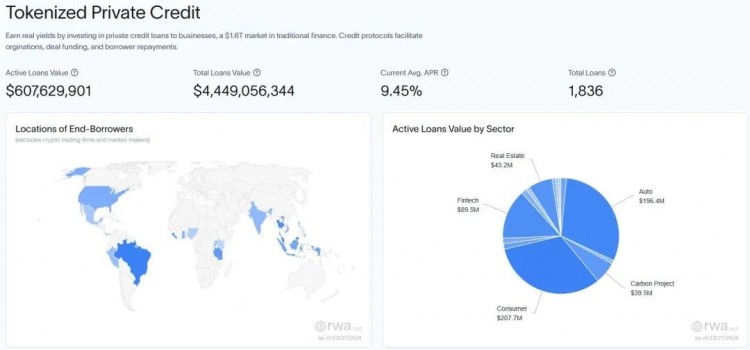

- The global private credit lending market is worth $1.5 trillion.

- Real estate is the world’s largest asset class, valued at $613 trillion.

Huge potential in tangible assets.

7. Personally, I think RWA projects without on-chain dashboard charts are similar to the "2017 Ghost ICO".

This is because RWAs face regulatory risks and infrastructure issues that are not easily solvable unless the project has been in development for many years.

The $CPOOL project is a good example.

8. Therefore, projects focusing on RWA deserve attention.

Major RWA projects are providing users with on-chain data such as active loans, revenue, and defaults.

Simply put, this means they are going about their business "normally."

9. This is expected to attract institutional and institutional investors when selecting RWA partners.

Ondo Finance is a classic example.

10. My RWA project watch list:

leader

- Avalanche - $AVAX

- MakerDAO - $MKR

- Ondo Finance - $ONDO

- Centrifuge - $CFG

competitor

- Goldfinch - $GFI

- Clearpool - $CPOOL

- Maple - $MPL

- TrueFiDAO - $TRU

- Polymesh-$POLYX

Potential

- Polytrade- $TRADE

- Hifi Finance - $HIFI

- Swarm - $SMT

- Props - $PRO

- Real - $RIO

Remember, if you view your position as a long-term investment, market declines should be viewed as a gift. It provides the opportunity to purchase more tokens.

Finally, it's crucial to develop a strategy before making any purchase, and never invest all of your money.

I hope this topic is helpful to you, Thank you for your likes and support