时间:2024-03-17|浏览:285

用戶喜愛的交易所

已有账号登陆后会弹出下载

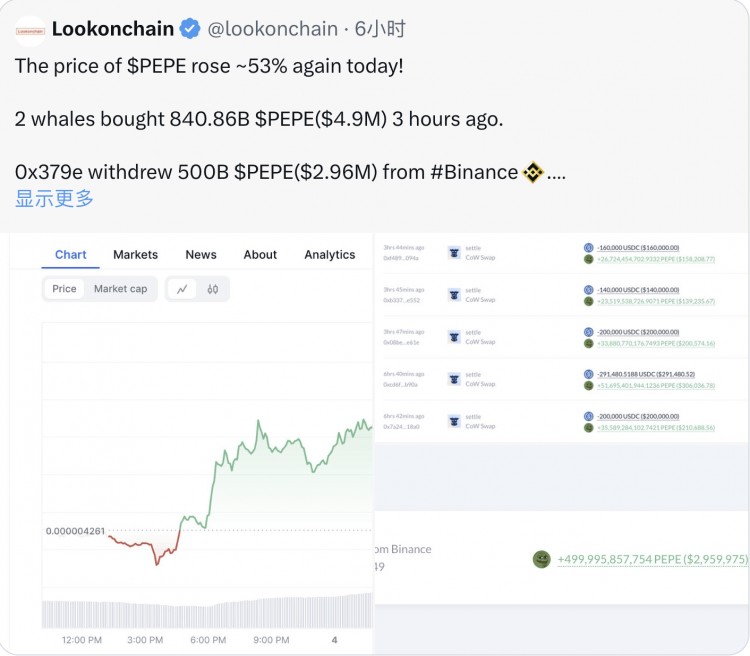

Fantasy and cruel reality of getting rich in the MEME market

Scenario 1: Missing the leader and chasing imitations

In a certain MEME craze, some investors may have missed the leading MEME leading the market, such as bome. Instead, they may choose to invest heavily in imitation projects that follow closely, such as pogai. Although this strategy carries certain risks, it also provides a possible remedy for investors who missed the initial opportunity.

Scenario 2: Leaving prematurely, filled with regrets

Another common situation is that investors successfully buy the leading MEME and make profits, but sell it prematurely. This premature exit may cause them to miss out on the huge subsequent gains and fall into deep regret. This remorse may drive them to take more risky actions, such as moving large sums of money on-chain and investing heavily in new, riskier projects. However, this impulsive behavior often causes them to suffer heavy losses in a very short period of time, or even their assets to zero.

Scenario 3: Short selling attempt after falling short

For those investors who missed out on MEME’s rally, they may choose to go short to cover their losses. When popular MEMEs are listed on small exchanges, they may conduct short selling operations directly at the market price. However, this strategy is also fraught with risks. On the one hand, if the market continues to rise, their short positions may be quickly blown up, causing assets to quickly evaporate. On the other hand, even if they are lucky enough to predict market trends correctly and make huge profits, they may encounter risk control problems on the exchange. For example, the exchange may prompt them to wait 60 days before releasing the funds, but eventually they may find that the assets have been cleared by the exchange.

In general, the MEME market is full of fantasy of getting rich and cruel reality. While we pursue profits, we must also be alert to risks and make wise choices.

![[币圈老司机]艺术家MEME BOME上线3天市值破10亿!如何捕捉下一个百倍MEME?](/img/btc/126.jpeg)