时间:2024-03-15|浏览:244

用戶喜愛的交易所

已有账号登陆后会弹出下载

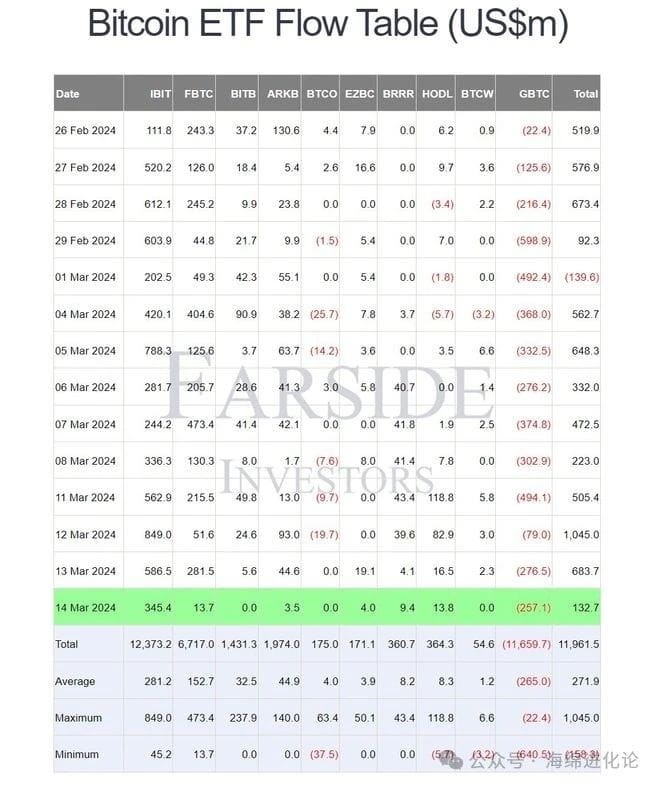

Bitcoin ETF inflows plunged 80% to $133 million as investors exercised caution amid market volatility and a pullback in BTC prices.

Investor sentiment in the cryptocurrency market took a hit as inflows into the U.S. spot Bitcoin ETF fell sharply on Thursday, March 14, down 80.6% to $133 million. Notably, this was the lowest level of inflows in the past eight trading days. That sparked talk of potential cooling interest from Wall Street players.

At the same time, this decline comes against the backdrop of a general downturn in the cryptocurrency market, with Bitcoin prices retreating from recent highs.

Bitcoin ETF inflows plummet on Bitcoin selloff

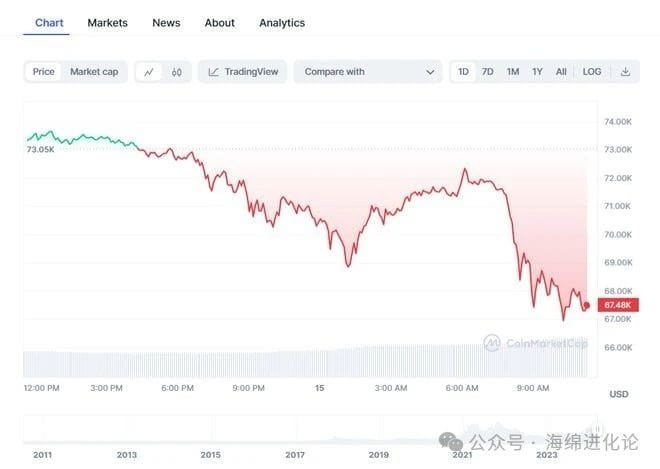

The recent plunge in Bitcoin and the intensification of market volatility have led to a significant decrease in inflows into U.S. spot Bitcoin ETFs, triggering market concerns. After Bitcoin surged to a record high and topped $73,000, the cryptocurrency faced a sharp drop, falling below the $67,000 mark.

Notably, the current decline reflects investors' weakening appetite for risk bets, especially ahead of the upcoming Federal Open Market Committee (FOMC) meeting. Next week's Federal Open Market Committee meeting is likely to reveal the Fed's potential plans to cut interest rates.

However, a report from Farside Investors showed that U.S. spot Bitcoin ETFs saw $132.7 million in inflows on Thursday, March 14, in stark contrast to the $586.5 million inflows seen in the previous days. Notably, BlackRock-owned IBIT, one of the prominent ETF issuers, saw inflows of $345.4 million, down from $586.5 million the previous day.

Additionally, Vaneck Bitcoin Trust ETF (HODL) and Fidelity’s FBTC recorded inflows of $13.8 million and $13.7 million respectively. Conversely, Grayscale saw $257.1 million in outflows from GBTC, albeit an improvement from the $276.5 million outflow reported on March 13.

Value for money amid market fluctuations

Diminished inflows into Bitcoin ETFs have worried investors, leading to a sell-off in the broader cryptocurrency market today. However, despite the recent economic downturn, cumulative net inflows into U.S. spot Bitcoin ETFs have remained substantial, approaching the $12 billion mark after 44 days of trading.

Meanwhile, some market experts say volatility in the cryptocurrency market, coupled with regulatory uncertainty and macroeconomic factors, is prompting investors to adopt a cautious approach. While Bitcoin's long-term outlook remains positive, short-term volatility may continue to impact investor sentiment and ETF activity.

As the cryptocurrency landscape evolves, market participants will be closely watching developments in regulatory frameworks and institutional adoption, which could have a significant impact on Bitcoin's trajectory. Amid the current market turmoil, strategic decision-making and risk management are critical for investors moving forward in the cryptocurrency space.

At the same time, Bitcoin price fell 7.72% to $67,483.45, while trading volume surged 54.20% to $74.48 million. In the past 24 hours, BTC prices have reached a high of $73,750.07 and a low of $66,855.76, indicating high market volatility.

If you want to know more about the currency circle and first-hand cutting-edge information, click on the avatar to follow the sponge, which publishes daily market analysis and high-quality potential currency recommendations. "