时间:2024-03-15|浏览:262

用戶喜愛的交易所

已有账号登陆后会弹出下载

Original source: Odaily Planet Daily

Original author: jk

Recently, the activity of the Bitcoin ETF market has attracted widespread attention from investors. Many products, such as BlackRock's IBIT, Grayscale Bitcoin Trust's GBTC, Fidelity's FBTC, and Ark Invest/21 Shares' ARKB, etc., all show complete volatility characteristics on the exchange. As Bitcoin continues to rise and the crypto market enters a bull market, the trading volume data of major Bitcoin ETFs have become a barometer of market sentiment.

Odaily Planet Daily has been continuously tracking the relevant data of Bitcoin spot ETF. It can be seen that as the price of Bitcoin continues to rise in recent days, ETFs have seen a large inflow of funds, and the momentum has completely overshadowed the net outflow of GBTC. At the same time, as buying enthusiasm grows, the Bitcoin holdings of major management companies have also completely increased. James Butterfill, director of research at CoinShares, said that the net inflow of digital asset ETFs/ETPs so far this year has exceeded US$12 billion, breaking the historical record of net inflows of US$10.6 billion for the whole of 2021. However, only one quarter of this year has passed.

At the same time, Bitcoin ETF-related data has reached several new highs: BlackRock Spot Bitcoin ETF (IBIT) holdings reached 223,645.98255 BTC (more than 1% of Bitcoin’s theoretical maximum supply of 21 million coins), and its market value exceeded 16 billion US dollars, a new high; on March 12, local time in the United States, the total net inflow of Bitcoin spot ETF was 1.05 billion US dollars, setting a record single-day net inflow since the first trading day of the ETF, compared with the second highest point (February The single-day net inflow on the 28th was US$673 million), an increase of approximately 56%; the total market value of Bitcoin ETFs (including spot and futures ETFs) was US$60.143 billion, and the total asset management scale (AUM) was US$55.374 billion.

Data overview

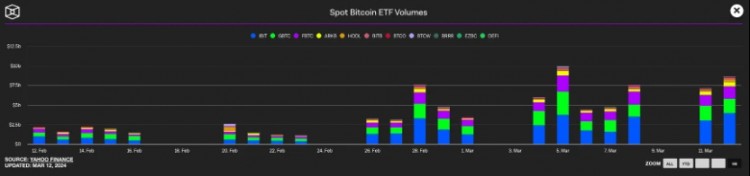

Spot Bitcoin ETF daily trading volume, source: The Block

The chart covers the entire trading volume of the newly approved Bitcoin spot ETF for the past month. It can be seen that since the end of February, before Bitcoin rocketed from a price of around $50,000, daily trading volume began to climb, with BlackRock’s IBIT being the highest (blue part of the figure) ), GBTC ranked second (the green part in the picture). It is estimated that most investors made profits and sold out, because investors who care about management fees may have left the market when it was first approved. Fidelity’s FBTC ranks third.

Spot Bitcoin ETF market share, source: The Block

In terms of market share, it is also consistent with what we see from the transaction volume: there was a clear decline starting in mid-February, in which VanEck’s HODL share gradually increased; but since then, it has recovered to IBIT’s third 1. GBTC ranks second, FBTC ranks third, followed closely by small players such as Ark, and after the bull market, BlackRock’s IBIT share has also increased significantly, jumping from about 33% before to 45% today. % about.

Taken together, the Bitcoin spot ETF has seen a cumulative net inflow of $11.8288 billion since its launch. in:

-IBIT’s cumulative net inflow is US$12.0278 billion;

-FBTC’s cumulative net inflow is US$6.7033 billion;

-BITB’s cumulative net inflow is US$1.4313 billion;

-ARKB’s cumulative net inflow is US$1.9705 billion;

-GBTC has a cumulative net outflow of US$11.4026 billion.

From this data, it can be seen that the momentum of net inflows has clearly covered the net outflows from Grayscale when the ETF was first approved. The net inflows of IBIT alone can already cover the outflow data of GBTC. According to the daily traffic data, it is as follows:

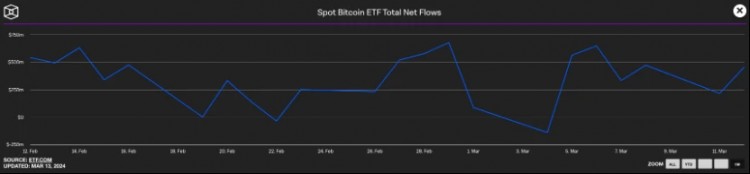

Bitcoin total net inflow data, source: The Block

It can be seen that in the single-day net inflow data in the past month, only a few days were in a state of net outflow, and the amplitude was small. At other times, the entire market is in a state of net inflows. Basically, few people have raised the issue of whether GBTC will sell off significantly and affect the price.

According to statistics from on-chain analyst Ember, the current total BTC holdings of the ten BTC spot ETFs have exceeded 800,000, accounting for 3.8% of the total BTC. Grayscale (GBTC)’s share of the ten BTC spot ETFs has dropped to less than 50%, and BTC holdings have fallen below 400,000. Grayscale (GBTC) has less and less influence on the market. The BTC holdings of BlackRock (IBIT) and Fidelity (FBTC) have reached 320,000 ($23.1 billion), which is about to surpass Grayscale (GBTC).

Secondly, there are currently two theories in the market regarding the relationship between Bitcoin spot ETFs and Bitcoin spot prices: Is it the inflow of ETF funds that pushes up the price of Bitcoin, or is the increase in Bitcoin prices due to other reasons driving up the price of ETFs? Money flowing in? The two obviously complement each other, but there is obviously no conclusion yet on this question, which is similar to which came first, the chicken or the egg. From a time point of view, the price of Bitcoin began to rise and the trading volume began to increase on February 26, local time in the United States. The difference is very small, and it is difficult to draw conclusions from the time. However, if the growth rate of ETF data slows down in a bull market, it may mean that the investment enthusiasm of investors attracted by the current bull market has been excessively consumed, or it may indicate a periodic high.

Looking at the current trading volume trends of Bitcoin ETFs, we can get a glimpse of subtle changes in investor confidence and market enthusiasm from the fluctuations in various data. Although future market performance is full of uncertainty, by closely tracking these key data, investors and analysts can better understand the market context and grasp investment opportunities. The performance of Bitcoin ETF will continue to be the focus of observation by Odaily Planet Daily.