时间:2024-03-03|浏览:295

用戶喜愛的交易所

已有账号登陆后会弹出下载

First of all, I would like to apologize to the readers. Yesterday was the first time in more than 300 days that I stopped updating for one day. Even if I had to catch a flight before, I would be busy writing updates at the airport to catch up.

Yesterday, one was because there was no big market, and the other was that the offline get out of class on the 2nd was really too busy and rushed. But overall, it started to be very in line with the expectations before the event. It lasted from 930 in the morning to 1130 in the evening, and I personally gained a lot of experience and information.

Special thanks to our event sponsor signalplus

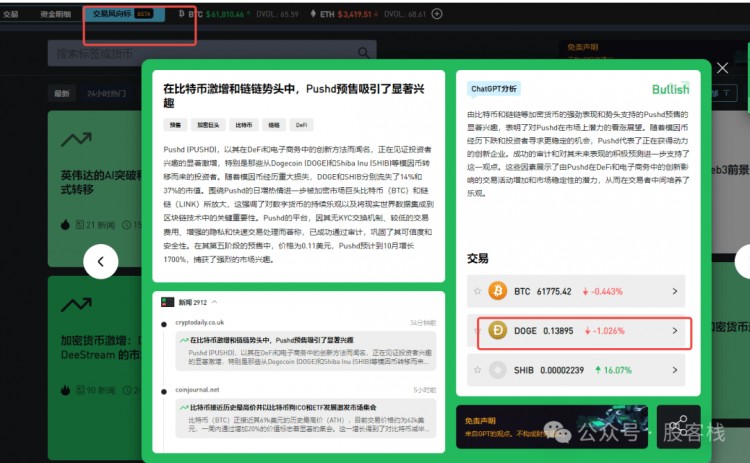

Just recently, SP launched their lightning trading module and long-short weather vane module. Let me introduce them briefly.

After clicking on the Wind Vane module, you can directly see the corresponding news and long-short tendencies based on AI analysis, and the trading targets mentioned in the news can be opened with one click to conduct corresponding futures or spot transactions. A seamless experience where what you see is what you get.

Lightning trading is a newly added module, which can be added in the NEW futures and spot section of the module.

The default is 100U for one hand. You can play long and short like a machine... I don’t recommend designing large numbers. It is suitable for the trading feeling when you are bored and want to hedge your own hands to increase APM. At this time, there should be advertising placement for mechanical keyboards to be perfect...

Yesterday's event lasted for nearly 8 hours, and special thanks to the guest teacher Sober for sharing on the spot. I know there are a lot of big guys in the audience, and it’s stressful to talk about it, haha. Fortunately, the preparation for the entire course was quite adequate. Because I am not a trader myself, I don’t go into too many details on technical operations. I have seen the IDs of many of my friends on the ranking list, and it can be seen from the trading volume that they are all very passionate about options.

By the way, I would like to preview the AMA on the 4th, which is Monday at 9 o'clock in the evening. The champion of the last individual competition and the champion of the VIP group (me) will also come together to chat with you about this competition and some trading experiences. You can subscribe in advance.

https://meeting.tencent.com/dw/jWeRlC0V5cJn

#TencentConference: 326-3413-7260

Judging from the market situation, the biggest surprise these days is that the stable currency OKB is no longer stable (see how beneficial the trading competition is, hahaha), and relatives of big pie such as BSV BCH have collectively exploded. Of course, there are many popular counterfeits, but these two are particularly eye-catching, and the DEFI series has also exploded. But unfortunately, the three or four most mainstream coins have remained stable without much movement.

There is a saying that when a whale falls, all things come into being.

The thing to be careful about in this kind of market is that after the whale really falls, not a blade of grass will grow...

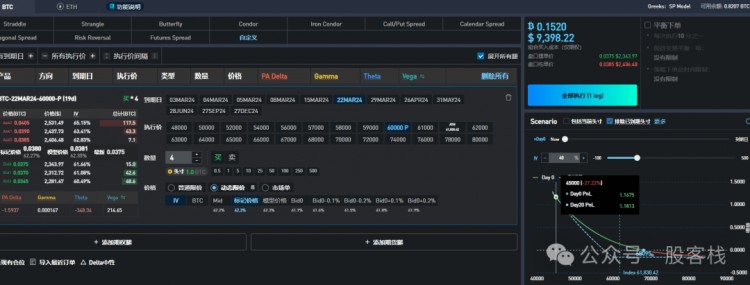

So judging from the current volatility surface, if you want to earn twice as much U, it’s even more difficult. If you want to earn twice as many coins, go buy PUT...

To give a very simple example, if you invest 9000U here, once the needle reaches the take-off price, you will directly receive a BTC on the spot. But you want to double the U when it rises to 12W... Which one do you think has a higher probability? Of course, I may choose to recover some costs at 7W SELL CALL, which is more cost-effective to synthesize the short position of RR here...

The above strategies do not constitute any investment advice, but just tell everyone that the current market price-performance ratio for mainstream currencies is actually very worrying.

In addition, according to the current rate, the 7-day rate is about 1.5%, which means that the wear and tear of a player with 10 times leverage in a week will be close to 15 points of the total position... This is really a drop, don't you look at it? ···

That’s pretty much it. Thank you for watching. Next week we will continue to post a video chat about a price difference case under extreme circumstances, which is very interesting.