时间:2024-02-29|浏览:261

用戶喜愛的交易所

已有账号登陆后会弹出下载

$PORTAL New coins have been launched. In the past quarter, Binance has launched several new coins in the game sector. The main direction of this cycle is now obvious.

ACE recently announced that it will transition to mainnet 2.0. This is also the inherent impression that many people have on $ACE , thinking that it is just a game ecological token, but in fact it is still an infrastructure.

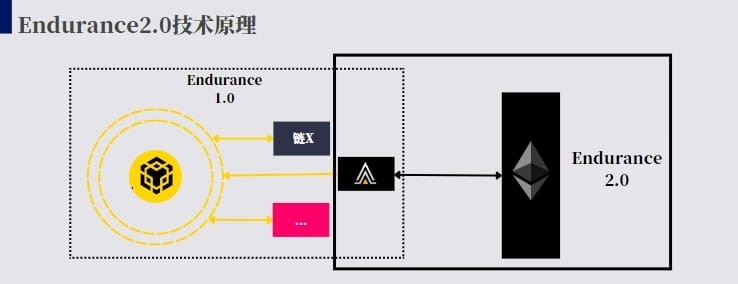

Endurancel is the name of its infrastructure solution. The previous version 1.0 used the BAS solution. A simple understanding can be that it exists as a parallel chain/side chain of BNB Chain. The latest mainnet 2.0 to be completed is an Ethereum side chain. direction of development;

Little knowledge: The side chain is an independent blockchain relative to the main chain. It maintains its own consensus, which is different from L2’s Rollup solution.

This means that on the basis of Endurance’s original EVM compatibility, its on-chain ecosystem will have the potential to be more open and prosperous. The previous version 1.0 can be said to be a closed private chain development environment. The main on-chain ecology relies on the main development team, and the transition to the Ethereum side chain will make the on-chain ecology more dynamic;

ACE exists as the native token of this chain, not a single ecological token

In addition, the token rights and interests need to be extended a little bit - BOAT, which can be said to be ACE's on-chain reputation system, has also become the core of the entire game ecosystem and token economic empowerment. The construction of this system can not only further Increasing the activity on the chain, forming a deep bond with users, and forming a good cycle between the ecology and tokens.

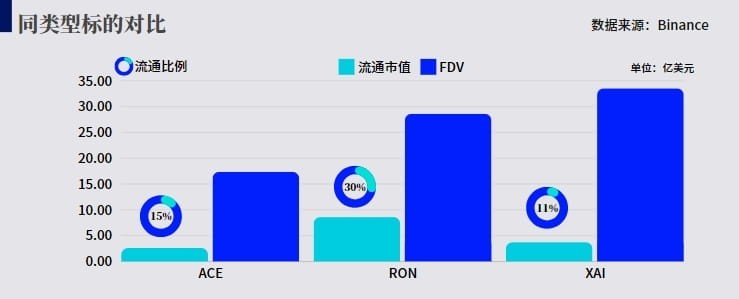

The above statistics include two targets of the same type as ACE: RON and XAI, which both belong to the game infrastructure of Binance New Coin. The data shows the circulating market value, FDV (full circulating market value) and circulation rate;

From a purely market value perspective, both the circulating market value and FDV of ACE are significantly lower than the two comparable targets. This has something to do with the stage of listing, because judging from the momentum and scale of the launch, ACE is both Obviously stronger than the latter two;

For a more vertical comparison, whether from the perspective of infrastructure or ecology, ACE will actually have a stronger competitive relationship with RON, because RON itself is also an Ethereum side chain, but ACE is ecologically bound to its on-chain identity system. , giving the token a higher equity position.

(The ecology on RON is slightly stronger than that on ACE, at least in terms of market popularity. #PIXEL in new coins is the ecology on the RON chain. However, RON has been attacked in the past, and the market trend has upward breakthrough pressure. will be relatively larger)

3. Disk analysis

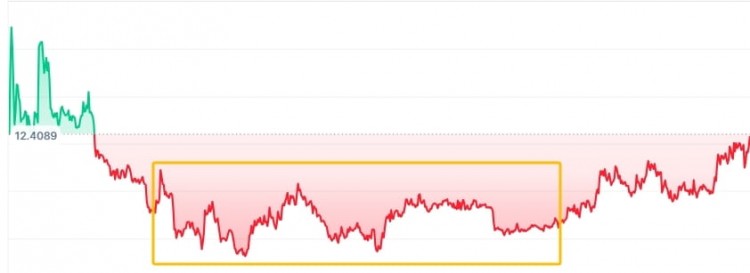

The performance of $ACE after its initial listing was not very impressive. It followed a non-classic trend of peaking at the top of the line. However, after a period of reshuffling and changing hands, the current price bottom is constantly rising. Combined with It is highly expected that the fundamentals of the project will be upgraded and that it will regain its previous high. After all, among competing products of the same type and targets listed in new coins, the current market value of ACE is also relatively small.

Adhering to the principle of speculating on the new rather than speculating on the old, ACE actually has a better profit-loss ratio than RON.

![[亚伯拉罕]护肤影响者超级糟糕:Michael Cera 是 Cerave 背后的主谋吗](/img/20240127/3342077-1.jpg)