时间:2024-02-29|浏览:298

用戶喜愛的交易所

已有账号登陆后会弹出下载

原作者:孙鹏

原始来源:前瞻新闻

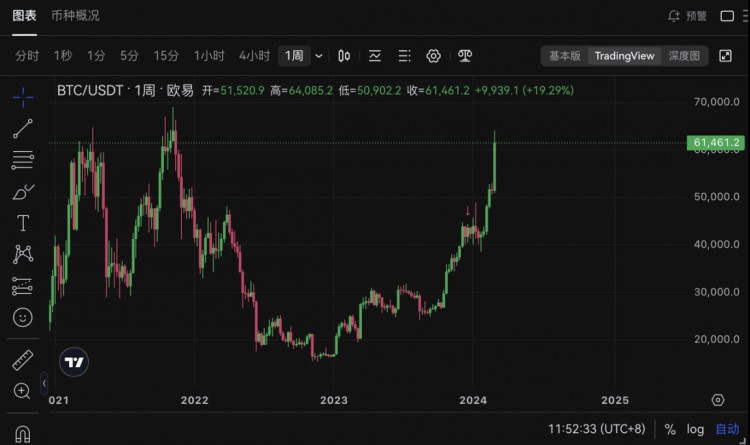

北京时间2月28日晚至2月29日凌晨,币圈欢度新年。 比特币时隔 832 天重回 6 万美元上方,引发了整个市场的 FOMO 情绪。 短短两天时间,比特币突然暴涨1万美元,从52,000 USDT涨至64,000 USDT。 此次,比特币市值最高达到1.225万亿美元,无限接近白银市值(1.277万亿美元)。

即使在极端的市场条件下,交易所也不会缺席。 凌晨1点54分,Coinbase以一次断电的方式向牛市致敬。 Coinbase在推特上表示,一些用户可能会看到自己的Coinbase账户余额为零,并且在买卖时可能会遇到错误。 几个小时后的上午,Coinbase逐步完成了断电修复,平台上的所有服务均已恢复。

6万美元比特币再次出圈

比特币又出圈了。 上次圈外朋友问我圈内情况是巴厘岛杀人事件。 当时,这起事件已在微博和小红书上广泛流传,对加密币圈子造成了很大的负面影响。 。

但这一次,比特币用它的收益说服了人们。 事实上,2天前,比特币涨至5万美元以上时就已登上微博热搜榜。 但今晚,由于比特币价格突破6万美元,“比特币”占据了2个热搜榜。

无独有偶,昨天下午我的传统财经媒体朋友也开始了FOMO。 听说有朋友用20万赚了200万。 想了想,前一天晚上通宵写作只赚了2000块钱,不自觉就开始问怎么买BTC。

凌晨1点,多空双方爆发

从凌晨1点到凌晨1点30分,短短半个小时左右,全网爆仓金额超3亿美元。

让我们看看到底发生了什么? 首先,00:54左右,比特币涨至62000USDT后,不到20分钟就突破了63000USDT,引爆市场情绪。 随后3分钟,比特币再次突破64000 USDT,空军爆仓1.35亿美元。

公牛势不可挡,但空军也不甘落后。 比特币突破64000USDT后并没有继续上涨,而是回落至63000上方几分钟,然后回落至61000USDT附近。 多头乘胜追击,15分钟下线pin跌至58666 USDT,导致多头爆仓1.77亿美元。

随后,市场重新进入多空拉锯阶段,目前,比特币仍在61000美元上方震荡。

数字货币概念股普遍上涨

At a time when Bitcoin is skyrocketing, digital currency concept stocks are experiencing general gains. Represented by Coinbase, Coinbase rose by more than 1.5% today, by more than 21% in a week, and by more than 51% in a month. At the same time, MicroStrategy rose more than 10% today, Marathon Digital rose more than 2.3%, Canaan Technology rose more than 5.7%, Yibang International rose more than 21.9%, and The9 rose more than 1.87%.

Bitcoin ETF's single-day trading volume hits record high

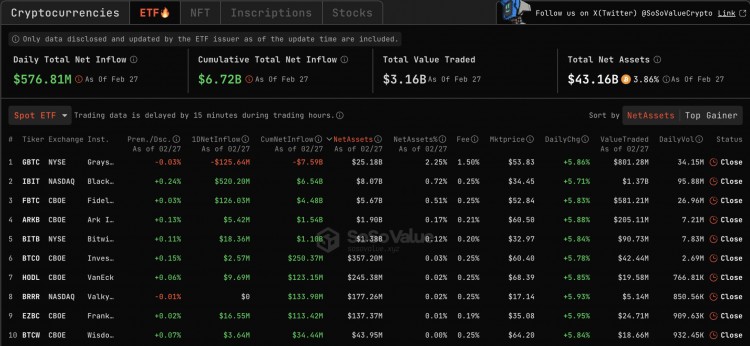

At present, the driving force for this round of gains can still be attributed to the large inflow of traditional funds into Bitcoin ETFs. First, trading volume in the Bitcoin spot ETF hit $7.69 billion yesterday (February 28), setting a new record since its launch. The previous record was $4.66 billion.

According to Sosovalue data, as of February 27, the total net inflow of Bitcoin spot ETF was US$576 million, and the Grayscale ETF GBTC had a single-day net outflow of US$125 million. It is worth noting that BlackRock, the Bitcoin spot ETF with the largest single-day net inflow yesterday was BlackRock ETF IBIT, with a single-day net inflow of approximately US$520 million, setting a new high for IBIT single-day net inflow. The current IBIT history Total net inflows amounted to US$6.54 billion.

The second largest net inflow on the 27th was Fidelity ETF FBTC, with a single-day net inflow of US$126 million. The current total historical net inflow of FBTC reached US$4.48 billion. As of press time, the total net asset value of Bitcoin spot ETFs is US$43.16 billion, the ETF net asset ratio (market value as a proportion of the total market value of Bitcoin) reaches 3.86%, and the historical cumulative net inflow has reached US$6.72 billion.

Bloom in many places: inscription, meme, storage, GameFi, AI

The recovery of the Bitcoin market has once again led to the rise of other tracks, which is directly related to Inscription. Since Inscriptions are denominated in sats, the rise in Bitcoin naturally drives up the price of Inscriptions. In the Bitget inscription sector, the leading project ORDI rose by more than 11% today, reaching a maximum of 81 USDT, almost returning to the market high in early January this year, and other tokens all experienced considerable gains.

The recent rise in the meme sector has been impressive. Bitcoin exceeded $64,000 in the early morning, and DOGE, as the largest meme token, took the lead in rising by more than 13%, boosting Bitcoin. BONK gained 47.7% in 24 hours. PEPE rose by more than 44% yesterday after a single-day increase of more than 50% in the previous two days, hitting a new high since May 6, 2023. WIF is pointing at 1 USDT, breaking through 0.93 USDT yesterday, rising by more than 44% in a single day. What’s clear is that the broader market is stronger and the community’s FOMO is directly reflected in the meme.

In the storage track, the launch of the supercomputer AO by Arweave has led to general gains in the sector. In the past two days, AR has exceeded 20 USDT and 30 USDT, setting a new high since May 2, 2022. It rose by more than 43% yesterday and rose by more than 19% today. FIL has also doubled in the past month, reaching a maximum of 8.6 USDT recently, a new high since August 2022. Filecoin launched FVM last year and is gaining momentum in L2, DeFi and other fields this year, and will launch Interstellar Consensus on the mainnet in the second half of the year.

Due to the recent rise in the GameFi sector, Binance will also launch the cross-chain game Portal in the near future. GALA, which has been declining for a long time, has finally begun to make up for its gains in recent days. Yesterday, affected by the news that Gala Games launched GalaSwap, GALA rose by more than 22% to 0.04 USDT yesterday morning. Another point worth noting is that Gala Games will activate the token destruction mechanism.

The AI + Web3 concept has been recognized as the consensus of 2024 since October last year, and Binance has invested in or launched Launchpool projects with multiple AI concept projects. Yesterday, FET rose to 1.38 USDT, a record high and an increase of more than 18%. WLD also hit all-time highs over the past week, reaching a high of 9.49 USDT.

Summarize

On February 29, 2024, Bitcoin reached a maximum of $64,000, which is still 10% higher than the historical high of $69,040 in the previous bull market. Currently, Bitcoin has stabilized above $61,000, and bulls and bears are still in a tug of war.

Interestingly, Bitcoin has not seen any pullback from last November’s low of $16,000. Many voices in the community have expressed panic. No one knows what is the reason for this round of rise. The participation of Wall Street capital has made everyone confused. Many senior traders have failed to predict and the market has gone short. The passage of the Bitcoin ETF and the entry of traditional capital may have invalidated the methodology of seeking a sword at every turn, but no matter what the future trend is, we should remain in awe of the market. After all, half an hour in the early morning is enough for many people to lose their positions.