时间:2024-02-28|浏览:264

用戶喜愛的交易所

已有账号登陆后会弹出下载

Original author: Riyue Xiaochu, crypto KOL

Editor's Note: Yesterday, Bitcoin briefly exceeded $57,000, setting a new high since January 2022. Bitcoin’s strong momentum has increased everyone’s confidence in this bull market. So, how is this bull market different from previous ones? Based on these differences, what adjustments need to be made to our trading strategy? In this regard, crypto KOL Riyue Xiaochu published his thoughts and opinions on X, and BlockBeats reproduced the full text as follows:

Regarding the upcoming bull market, there are three major differences from the bull market in history. Based on these differences, our trading strategies also need to be adjusted.

1) The amount of funds is different. The current total market value of crypto is 2 trillion, and the price of BTC is 50,000. At the beginning of 2020, BTC was only 10,000;

2) The consensus on the bull market is different. In the 18th, 19th, and early 20th before the start of the last bull market, there were reports of cryptocurrency returning to zero, and I have personally seen many people leave the industry. But this cycle, even in the big down year of 2022, most people will believe that the next bull market will come;

3) The number of people in the market is different;

The above three differences are obvious and can be used to deduce the differences of this bull market.

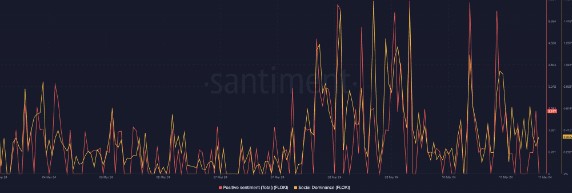

1. Increased professionalism in the market and increase in professional secondary institutions

As the amount of funds in the secondary market increases, the professionalism of the market will definitely increase significantly. Specialized secondary fund institutions have increased accordingly. The simplest principle is that when you have 100K in funds, just do your own research. When your capital reaches 10M, you will need a professional research team to operate. In addition, there are funds that are specifically established to be optimistic about the secondary market. Generally speaking, these funds have professional teams, strong funds, and abundant resources. If you are a leek and cannot compete with it, BTC has become more difficult to predict its trend in the past two years. This is also the reason because there are more powerful large institutions, and it has become a confrontation between large institutions.

So what should I do while waiting for leeks?

1) The accuracy of some original skills will decrease, which is an inevitable result of the increase in market professionalism;

2) Consider entering the inner circle of professional institutions and communicating through relationships and connections;

3) If you can’t find an institution, get together with some friends who are equally capable and do research together;

4) In terms of transactions, you can take advantage of the disadvantages of professional institutions,

For example, the speed of investment decision-making is slower than that of individuals, which results in the reaction speed of new projects and new hot spots being slower than that of individuals.

The investment targets of institutions are limited, because institutions will pursue a set of mainstream investment logic, and some investment sectors do not comply with transaction logic. The most obvious is the inscription. In the future, there may be a greater chance of getting rich on tracks similar to Inscription.

2. Deepen some projects or ecology

Assume that operating a project to a certain market value (such as $1 billion in circulation) requires a certain amount of funds. So in this bull market, the amount of funds in the market has increased dozens of times, which means that the opportunities have also increased dozens of times. Of course, the actual situation is worse than ideal, because projects with high initial market value need to be eliminated. But compared with the last bull market, the opportunities are still much greater. In other words, in this bull market, a good project or public chain, with a few institutions that are optimistic about it, and some community users, can become a project with a high market value.

At the same time, it also means that a project does not need to be favored by many people, or even if it is not favored, there will be no problems. Because it only requires the recognition of a small proportion of institutions, large investors, and retail investors in the market, it will still have a high market value.

Taking this round of market conditions as an example, Inscription may have the largest increase, followed by Sol Ecosystem. But apart from the general trend of the market, many coins still have very good growth rates, and many coins have even been completely unheard of. Not to mention, some new online projects will benefit a group of people when they are launched. Such as Pixel, Dym, etc.

But don't be happy too soon. Because although there are more opportunities, there are also more institutions and more professional teams. Therefore, better projects will be watched by many people. So in this bull market, you are still just trying to get a taste of it, or just follow the trend and follow the trend. Then you may only be able to eat some of their leftovers, and sometimes you won’t be able to eat them.

Therefore, the way to maximize profits is to focus on good projects. Due to the large amount of market capital, better projects will have good returns in the future. But make sure you are in the car in advance.

3 The valuation premium is obvious and there are very few undervalued projects.

In this bull market, what everyone has realized is that the market value of many online projects is very high. This is an inevitable manifestation of a well-funded market. But what many people don’t realize is that there are very few undervalued projects in the market.

The reason is simple: there are many people with more money in the market. Some professional teams can identify projects that are undervalued. But it is very difficult for ordinary people to find it. So, instead of spending my time looking for undervalued projects, it would be better for me to study the bottom of trend cycles. Every cyclical adjustment in the market will drive the currency down, and basically no one is immune. And, in times of panic, prices are wrongly priced. So, take the time to research the bottom of the cycle and you'll be able to buy at a great price.

Taking advantage of the information gap is also a way. Especially when the market funds are abundant, it will also take a certain amount of time for new projects on the chain to be discovered.

Original link