时间:2024-02-27|浏览:241

用戶喜愛的交易所

已有账号登陆后会弹出下载

Is Bitcoin going to have a correction and plummet?

This is a question that many cryptocurrency enthusiasts are concerned about now. After all, Bitcoin accounts for more than half of the volume. As the weather vane of the entire crypto market, if it plummets, all currencies will plummet with it, and the decline will be even worse.

It can be clearly said that the probability of a sharp decline in a short period of time is unlikely. Even if there is a subsequent correction and decline, there is a high probability that it will first fall and then reach the top. Because Bitcoin is now large enough and the consensus is strong enough, without a serious black swan causing a stampede, it would be difficult to have such a large amount of funds to smash the market on a large scale in a short period of time.

The first shocks and negative declines consume patience and make retail investors unconfident and wait and see. When market liquidity reduces to a certain threshold, they take the opportunity to quickly sell the market. This scenario may be the most common trend pattern in the fourth round of Bitcoin's market later.

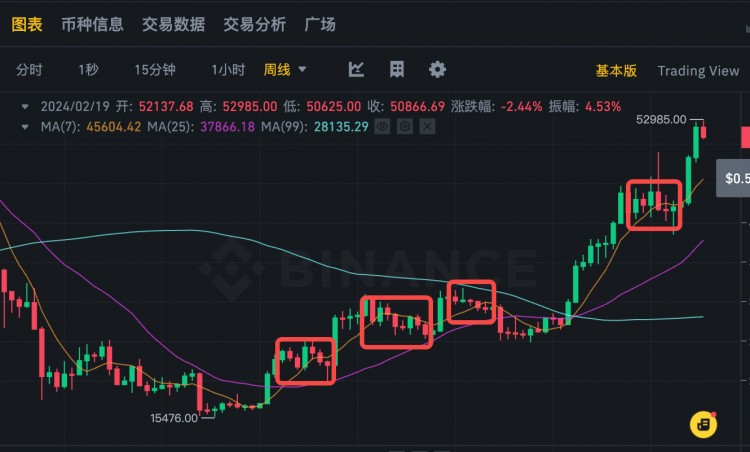

Judging from the rising market in the past half year, every time Bitcoin rises too much, it will fall and reach the top for 5-7 weeks, and then fall sharply to recover. This round of rising prices has only lasted two weeks. Although it has indeed reached a pressure level, the correction will not be so fast and will appear in the form of a short-term plunge.

From a historical perspective, the number of Bitcoin slumps in each round of halving is decreasing, and the magnitude of the slump is also narrowing. When I wrote an article before, I specifically pulled the prices of the first two halvings from Trading View. The daily rise and fall data counts the number and magnitude of plummets, as follows:

On November 28, 2012, Bitcoin halved for the first time, rebounding from the bottom of $11 to the highest point of the market cycle above $1,169, an increase of 10,500%, which took 1 year. In this round of market conditions, the highest single-day decline exceeded 20% 14 times, and exceeded 15% 25 times. The highest single-day decline was 65%.

On July 10, 2016, Bitcoin halved for the second time, rebounding from the bottom of $650 to the highest point of the market cycle of $19,800, an increase of 2,950%, which took 1 and a half years. In this round of market conditions, the highest single-day decline exceeded 20% 8 times, and exceeded 15% 17 times. The highest single-day decline was 31%.

It can be seen from the overall data that the duration of the bull market is getting longer and longer, but the frequency and amplitude of the crash are getting smaller and smaller.

As we all know, the bull market and bear market market performance are usually: sharp rise and slow fall; the bull market is slow rise and sharp fall. If you are interested, you can ponder the logic behind it, and you will have the opportunity to explain it specifically in the future. Mastering this logic is very useful for people who trade frequently. helpful.

At present, Bitcoin's daily line has clearly moved out of the shock range: 50,000-53,000. The current top shock and grinding time is only 8 days. According to the trend of the market in the past six months, there may be at least four weeks to kill. Your patience. Of course, if this range is maintained in the future (a slight breakthrough and quick recovery is OK), it will give room for high-quality altcoins to continue to explode, such as the current conceptual leaders: UNI (dex), FIL (storage), BNB (platform currency), WLD (AI), etc., all have good gains;

Judging from the time and progress of this round of rise, there will be some concept coins breaking out in the future. If you want to buy, you can try to buy leading projects and avoid small coins. The current market capital volume does not support a general rise.

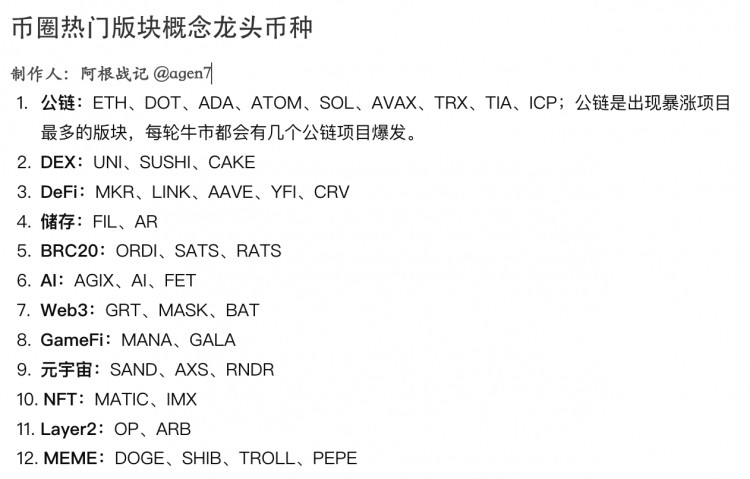

We have sorted out some leading currencies for currency friends, typed purely by hand, you can refer to:

If you just play spot, most currencies are actually at a low level now, especially the currencies born in the last bull market. As I said before, the fourth round of Bitcoin halving will restore its strength by 10 times or 50 times. Double the increase, but most people may not have the patience and determination, because the current fourth round of big bulls has not really started. For details, see the article: What stage is the "bull market" in now? Can I still see 30,000 Bitcoins?

It's just the beginning of the bull's horns now. What I'm most afraid of is that you are like a monkey breaking the corn. When you see a sharp rise, you will drop the corn in your hand, chase the rise and kill the fall, and finally die before dawn.

To borrow a paragraph from the previous article: From the perspective of the overall environment, it can only be regarded as a small bull market at present. Market funds are mainly concentrated in Bitcoin, and other currencies have a little bit of soup. Therefore, we cannot imagine that it will always be 10 times, 20 times, or 100 times. As for the increase, double the increase is good. If you get three or five times the increase, it is considered to be meat. Don't be greedy. #内容挖矿

Finally, this article is only for reference and not investment advice. The market is risky, so be cautious when entering the market.