时间:2024-02-23|浏览:298

用戶喜愛的交易所

已有账号登陆后会弹出下载

Although Bitcoin once surged to nearly US$53,000 on the 20th, setting a new high since November 2021, it then began to fall back, repeatedly fluctuating within a narrow range between US$51,000 and US$52,000, and even fell for a time on the evening of the 21st. to $50,625. The future trend of Bitcoin has affected the hearts of many investors.

After rising more than 30% since the launch of the Bitcoin ETF in late January, a failed attempt to break above $53,000 could signal further consolidation in the current range. However, market analysts generally believe that Bitcoin’s correction is normal and predict that Bitcoin will enter a parabolic rise stage after the halving.

Cryptocurrency technical analyst CryptoCon pointed out that the $52,800 area is a key resistance area and marked the top of the previous market cycle. It posed major resistance to BTC price in 2016 and 2019, and the breakout in early 2017 and late 2020 was Fresh gains clear the way to new all-time highs.

According to the chart released by CryptoCon on After the annual Bitcoin halving event.

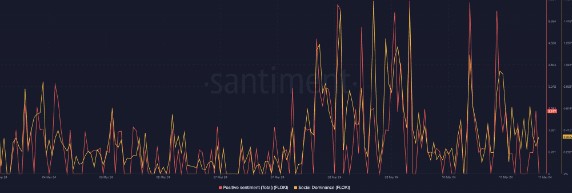

Cryptocurrency trader and analyst Rekt Capital says Bitcoin has one final pre-halving retracement left before resuming its upward trend. Independent market analyst Sjuul noted that Bitcoin’s funding rates are high, warning traders that a full correction is possible. However, he believes that this is the bargain-hunting opportunity that investors are looking for.

Bitcoin has gone through similar phases in past bull markets, first returning to previous levels, then going through a period of consolidation, and finally breaking through resistance and setting new highs following the Bitcoin halving event. Because of this, market sentiment remains positive.

The latest on-chain data shows that stablecoin holders with between $10,000 and $100,000 have added $44.3 million in USDT over the past 2 weeks, suggesting they may be waiting for a pullback and preparing to buy on dips. Market intelligence firm Santiment pointed out that major moves by mid-sized traders are often excellent signals for profit-taking and "buying on dips."

IntoTheBlock data shows that since the beginning of this year, long-term Bitcoin holders have sold a total of about 200,000 Bitcoins. This selling trend has continued for nearly three months, and the Bitcoin holdings of long-term holders have increased during this period. Continuous decline.

While the selling occurred, it was typical long-term holder activity during a bull market, and there was a clear difference in the pace of the selling compared to previous bull markets, during which long-term holders reduced their holdings by approximately 15%. , but the current holdings have decreased by only about 1.5%.

At the same time, a large amount of currency hoarding by various investors also offset the impact of the sell-off. Ki Young Ju, CEO of CryptoQuant, released data showing that 25,300 BTC flowed into Bitcoin hoarding addresses on the 21st, setting a record high.

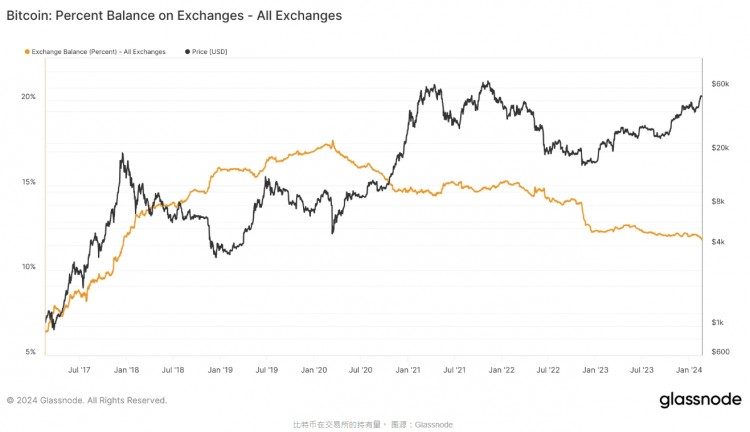

In addition, since mid-March 2020, the number of Bitcoins held by exchanges has begun to decline significantly, indicating a change in investor behavior. In the past, exchanges held a peak of more than 17% of the Bitcoin supply in 2020. But it has continued to decline since then, showing a trend of investors transferring coins out of exchanges and continuing to accumulate coins.

According to Glassnode data, since the beginning of this year, Bitcoin holdings on exchanges have continued to decrease. From January 1 to February 19, the Bitcoin balance in exchange wallets has dropped from 2.356 million BTC to 2.314 million BTC. BTC, reaching the lowest level since April 2018, which has caused the exchange’s share of the Bitcoin supply to drop to 11.79% from 12.03% at the beginning of this year.

The fourth halving of Bitcoin is now approaching. Looking back on the past three halvings, the price of Bitcoin will rise significantly. Anthony Scaramucci, founder of Tianqiao Capital, even gave a specific price prediction last month, believing that Bitcoin will After the halving, it will soar to at least $170,000, and will reach $400,000 in the future.

It should be noted, however, that while past halving events did have a positive impact on Bitcoin prices, past trends cannot simply be applied directly to the future. Price prediction is a very challenging task, especially for the highly volatile and uncertain cryptocurrency market. Market movements can be affected by many factors, and price changes are difficult to predict accurately.

Summarize

In short, the retracement of Bitcoin’s price does not mean that its upward trend has ended. On the contrary, market analysts predict that Bitcoin will usher in a new round of rise after the halving. Investors’ hoarding behavior and historical halving events provide support for this view.

Today, bullish buyers are now preparing for a new battle to defend the support area between $51,700 and $52,000. A close above or below this area will determine the direction of BTC’s next move.

$BTC #比特币减半 #BTC