时间:2024-02-09|浏览:248

用戶喜愛的交易所

已有账号登陆后会弹出下载

Author: Arjun Chand, Bankless; Compiler: Deng Tong, Golden Finance

Cryptocurrencies are buzzing again. All the signs of a bull market are here. The coin increased 2x overnight. The CT timeline is full of "I gave you x for $69 before it was done 1000x" posts.

However, there is usually a quiet time before such excitement. This is when the real bull markets happen. This time is no exception.

Back in November 2021, Bitcoin hit $69,000 and Ethereum hit $4,800. The total value of cryptocurrencies topped $3 trillion. Everyone thinks cryptocurrencies are the future of finance, and the growth seems unstoppable. But unfortunately, that was the small top of the last bull market. Over the next two years, the market continued to decline. We entered a bear market and bottomed out in November 2022, marked by the collapse of FTX.

A bear market may seem depressing, but it's not all bad news. Yes, prices are down hard and cries of “cryptocurrency is dead” are still echoing, but what does that say?

The bear market attracted builders, builders created projects with product-market fit, products with PMF attracted new users and investors, adoption led to speculation that cryptocurrencies were the future of finance, and a new bull market began.

There is a strong sense that we are now before a real bull market takes off. If you listen to Anonymous at Penguin PFP on X, they'll tell you the past few months have been just a preview of the wild ride we're in for.

However, this article is not about the upcoming bull market and how you should prepare. This is to celebrate the builders who stayed through the crypto winter and built solid projects. Today, we'll focus on some of the key sectors that developed during the bear market.

Solana's glorious return

There are often multiple ways to achieve your goals. Solana’s comeback story is a powerful reminder that there are different approaches to achieving mass adoption.

Remember when we mentioned that the bottom of the bear market was marked by the FTX crash? Our builders’ cry for ecosystems seems appropriate, with many fearing ecosystem collapse will follow.

Solana's comeback story is nothing short of a miracle, and one the entire industry is celebrating.

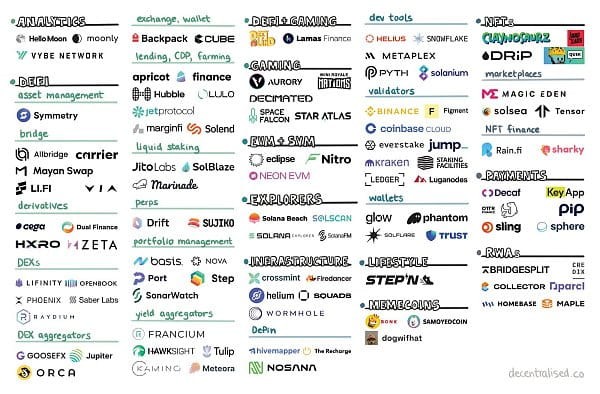

Solana Virtual Machine (SVM) is turning heads, and for good reason. The "Only Possible on Solana" tag is more than just a MeMe thanks to its local fee market mechanism that keeps gas prices low. SVM’s reach is expanding beyond Solana. Modular Rollups like Eclipse are adopting it, Ethereum heavyweights like MakerDAO are considering it for their own native chains, and innovative projects like Rome Protocol are using it to solve Ethereum’s scaling challenges.

On the application side, Solana has feature-rich platforms like Jupiter and Tensor that are redefining the user experience in DeFi. The great user experience of the Solana app continues to be the network’s low fees and fast transaction execution.

In addition to its diverse app ecosystem, Solana has fostered a loyal community with a unique culture. From NFTs like Mad Lads and Tensorians to Memecoins like BONK and Dogwifhat, transforming the ecosystem into a live casino — and not forgetting airdrops like JTO and JUP that create instant wealth for users — Solana has all the makings of a standout player in the bull market.

Layer2 value added

The Ethereum community has a dream, a dream to scale via L2 so that users can make cheap transactions. Now, as L2 is scaling Ethereum approximately 5x, this dream is becoming a reality.

L2 is key to Ethereum’s success and scalability. A number of projects are launching in 2021, with some speculating that their launches are boosting ETH and several ETH ecosystem tokens as Ethereum’s Rollup-centric roadmap unfolds, showing a clear path to scaling. of rise. Since then, L2 has seen impressive growth. Here are some statistics showing that L2 is a major bear market success story:

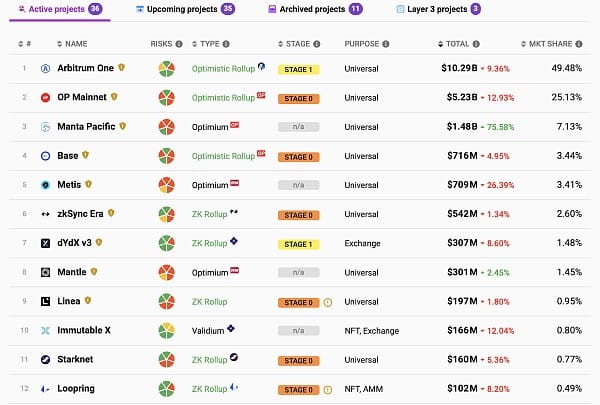

As of January 2024, L2 handles 5 times the daily transaction volume of Ethereum.

On February 21, 2023, Arbitrum became the first rollup to surpass the Ethereum mainnet in daily activity and later reached 2.5x Ethereum transaction volume after the $ARB airdrop.

In December 2023, zkSync Era became the first Rollup to process more transactions than Ethereum in 30 days.

By April 2023, total TVL across all L2s exceeded $10 billion for the first time, doubling to $20 billion by January 2024.

Currently, there are 4 L2s with over $1 billion in TVL, one of which (Blast) isn’t even live yet. There are currently 12 Rollups in production, each with a TVL of over $100 million. Arbitrum is in the lead with TVL of over $10 billion (50% market share), while Optimism is in second place with over $5 billion (25% market share).

With advancements like danksharding (EIP-4844), data availability solutions (Celestia, EigenDA, Avail), Rollup frameworks (OP Stack, Arbitrum Orbit, ZK Stack, Polygon CDK), and Rollup-as-a-service providers (Caldera, Conduit), AltLayer ), we may see thousands of Rollups deployed in 2024.

The ease of Rollup deployment means teams will experiment to stand out. We’ve seen this with Rollups like Blast and Manta Pacific, which offer native yields for holding funds on their chain.

Modular, not maximalist

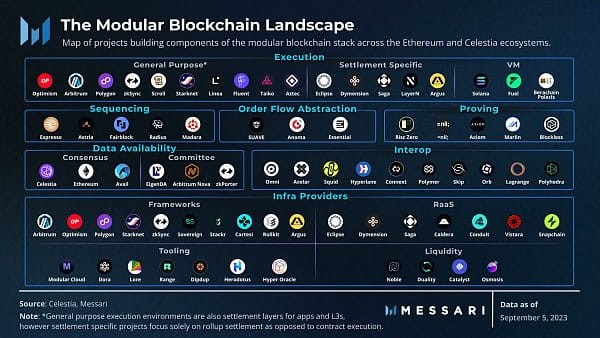

In the era of modular blockchains, high gas costs are no longer a barrier to building cool things on Rollups. Rollups can now scale by storing data in different layers outside of Ethereum.

Modular blockchains, which deconstruct the various layers of the blockchain (execution, settlement, and data availability) into specialized chains, made significant progress during the bear market and are now seeing early adoption.

There is innovation at every level. For example, at the execution layer, teams such as Monad and Sei are working on parallelizing the EVM to improve throughput. Meanwhile, teams like Aptos, Sui, and Movement Labs are developing new programming languages such as Move for blockchain and smart contract development.

The data availability (DA) layer is particularly interesting these days. Celestia’s mainnet launch in October 2023 officially kicked off the DA war. Major ecosystems such as Starknet, Eclipse, and Manta, as well as L3s such as Lyra and Aevo, have begun integrating Celestia into DA, signaling a trend that may shape the future as more chains launch with Celestia support.

Additional DA solutions expected to launch in 2024, such as EigenDA and Avail, will provide chains with multiple DA options. Coupled with Ethereum's own prototype danksharding (EIP-4844) (expected to go live in 2024 and aimed at reducing L2 DA costs), it will be interesting to see whether the chain sticks with using Ethereum for DA or moves to a dedicated DA layer. Very interesting thing.

The future is multi-chain and cross-chain

Bridges in cryptocurrencies: the legend that connects different chains. We might prefer a world without them, but the fact is that they are integral to multi-chain ecosystems.

In 2022, Vitalik Buterin shared his opinion that the future will be multi-chain but not necessarily cross-chain, citing security issues with bridging. However, as we have seen time and time again, both users and capital move towards the most profitable opportunities. As adoption of different chains increases, there is an inherent need for users and capital to flow within these ecosystems, leading to significant developments around interoperability solutions such as messaging protocols and liquidity networks that support the movement of data and assets.

Key innovations developed during the bear market to support this cross-chain functionality include:

Messaging protocols – These protocols enable smart contracts on one chain to receive data from other chains. Major players in this space include LayerZero, Axelar, Wormhole, Chainlink CCIP, and Circle CCTP.

Liquidity Networks – Also known today as intent-based bridges, these networks facilitate the transfer of assets between chains. Leading solutions include Across, Stargate and THORChain, as well as aggregators like LI.FI and interfaces like Jumper to help users find the best route for cross-chain transactions.

Cross-chain applications – These are blockchain-agnostic applications built on top of messaging protocols. Popular examples include liquidity networks like Squid with Axelar, Stargate with LayerZero, and various applications such as the Radiant Capital money market on LayerZero or the Prime Protocol lending platform on Axelar.

Cross-chain token standards — These standards ensure