时间:2024-02-05|浏览:299

用戶喜愛的交易所

已有账号登陆后会弹出下载

$JUP

#木星

Jupiter是建立在Solana网络上的交易聚合器。Jupiter于2021年10月上线,发展至今已成为Solana用户最爱使用的交易前端,聚合了Solana超过一半以上的交易量,Jupiter交易聚合功能的发展已经协议推出了Launchpad平台Jupiter Start和孵化器Jupiter Labs来进行横向拓展。Jupiter拥有庞大的用户群和资源,Launchpad平台的项目质量有一定的保障。且其Jupiter Labs的衍生品项目TVL和交易量其中。综上,我们选择关注木星。

投资概要

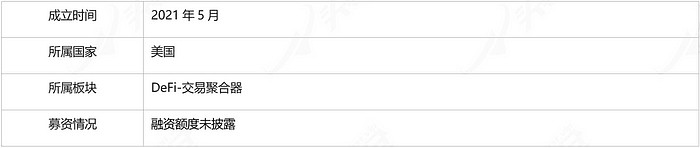

Jupiter是建立在Solana网络上的交易聚合器,用户界面类似于1英寸。协议提供交易聚合、限价单、定投功能。Jupiter聚合使Solana的交易量超过一半,在交易聚合上进一步发展空间更大。协议横向拓展推出类似发射平台的Jupiter Start和Jupiter Labs。截至2024年1月15日,协议很明显公布了融资信息。

总体来看,Jupiter在Solana的交易聚合板块已无竞争对手,且聚合了超过一半的交易量,使DEX在Solana上成为基础的流动性协议。在庞大的用户基础和项目资源加持下,其横向扩张推出的Jupiter Start和Jupiter Labs同样具有外接的市场潜力,且Jupiter Start和Jupiter Labs可能产生联动效应。综合上述条件,我们选择关注Jupiter。

2. 项目详解

2.1 团队

团队的主要人员为Meow和Ben Chow,二者于2021年5月成立Jupiter,同时,他们也是Solana上流动性平台Meteora的成员。

2.2 资金

Jupiter 明显公布了任何融资。

2.3代码

Jupiter由OtterSec进行审计,OtterSec曾审计过Solana、Aptos、Sui、Wormhole等知名项目(多为Solana知名项目和美国项目)。有较为丰富的审计经验和一定的重复。

2.3 产品

作为建立在 Solana 网络上的交易聚合器,Jupiter 是 Solana 交易用户的主要选择之一。其目前主要提供交易聚合、限价单、DCA/定投、Jupiter Start 四大功能。同时,Jupiter Labs 联合社区与用户推出了独立的项目,目前包括永续合约产品和LSD稳定币。

2.3.1 交易聚合

和大多数交易聚合器一样,用户可以在Jupiter中选择交易并输入交易数量,Jupiter将在支持的去中心化交易所中自动寻找最优化的交换路径。 对于仅在个别DEX上有流动性的代币值修改来说,交易聚合可以直接找到流动性。对于交易额增加的代币,交易聚合或者可以通过多路径的方式提供更好的交易价格/滑点。在交易前,用户可以自行选择交易费用、滑点大小和是否采用直接路径等参数。

Jupiter交易界面非常整洁(类似1英寸),交易体验更好。在设置中可自行调节语言、区块浏览器和RPC节点来适应不同的需求并避免单点故障。Jupiter目前支持29个包含交易功能的应用。DEX被木星整合须满足一定的条件,其中主要包括流动性和安全审计。DEX需要至少50万美元的流动性来保证有一定的交易量需求,其次需要代码被审计来保证安全性。

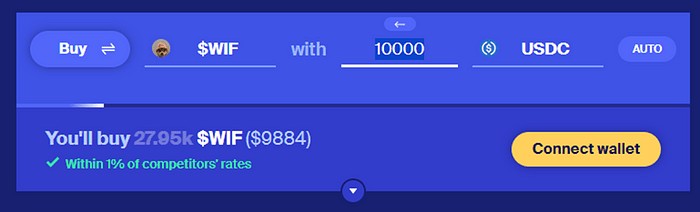

Jupiter aggregates the majority of transaction volume on Solana, partly due to user interface issues. The most liquid DEX on Solana is Orca, which accounts for $190 million in liquidity. Next is Raydium. Except for Raydium’s own protocol token RAY, Orca has more liquidity than Raydium in other mainstream tokens. However, Orca's own trading volume is often lower than that of Raydium (Orca's trading volume mostly comes from Jupiter aggregation). Orca's trading interface is not a conventional Uniswap-like operation interface. Instead, you can choose buy/sell and then enter the quantity, which is not in line with users' operating habits. Secondly, WIF has not joined Orca's whitelist (you need to enter the contract address to search) . Although Orca can meet users' small-amount transaction needs, the trading experience is far inferior to Jupiter.

Figure 2–1 Orca trading interface [1]

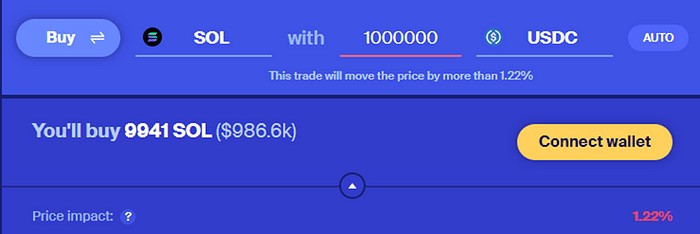

Secondly, the overall liquidity of the tokens on Solana is not strong. Using an aggregator for large transactions can reduce certain slippage losses. Taking SILLY as an example, the slippage loss of using one million USDC to exchange SOL is close to 1.22%. Using Jupiter slippage loss is close to 0.4%, which means the aggregator can reduce slippage loss/price impact by 0.8%.

Figure 2–2 Orca SOL/USDC large transaction display

Overall, the main reasons for Jupiter's large-scale application are user interface, liquidity and airdrops. And after getting used to using aggregators, users will first use aggregators instead of DEX for transactions, which has a certain degree of user stickiness.

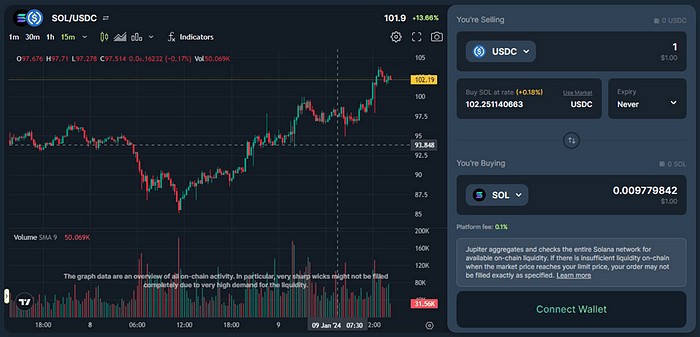

2.3.2 Limit order

Jupiter also provides a limit order function, which avoids cost increases and slippage problems caused by price effects during transactions (there is no MEV problem). Limit orders can be partially filled and receive a portion of the trading tokens without being fully filled. When trading, users can choose the order validity period, exchange price and exchange quantity. The protocol cooperates with Birdeye and TradingView. Birdeye provides on-chain price data of tokens, and Jupiter uses TradingView’s technology to display chart data. The overall trading experience is very similar to that of a centralized exchange.

Figure 2–3 Jupiter limit order function display

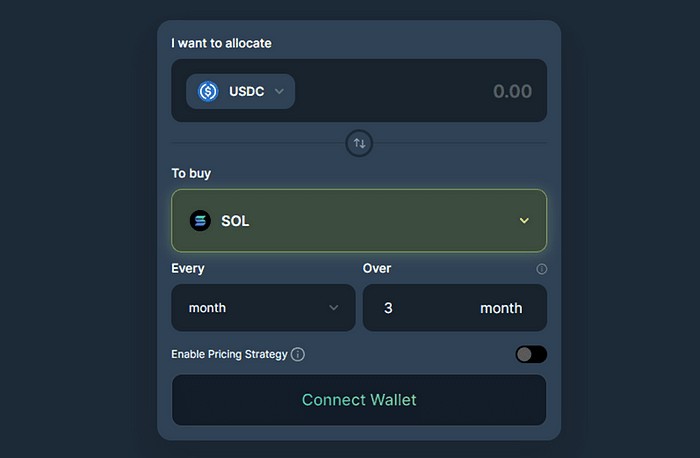

2.3.3 DCA/fixed investment

DCA (Dollar Cost Averaging) is called dollar cost averaging, also called fixed investment. Amortize the cost of purchase by making multiple investments over a certain period of time. Jupiter provides fixed betting with a minimum frequency of minutes and a maximum frequency of months. Users can choose the frequency of fixed investment, the total time period and the price range of fixed investment.

Figure 2-4 Jupiter fixed investment interface display

When fixed investment begins, tokens will be transferred to the relevant account of the fixed investment token, and trading operations will be performed at regular intervals (transactions may vary for 2–30 seconds to prevent MEV). After the transaction is completed, the fixed investment account will be closed automatically and all tokens will be transferred to the wallet. The agreement charges a one-thousandth fee for fixed investment. Fixed investment is suitable for accumulating tokens in bear markets and gradually selling less liquid tokens, but the overall demand is less.

2.3.4 Jupiter Start

Jupiter will establish its own project promotion platform, Jupiter Start, dedicated to promoting the development of new projects while protecting the interests of investors. The process of Jupiter Start is divided into five parts: social introduction, education, pre-launch, Launchpad and Atlas. The community introduction will last for a week, mainly introducing the project's concept, economic model, etc. and conducting community discussions. Education will place individual projects as part of the website, with partially qualified users earning tokens through reading materials and on-chain operations. Pre-listing allows users to place limit orders and DCA operations before liquidity is added.

At present, the community introduction, education and pre-launch functions have been launched, and the ones worth looking forward to are the Launchpad and Atlas (not yet explained) functions. Since Jupiter Labs’ projects will issue their own protocol tokens, its Launchpad project may be a derivatives project.

2.3.5 Jupiter Labs

Jupiter Labs is independent of Jupiter. Jupiter Labs projects will eventually operate independently, and Jupiter users and the community will receive certain priority rights and token incentives. The projects currently launched by Jupiter Labs are perpetual contracts and LSD stablecoins.

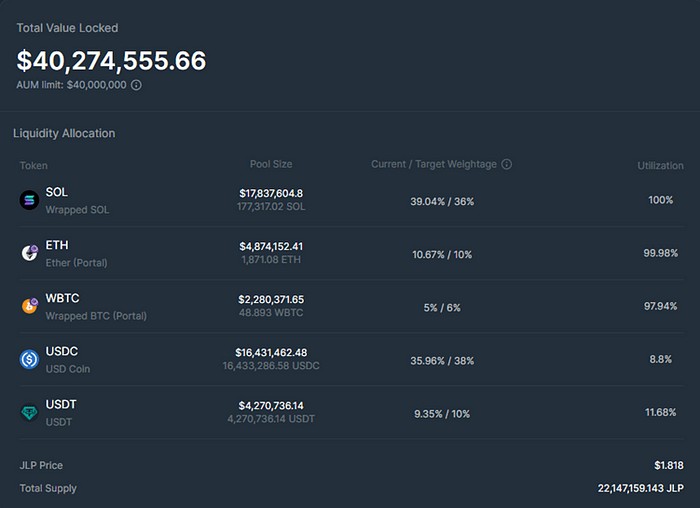

Jupiter Perpetual

Jupiter Perpetual is a derivative protocol similar to GMX V1 launched by Jupiter Labs and is currently in the use stage. Protocol users are mainly divided into liquidity providers and traders. The liquidity provided by the liquidity provider is converted into a basket of tokens (currently including BTC, ETH, SOL, USDC, and USDT). The tokens in the pool with higher weights are mainly SOL and USDC, that is, the main trading target is SOL. .

When a trading user performs a leveraged trade, the trader borrows tokens from the pool to establish a leveraged position. Users of this derivatives trade do not need to bear transaction slippage, but only pay transaction fees and borrowing fees, which depend on the utilization of the token. Liquidity providers receive 70% of transaction fees and all borrowing fees. Correspondingly, liquidity providers also bear the risk of losses caused by traders' profits and token depreciation. From the end of 2023 to now, the price of JLP has been fluctuating around $1.8.

Figure 2–5 JLP data[2]

LST stablecoin

Jupiter Labs' LST stablecoin protocol XYZ has not yet been launched. According to its documentation, the protocol is similar to Lybra V1. Users can mint the interest-bearing stablecoin SUSD (without borrowing interest) by staking SOL. The protocol obtains staking income through the pledged LST, and the income will be distributed to SUSD holders and the governance token of the agreement. The main feature of the agreement is that when the LST yield is higher than the SOL borrowing rate, SOL LST will be mortgaged in the lending agreement and used to lend SOL an 热点:DEX