时间:2024-02-01|浏览:267

用戶喜愛的交易所

已有账号登陆后会弹出下载

不到三个月的时间,比特币将经历减半,减半后,交易者应该做好跌幅百分之七到百分之三十的准备。

假设 BTC 遵循过去减半的历史模式,比特币的市场价格可能会在 2025 年 4 月至 10 月期间达到峰值。

交易者可以根据比特币链上数据买入逢低买入。

周四比特币(BTC)价格持平,徘徊在 42,000 美元左右。

在美联储主席杰罗姆·鲍威尔表示通胀“仍然过高”并且三月份不太可能降息后,美元从周三的低点 42,276 美元小幅反弹。

由于美联储尚未表现出任何放松货币政策的意图,市场人士可能会感到担忧。如果发生这种情况,资金可能会开始逃离比特币和其他风险投资。

比特币的近期价格走势主要受到鲍威尔言论以及即将到来的减半事件和比特币链上措施的兴奋影响。然而,在短期内,链上指标表明比特币的价格将会上涨,这是个好消息,因为像减半之前发生的“抛售新闻”影响在此类事件中很常见。

周三,在美联储主席鲍威尔表示他预计 3 月份不会降息后,比特币价格受到了小幅打击。

周四早些时候,比特币从周三的低点 42,276 美元攀升至 42,687 美元,略有回升。

Nicehash 报道称,比特币减半事件即将进入 88 天倒计时。预计比特币的价格将受到重大影响。

减半后的一个月内,比特币的价格急剧下跌,与其他减半事件一样,损失了百分之七至百分之三十的价值。

减半事件发生后,比特币的价格通常会在 12 至 18 个月内升至市场峰值。

如果以过去的经验来看,比特币的价格可能会在减半后仅 30 天(2024 年 4 月或 5 月)下跌,然后就达到市场峰值(2025 年 4 月或 10 月)。 2012年减半后,比特币价格上涨了3,850%,2020年减半后上涨了700%,2016年减半后上涨了11,000%。

比特币正在从链上数据中获取买入信号。根据市场价值与已实现价值比率(MVRV),交易者现在应该“逢低买入”比特币,该比率衡量交易者在特定时间段内的平均利润或损失。

The asset's price always recovers within a week or ten days if the 30-day MVRV falls below the 90-day MVRV ratio, as seen in the Santiment chart below. Between January 22 and 25, this occurred, indicating that Bitcoin is now in a "buy the dip" window, which might result in short-term profits for holders.

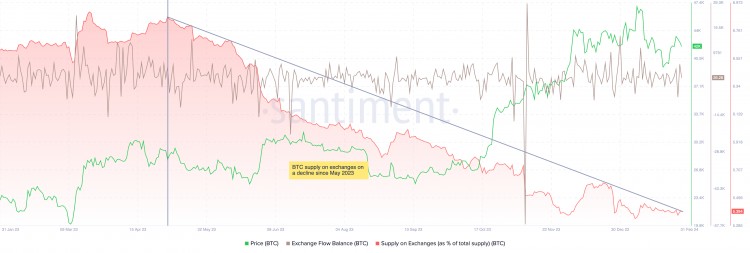

Since May 1, 2023, the Bitcoin exchange supply—another important on-chain metric—has been falling. As Bitcoin's exchange reserves continue to shrink, the selling pressure on the asset is likely to subside, creating an opportunity for possible price rises for BTC. Traders are probably keeping their Bitcoin off exchanges and not taking gains because of the recent surges in the flow balance, which indicate withdrawals from exchange wallets.

The recent flattening down of Bitcoin's price has opened the door for price surges in other cryptocurrencies. The present price of Bitcoin is crucial to the continuation of the rallies of major cryptocurrencies. This article analyzes the last three halvings to provide light on altcoin narratives and Bitcoin price predictions.

Despite a little drop on Wednesday, the price of bitcoin has remained around $42,000 on Thursday. In the bearish imbalance zone, which extends from $43,904 to $45,597, Bitcoin has been unable to break through the barrier level. Up until it breaks through the barrier, the Bitcoin price is likely to stay in a sideways trend.

With an RSI of 49.33, which is around the average, it seems that future decisions will be difficult to make. Bulls are probably in charge, however, since the Awesome Oscillator (AO) histogram bars are flashing green. Bitcoin (BTC) has the potential to break over the upper border of the imbalance zone at $45,597 and turn resistance at $43,904 into support if purchasing pressure remains strong. Assuming market sentiment remains strong, the price of bitcoin (BTC) may rise over its two-year high of $48,989 and approach the $50,000 mark.