时间:2024-02-01|浏览:263

用戶喜愛的交易所

已有账号登陆后会弹出下载

2022年,加密货币市场创下历史新高,总市值损失1.4万亿美元,导致普遍悲观情绪。

然而,加密市场再次展现出韧性,从 2023 年开始复苏,BTC 从不足 16,000 美元上涨至超过 40,000 美元,ETH 也反弹至 2,200 美元左右。

2024年,加密货币行业的前景将更加乐观,原因如下:

1. 增强区块链基础设施的可扩展性

2023年,以太坊完成合并,共识机制从PoW变为PoS,网络可扩展性得到提升,但这显然不足以满足市场需求。 为了进一步提高可扩展性,开发人员创建了多种链上和链下可扩展性解决方案,包括:

侧链(例如 Gnosis 链)

状态通道(例如雷电网络)

乐观汇总(例如乐观)

ZK rollup(例如zkSync)

Validium 链和分片(例如 Zkporter 根)

这些类型的解决方案基本上基于以太坊的二级链,并通过互操作协议和(越来越安全的)桥连接到以太坊网络。 它们中的大多数都幸存下来并使用了更长的时间,使它们的技术得以成熟和改进。 像 Optimism 这样的项目已经发布了工具,使开发新的扩展解决方案变得更加容易。

此外,还有一些创新项目正在持续推出,例如Zircuit(兼容EVM的ZK-Rollup)、LayerZero(刚刚推出V2的Omnichain消息传输协议)。 如果开发者对区块链的可扩展性不满意,他们还可以选择构建在更具可扩展性的区块链上,甚至以低成本推出适合特定应用程序的区块链,同时仍然受益于以太坊的安全保证中带来的好处。

对于用户来说,更好的可扩展性意味着更快的交易处理、更低的费用和更好的用户体验,这对于主流采用至关重要。

2.区块链创新正在加速

与任何其他新兴技术一样,区块链在早期阶段进展缓慢,并遇到了各种阻力。 但现在,它开始获得动力,升级正在加速。

随着区块链技术的成熟,出现了几种新的解决方案,使创新项目更容易创建。 例如,ZK rollup 为区块链增加了隐私性,同时结合了高安全性、可扩展性和易于操作性。 由于各个项目的早期努力,ZK-proofs已经开始被广泛采用,并成为区块链行业最大的发展趋势之一。

According to Cryptomeria Capital’s zero-knowledge report, in 2024, ZK technology is expected to redefine the security and privacy paradigm and provide excellent solutions to emerging challenges. This is just one example in the crypto industry, and other innovations are constantly emerging to drive the adoption of blockchain technology.

3. The Web3 developer community is active

Despite a deep bear market, the Web3 developer community remains active. This is also one of the most important factors to look forward to in the crypto industry in 2024. After all, the developer community is Web3's greatest asset. Since all blockchains and cryptocurrencies are built by developers, having a vibrant development community is crucial to keeping the industry moving forward.

As you can see from websites such as Coindesk and Cointelegraph, new Web3 projects are created or updates to outstanding projects are made every day. The developer community is more optimistic than ever, which is also a very critical metric.

4. Major improvements to developer tools

Developer tools have been significantly improved since 2023. Notable examples include: modern smart contract frameworks (such as Foundry); blockchain APIs (such as QuickNode); leading rollup development frameworks (such as Optimism's Bedrock), etc.

Building blockchain applications is becoming faster and faster, which can promote innovation, attract more developers, improve interoperability, and improve cost efficiency.

5. Improved security of smart contracts

Smart contracts have been fighting hacker attacks since their inception. Hackers have taken away a large amount of funds from DeFi projects, but the community is working hard to improve the security of smart contracts.

Currently, the smart contract auditor community is very active and can help them earn considerable income by checking smart contract security issues. In the past, this kind of thing was usually done by large companies, but now more individual auditors are involved, thanks to bounty incentives offered by crypto bug bounty platforms like Immunefi and Hackenproof. With the participation of more security auditors, the future of cryptocurrency will become more secure, which is a key step in winning the trust of Web2 businesses and users.

6. Encryption user experience improved

In the crypto industry, just as important as security is user experience (UX), which is a key driver of mainstream adoption and engagement. Since most users are unable to spend a lot of time and energy learning things like cross-chain compatibility and encryption private keys, effective design must be relied upon to simplify usage. Poor user experience can lead to serious consequences such as lost assets, etc., resulting in user losses and reduced engagement. Optimizing UX design is key to building user trust, especially considering the anonymous nature of blockchain transactions.

As blockchain technology becomes more popular, only products with good user experience can attract and retain more users. Furthermore, blockchain solutions will have to compete with existing services such as financial, social media and supply management applications that have seamless UX and familiar interfaces.

In the past, the user experience of Dapps was not satisfactory, but now it has been improved through various practices. For example, crypto wallets now offer a smoother experience, making it easier for non-technical people to participate in Web3. An example is the Immutable project’s “Passport,” which allows users to enter the game through a single login process rather than connecting to a wallet. This abstracts the interactions of the blockchain and makes logging in more familiar to users. This increased convenience could lead to greater adoption of blockchain-based games.

7. The blockchain user base continues to grow

The purpose of building crypto infrastructure is to support the development of Dapps and serve a large number of users, so user adoption is an important metric. The crypto world is attracting more users thanks to better security, improved user experience, and lower fees. Although adoption is still low at the moment, we can see some progress in adoption in some decentralized social media, such as Lens. Additionally, the Web3 gaming landscape is vibrant, with many new games being released.

According to Vaneck’s 2024 cryptocurrency predictions, there will be projects with more than 1 million daily active users in the blockchain game field this year, and the most likely candidate is the game launched by Immutable.

8.Tradfi and Fintech merge with the crypto world

An excellent example of the integration of Tradfi and Fintech into the crypto world is the fintech company Paypal’s embrace of cryptocurrencies. Paypal has a whopping 42% market share in online payments, and it has been allowing merchants to accept crypto payments since October 2020. In August 2023, PayPal launched its own stablecoin, continuing its development into the cryptocurrency field. It also introduced crypto wire functionality, enabling users to buy and sell cryptocurrencies.

Considering that PayPal is the preferred payment method for most online merchants and a key player in the e-commerce space, this is a huge improvement. It can be said that PayPal has opened up new possibilities and opportunities for wider adoption of digital currencies in online transactions by increasing accessibility, credibility, liquidity and mainstream awareness. Furthermore, the involvement of major players like this may encourage regulators to develop clearer and more favorable regulations for the crypto industry.

9. The passage of Bitcoin ETF and the arrival of the halving cycle

众所周知,美国有大量资金被捆绑在养老基金中,而这些基金通常仅限于投资股票。 从技术上讲,比特币 ETF 也是一种股票,从长远来看,养老基金可能会将其配置多元化到加密货币。

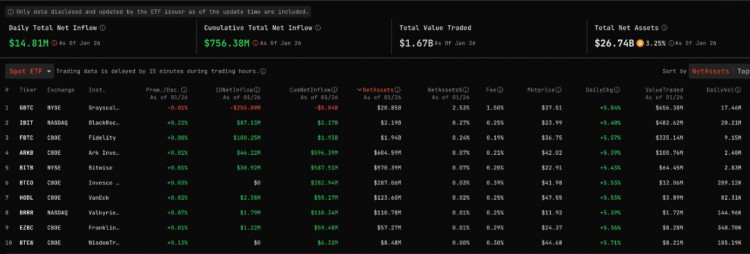

截至1月26日,比特币现货ETF累计净流入已达7.56亿美元,比特币现货ETF总资产净值为267.4亿美元。 目前整个加密货币市场价值为1.67万亿美元,根据相关统计,养老基金每年的投资金额可达60万亿美元以上。 从市场规模来看,加密货币ETF未来增长潜力巨大。

此外,比特币第四次减半周期将于今年4月发生,矿商抛售压力将持续减轻。 从市场供需角度来看,这也是长期利好比特币的因素。

10、降息周期即将到来

加密货币与股市高度相关,因此受利率水平的影响很大。 自2021年底以来,世界各国央行纷纷加息,以抑制通胀。 据路透社报道,由于通胀已大幅放缓,大多数主要发达经济体现已决定停止大幅加息。

为了确保软着陆而不是衰退,一些美联储官员认为降息将从2024年开始,预计2024年全年利率将降低75个基点。欧洲央行也可能在2024年开始降息。 2024年6月。当利率降低时,市场上将有更多资金,这将有助于股市繁荣,这种积极影响也将延伸到加密货币市场。