时间:2023-12-18|浏览:228

用戶喜愛的交易所

已有账号登陆后会弹出下载

最新的每周收盘价并没有给紧张的交易者带来什么安慰,因为“仅上涨”的比特币价格活动仍在继续暂停。

距离年度蜡烛结束仅剩两周时间,风险资产的倒计时已经开始,压力也随之而来。

宏观数据——关键的短期波动催化剂——将在 12 月剩余时间内持续发布,随着市场消化美联储上周的举措,美国 GDP 数据也将公布。

目前,比特币似乎越来越不可能出现“圣诞老人集会”,而且高额费用让持有者感到苦涩,评论员建议重新关注下个月潜在的现货 ETF 批准。

潜在的一线希望来自于加密货币内外的市场情绪。虽然“贪婪”是景观的特征,但不可持续的情况却不见踪影,随着“怀疑”的出现,可能为进一步上涨留下空间。

随着年度 BTC 价格表现的关键时刻临近,Cointelegraph 将更详细地研究这些因素。

分析师列出了关键的比特币价格支撑位

12 月 17 日周收盘价约为 41,300 美元,当时正值 BTC/美元局部抛售期间。

Cointelegraph Markets Pro 和 TradingView 的数据显示,隔夜比特币继续下跌,比特币触及 40,800 美元,然后在亚洲交易时段逆转回略高于 41,000 美元。

基于最近的比特币价格走势,交易员和分析师已经对潜在的进一步下跌保持警惕,因此仍保持谨慎态度。

“图表不会说谎”,交易资源 Material Indicators 在当天 X(以前称为 Twitter)上的一篇文章的开头总结道。

Material Indicators 指出,进入新的一周,比特币已经失去了 21 天移动平均线——它称这一事件“本质上是看跌的”。

它补充说,“预计年底获利回吐和税收损失收割将在短期内盛行。”

联合创始人 Keith Alan 继续表示,争夺关键斐波那契回撤位(相当于 2021 年 11 月的历史高点)的斗争仍在继续。

受欢迎的交易商 Skew 在 4 小时时间范围内以 200 周期和 300 周期指数移动平均线 (EMA) 以及 50 天 EMA 的形式添加了一些线条——目前均比现货价格低 2,500 美元左右。

“从这里开始,1W/1M 有两个技术水平,”他在每周和每月时间框架的评论中继续说道。

“$39K - $38K ~ HTF 的潜在支撑,不可持续的推低将会有一个不错的出价。 47,000 美元 - 48,000 美元 ~ HTF 阻力位,不可持续的走高将是获利了结的好区域。”

随着人们对美联储“转向”的信心增强,个人消费支出和国内生产总值即将到期

未来一周,美联储“首选”通胀指标——11 月个人消费支出 (PCE) 指数将成为美国宏观事件的主导因素。

Coming after last week’s multiple key Fed decisions, data must now continue to show inflation abating heading into the new year.

The next Federal Open Market Committee (FOMC) meeting to decide changes to interest rates is not until the end of January, but since last week, markets are entertaining the prospect of a “pivot” becoming reality.

The latest data from CME Group’s FedWatch Tool currently puts the odds of a rate cut next meeting at around 10%, with the majority of key macro figures still to come.

“Even with stocks up, uncertainty is still everywhere,” trading resource The Kobeissi Letter concluded in an X post outlining the coming week’s prints.

In addition to PCE, jobless claims and revised Q3 GDP will both hit on Dec. 21.

As Cointelegraph reported, U.S. dollar strength hit multi-month lows around FOMC in a potential fresh tailwind for crypto markets. Those lows have now faded as the U.S. dollar index (DXY) makes a modest comeback, still down around 1.9% in December.

Fees stay elevated

The heated debate over Bitcoin transaction fees has swelled in recent days thanks to these hitting their highest levels since April 2021.

With Ordinals back on the radar, those wishing to transact on-chain faced $40 fees at the weekend, while “OG” commentators argued that the fee market was simply functioning as intended given competition for block space.

Miners, meanwhile, have seen revenues skyrocket as a result — to levels not witnessed since Bitcoin’s $69,000 all-time high.

Into the new week, however, fees have already fallen considerably, with next-block transactions confirming for under $15 at the time of writing.

Commenting on the situation, popular social media personality Fred Krueger argued that market participants should now turn their attention to the decision on the first U.S. spot exchange-traded funds (ETFs) due early next month.

Noting that fees were “already falling fast,” he defended Ordinals’ creators’ right to use the blockchain to store their work.

“This debate looks like a nothingburger for now. Back to waiting for the ETF,” he concluded.

Others, including researcher and software developer Vijay Boyapati, also referenced the transitory nature of the fees debate as it has occurred throughout Bitcoin’s history.

Calling for so-called “Level 2” solutions to speed up development as a result, reactions to the recent elevated fees underscored that off-chain solutions for regular users — specifically the Lightning Network — already exist.

“L1 fees are incredibly high right now. Seems obvious — even if self-serving — that defaulting most transactions to the Lightning Network is the way to go for all exchanges and wallets,” David Marcus, the former Facebook executive now CEO of co-founder of Lightning startup Lightspark, wrote in part of an X post at the weekend.

Per data from monitoring resource Mempool.space, meanwhile, block space remains in huge demand, with the backlog of unconfirmed transactions still circling 300,000.

新地址构成牛市动量风险

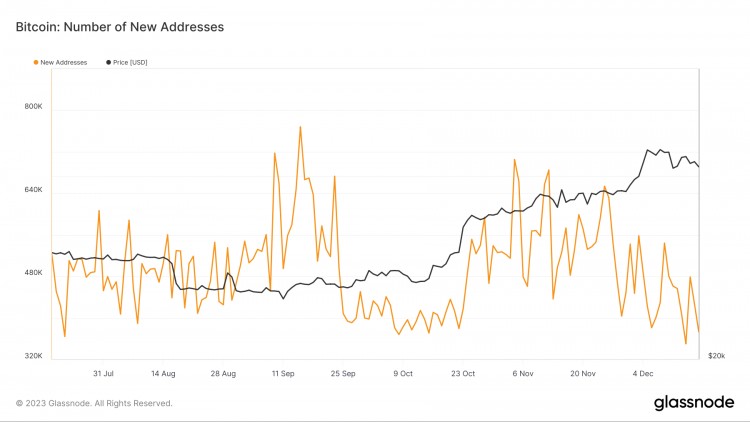

本月,比特币网络的增长已经暂停——与牛市的回归一致。

来自链上分析公司 Glassnode 的新数据证实,新的 BTC 地址数量在整个 12 月持续呈下降趋势。

截至 12 月 17 日(可获得数据的最新日期),约 373,000 个地址首次出现在链上交易中。这大约是最近当地每日高点的一半,Glassnode 显示该高点是在 11 月初出现的。

受欢迎的社交媒体分析师阿里在评论这些数字时称,新地址的减少是“引人注目的”,也是比特币价格上涨的障碍。

他写道:“过去一个月,比特币网络增长明显下滑,这让人对 BTC 最近升至 44,000 美元的可持续性产生怀疑。”

“为了牛市反弹的强劲持续,看到新的 BTC 地址数量增加至关重要。这将为持续看涨势头提供所需的支持。”

比特币新地址图表。来源:Glassnode

恐惧背后的怀疑

比特币最近“只涨”阶段的降温导致市场贪婪相应暂停。

相关:“没有借口”不做多加密货币:Arthur Hayes 重复 100 万美元的 BTC 价格押注

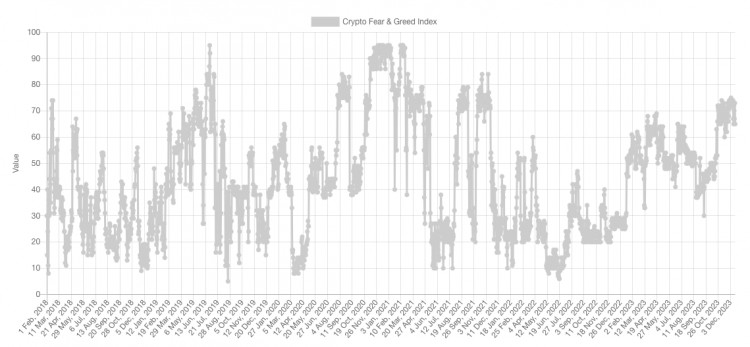

根据 Crypto Fear & 的最新数据,贪婪指数,过去一周大多数加密货币市场参与者都陷入了思考。

目前,恐惧与恐惧为 65/100。贪婪是加密货币领域的首选情绪指标,它仍然将整体情绪定义为“贪婪”,但接近近一个月来最热度。

缩小范围来看,超过 90/100 的指数得分对应于长期市场顶部,因为非理性繁荣已成为普通市场参与者的心态。据 Cointelegraph 报道,一个值得注意的例外是 2021 年的历史新高 69,000 美元,Fear & 2021 年创下历史新高。贪婪达到75/100才逆转。

与此同时,Cubic Analytics 高级分析师 Caleb Franzen 在评论传统市场指数的现状时表示,同样于 2021 年底开始的美联储延长紧缩周期的情绪仍在显现。

“恐惧与恐惧”贪婪指数正好处于“贪婪”范围内。然而,4 周前它才处于‘恐惧’状态,9 月至 11 月的 2.5 个月内处于‘中性’到‘极度恐惧’状态,”他在 12 月 14 日告诉 X 订阅者。

“欣快感?不,这令人难以置信。”